This article first appeared in Project Syndicate on February 24, 2025.

A troubling trend persists across Asia, Latin America, and Europe: countries are running fiscal deficits to restore growth and support higher debt-service costs. As fragmentation, climate change, and population aging shape long-term economic prospects, policymakers must balance fiscal consolidation with rising expenditure needs.

As economies worldwide start to emerge from the inflation-fueled cost-of-living crisis that followed the COVID-19 pandemic, fiscal policymakers are confronting a sobering reality: they are not out of the woods yet.

Geoeconomic fragmentation, climate change, and population aging are shaping immediate and longer-term economic prospects. These trends carry a hefty price tag, and the ability to bear the costs varies widely across Asia, Latin America, and Europe. With economic recovery and fiscal consolidation progressing at different speeds within each region, policymakers must strike a delicate balance between addressing them and supporting growth.

When the pandemic erupted, governments across these three regions unleashed massive fiscal stimulus to stabilize their economies. The resulting strain on public finances has revealed divergences in fiscal health. ASEAN+3 economies – the ten members of the Association of Southeast Asian Nations, plus China, Japan, and South Korea – have experienced the steepest deterioration, with debt-to-GDP ratios surging by 17 percentage points since 2019. In Latin America, debt ratios have increased by a comparatively modest six percentage points, while public debt in Europe is now closer to pre-pandemic levels, owing to inflation and the phaseout of economic-support measures.

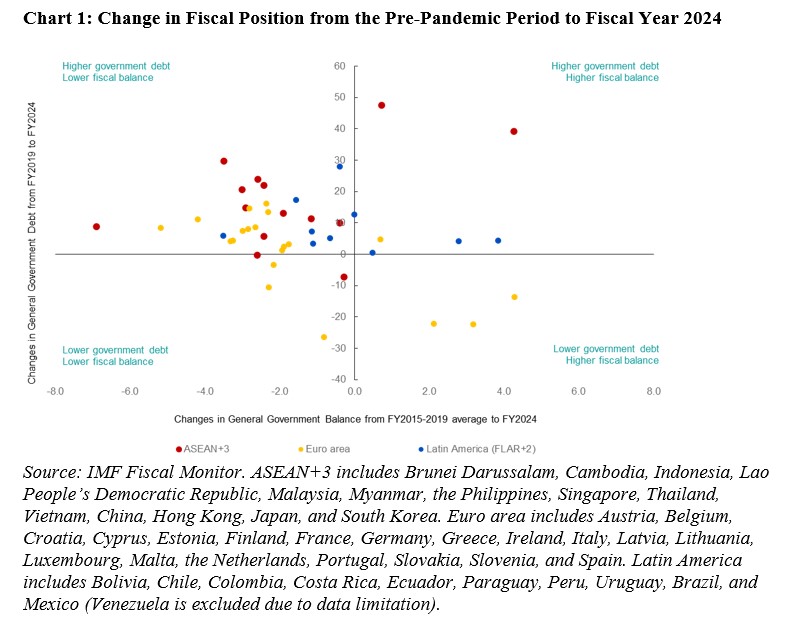

Despite these differences, a troubling trend has emerged across the three regions: countries are running persistent fiscal deficits to restore growth and cover higher debt-service costs (Chart 1). For many economies, including some highly indebted ones in Europe and large emerging markets in ASEAN+3 and Latin America, debt levels look set to climb even higher in coming years unless decisive measures are taken to consolidate fiscal positions.

Increasing economic fragmentation, heightened geopolitical tensions, and protectionism are some of the most immediate challenges for ASEAN+3, Latin America, and European economies. These factors add to economic insecurity and uncertainty by driving up costs, fueling inflation, slowing growth, and disrupting market access. This, in turn, triggers financial-market volatility and puts pressure on emerging-market monetary authorities. Higher interest rates in advanced economies further strain public budgets, compounding these risks and narrowing policy options.

The fracturing of global trade, and the resulting trade diversion and shifts in production to circumvent protectionist barriers, does offer short-term benefits for some ASEAN+3 and Latin American economies. But these gains are fragile and subject to the political whim of others. Moreover, Latin America’s dependence on commodities and need for more investment in infrastructure, education, and technology limit the region’s ability to capitalize on these trends.

Recent economic and political shocks have underscored the European Union’s competitiveness and security challenges. No longer able to rely on cheap Russian gas, the bloc must urgently strengthen its energy security. Given its lack of productivity growth, Europe also faces immense pressure to invest in infrastructure and technological innovation. And the bloc needs to do all this while ramping up defense spending to meet NATO’s 2 percent-of-GDP target or higher.

Meanwhile, the economic toll of climate change is mounting, particularly in climate-vulnerable countries. In Latin America, extreme weather events have already pushed up costs for the agriculture and infrastructure sectors. Government spending has so far focused on reconstruction and mitigation, while adaptation has been given short shrift. Projections indicate that the region’s climate-related costs could reach 2-6 percent of GDP by 2050. Many Latin American economies rely heavily on natural-resource exports, and thus face the twin challenge of mitigating environmental damage while also sustaining economic growth.

ASEAN+3’s high exposure and vulnerability to climate change requires urgent regional collective action and large-scale public investment in adaptation and mitigation measures, including targeted subsidies and incentives to accelerate the transition to a sustainable, low-carbon economy. The EU, for its part, is already making progress on its ambitious goal of achieving net-zero carbon emissions by 2050, with a significant portion of the NextGenerationEU fund earmarked for green projects. Still, European countries estimate that they will need to spend around 2.5 percent of GDP, on average, on decarbonization measures until 2050, in addition to investments in adaptation.

Lastly, demographic shifts have added to fiscal pressures in these regions. Some ASEAN+3 economies are already feeling the strain of population aging on social-protection and health-care systems. By 2050, the fiscal costs of a graying society are projected to rise by 2.7-9.3 percentage points of GDP in ASEAN+3 economies that are already classified as aged or super-aged. The EU is also grappling with demographic headwinds as well, as population aging shrinks the labor supply and some governments’ revenue base. Despite pension reform, old-age benefits, together with long-term care and health services, could cost about 2 percent of GDP by 2050, with some economies more exposed than others.

Despite being relatively young, Latin America is graying at an accelerated pace, which threatens the sustainability of pay-as-you-go pension systems, drives up health-care costs, and exposes gaps in social-safety nets. The region’s high levels of informal employment further exacerbate pressures on social-security systems. By 2050, the fiscal impact of population aging is estimated to rise by 3-7 percentage points of GDP, with more pronounced effects in older societies.

Amid these challenges, policymakers must balance fiscal consolidation with rising expenditure needs. Reducing deficits is crucial, but so, too, is fostering economic growth and resilience. To walk this fiscal tightrope, governments in Asia, Latin America, and Europe must adopt revenue-enhancing measures, restructure expenditures, redirect resources toward growth-friendly initiatives, and establish public-private partnerships to finance investments in infrastructure, climate measures, and technological innovation.