The ringgit has drawn significant attention in the past two years. Throughout much of 2023 and into early 2024, it was ranked among the region’s worst-performing currencies. However, recent months have seen a sharp reversal, with the ringgit emerging as the best-performing currency in the region (Figure 1). What caused these extreme movements, and will they last?

In the recently published AMRO’s 2024 Annual Consultation Report for Malaysia, we analyzed the historical drivers of ringgit fluctuations during periods of depreciation and appreciation.

Our findings show that episodes of ringgit depreciation are predominantly influenced by external factors, including deteriorating global risk sentiment, falling oil prices, and a weaker Chinese yuan. Conversely, ringgit appreciation tends to be driven by a combination of external and domestic factors, such as improving growth prospects for Malaysia and a reduction in the country’s risk premium.

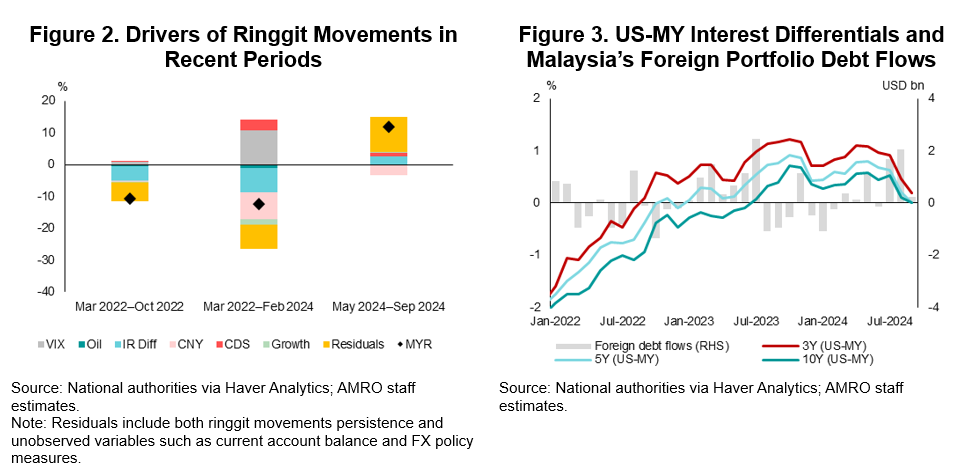

The ringgit’s decline since 2022 can be largely attributed to the widening interest rate differentials between the US and Malaysia, as well as the weakness in the yuan (Figure 2). Additionally, a significant deterioration in Malaysia’s current account balance, coupled with the ringgit’s tendency to decline more sharply during periods of broader depreciation in regional currencies, are key factors contributing to its continued underperformance.

What drove the ringgit’s recent outperformance?

According to our findings, the recent appreciation of the ringgit is partly driven by an improvement in external factors that previously weighed it down, alongside strengthening domestic fundamentals.

The narrowing of interest rate differentials between the US and Malaysia, following the anticipation and eventual commencement of the Fed’s easing cycle, has triggered a surge in foreign portfolio debt inflows into Malaysia (Figure 3). The announcement of industrial masterplans, infrastructure projects, and the enactment of fiscal reforms have boosted Malaysia’s growth prospects and strengthened investors’ confidence.

These developments have enhanced the appeal of Malaysian assets, attracted larger foreign portfolio inflows, and drove the outperformance of Malaysia’s domestic equity markets, providing strong support for the ringgit.

Additional factors that potentially contributed to the ringgit’s recent outperformance include the effectiveness of the coordinated efforts between the government and Bank Negara Malaysia to encourage Government-Linked Companies and Government-Linked Investment Companies to repatriate and convert their foreign investment income for a more balanced two-way flow. This has propped up market confidence, reduced expectations of a prolonged ringgit decline, and discouraged the hoarding of foreign currencies.

Notably, the share of foreign currency deposits among enterprises has been declining since May, indicating that corporates are increasingly converting their foreign currency proceeds into ringgit.

On the back of a stronger rebound in exports supported by the global technology upcycle, market analysts are expecting Malaysia’s current account balance to improve more significantly than that of most regional peers by the end of this year following a sharp deterioration in 2023.

Risks to the ringgit’s outlook

Although existing external conditions and domestic fundamentals remain broadly supportive of the ringgit, several factors could pose downside risks to its current trajectory.

A significant shift in the Fed’s rate outlook or a downgrade in China’s growth prospects could weigh on the ringgit. The ringgit has benefited from narrowing yield differentials amid the start of monetary easing by the Fed. However, any developments that will lead to a substantial delay or a reduction in the size of the Fed’s rate cuts could constrain the ringgit’s recovery.

Furthermore, any negative developments in China could be reflected in the movements of the ringgit given Malaysia’s close economic ties with China and the ringgit’s association with the yuan.

Other external factors, such as the escalation of trade and geopolitical tensions, could lead to a deterioration in global risk sentiment or weaker global growth prospects. These developments may trigger risk-off flows from emerging market assets, further putting pressure on the ringgit.

Domestically, a slower-than-anticipated implementation of the planned investment projects and fiscal reforms may challenge investors’ optimism regarding Malaysia’s growth prospects and debt sustainability, thereby undermining the support for the ringgit.

Notwithstanding the potential risks, strong domestic fundamentals have historically been vital in supporting the ringgit. Malaysia should continue its efforts to implement structural and institutional reforms aimed at strengthening these fundamentals. Ensuring the diversification of trade and investment networks and maintaining regular engagement with the markets will also provide enduring support for the ringgit in the medium term.