A version of this article first appeared in South China Morning Post on September 23, 2024.

For decades, Cambodia’s high economic growth has been fueled by strong garment exports, supported by tourism. However, a new trend in the country’s exports has emerged in the past two years – a sharp increase in electrical and electronics (E&E) manufacturing products, particularly solar panels.

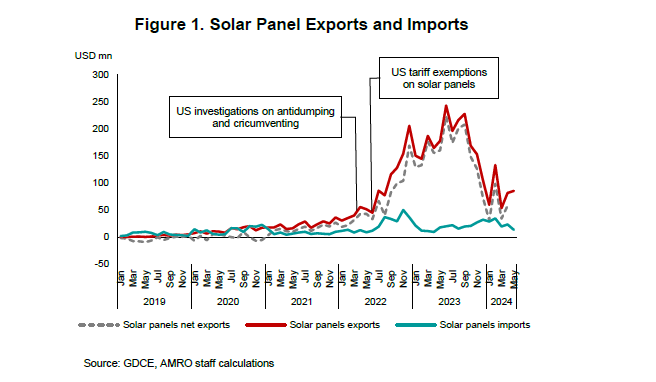

In 2022, Cambodia’s solar panel exports soared by 2.8 times year-on-year to USD1.0 billion; the share of solar panel exports to the country’s total exports rose to 4.6 percent from 1.4 percent. During the same period, the country’s solar panel imports rose rapidly and doubled to USD272 million but the volume was significantly lower than solar panel exports (Figure 1). This trade pattern suggests that a substantial portion of Cambodia’s solar panel exports may have been assembled domestically rather than imported and re-exported. The upward trend in exports continued into 2023, with the export value reaching USD2.1 billion, double that of the previous year.

What triggered the surge

The rapid growth in Cambodia’s solar panel exports underscores its emerging role in the global value chain. This surge coincided with the U.S. government’s decision in June 2022 to diversify its supply chain from China and to temporarily exempt tariffs on solar cell and module imports from Cambodia, Malaysia, Thailand, and Vietnam.

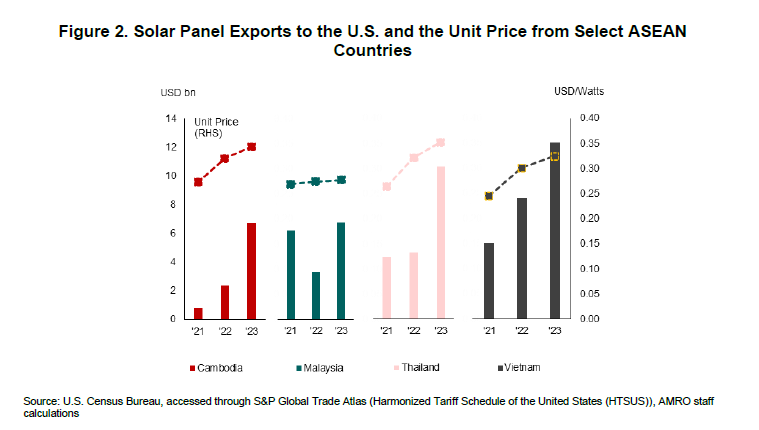

As a result, solar panel exports to the U.S. from these four ASEAN countries increased sharply in 2023, accounting for 75 percent of U.S. solar panel imports. Cambodia’s performance stood out. Its solar panel exports to the U.S. in 2023 accounted for over 90 percent of the country’s total solar panel exports.

Remarkably, more than 90 percent of Cambodia’s solar panel imports came from China in both 2022 and 2023. This high share suggests a possible rerouting of Chinese exports through Cambodia to circumvent trade restrictions, or reflects China’s heavy investment in Cambodia’s solar panel manufacturing industry, which gained growth momentum shortly after the U.S. tariff exemption announcement.

Critical juncture

After a short-lived boom in 2022-2023, Cambodia’s solar panel exports entered a critical juncture in 2024, facing significant challenges.

A primary concern is that solar panel exports to the U.S. will be subject to antidumping and countervailing duties ranging from 50 percent to 250 percent, following the expiration of the U.S. tariff exemptions in June 2024. Some solar panel factories halted production even before June, citing “facility upgrades” or “maintenance”. Some are considering shutting down their factories in Southeast Asia, highlighting the sector’s vulnerability. As a result, Cambodia’s exports experienced a significant drop in the early months of 2024, with similar declines seen in Malaysia, Thailand, and Vietnam.

Domestically, Cambodia’s solar panel industry is confronted by challenges from unstable electricity supply and high transportation costs. The unit price of its solar panel exports remains higher than that of the other three countries (Figure 2), reflecting the need for Cambodia to address its infrastructural bottlenecks to lower production costs and stay competitive.

Despite facing significant challenges, Cambodia possesses several advantages that would support the continued development of its solar panel industry. Cambodia can diversify its export destinations from the U.S. to developing economies, such as those in the Middle East or Africa who are transiting to greater use of renewable energy.

Cambodia’s low labor cost remains a major source of competitiveness for its manufacturing sector. Furthermore, the country’s high level of dollarization minimizes currency mismatch risks for foreign investors. Given the lack of strict capital control policies, foreign investors can freely move their money in and out of the country, increasing their confidence in the economy.

The government is also working on streamlining regulations, improving the business climate, and offering more investment incentives, such as tax holidays and duty exemption. These policy measures aim to make Cambodia an attractive destination for foreign direct investment and an appealing diversification option for companies considering ‘China+1’ or ‘Thailand+1’ strategies.

Additionally, the government has published its Power Development Plan for 2022-2040, focusing on increasing the share of renewable energy, improving grid stability, and reducing energy costs, allowing the country to deepen the development of its renewable energy sector.

In recent years, Cambodia has been able to benefit from the emerging solar panel industry by establishing factories, training workers, and developing trade partners. By continuing to improve both hard and soft infrastructure and to strategically explore more trade opportunities, Cambodia’s solar panel exports have more room to grow. A little spark may start modestly, but an extra push can go a long way.