The Japanese economy has rebounded from deflation, with inflation expectations now anchored at higher levels. The stock market climbed to an all-time high in March after 35 years of stagnation. This resurgence can be attributed to various factors, notably the recent spike in global inflation and accommodative macroeconomic policies and structural reforms implemented over the past decade.

For a long time, effective fiscal measures related to labor market reform, investment in human capital and the adoption of new technologies have been instrumental in addressing its multifaceted challenges. To sustain its dynamism, Japan needs to embark on further structural reforms.

Given the country’s challenging fiscal situation, striking a right balance between growth-enhancing spending and fiscal consolidation is crucial to maintain market confidence in its long-term fiscal sustainability.

Today, Japan grapples with a record high public debt of around 260 percent of GDP, which is the highest among advanced economies. Since the COVD-19 pandemic, debt has risen by more than 20 percentage points of GDP due to the large fiscal stimulus policies.

Despite the fading impact of the pandemic and the steady recovery of the Japanese economy, the government has been slow in rolling back expenditure and instead has continued to pursue an expansionary fiscal policy.

Decoding Japan’s fiscal risks

Japan must carefully assess the factors associated with the continuous deterioration of its fiscal accounts.

First, weak fiscal discipline is a concern. The proliferation of new initiatives, particularly on childcare and defense, could increase the fiscal deficit, especially when they are not complemented by revenue-raising measures or expenditure realignment. Warning signals are already evident with the rising costs of military equipment amid tight supply and a weaker yen.

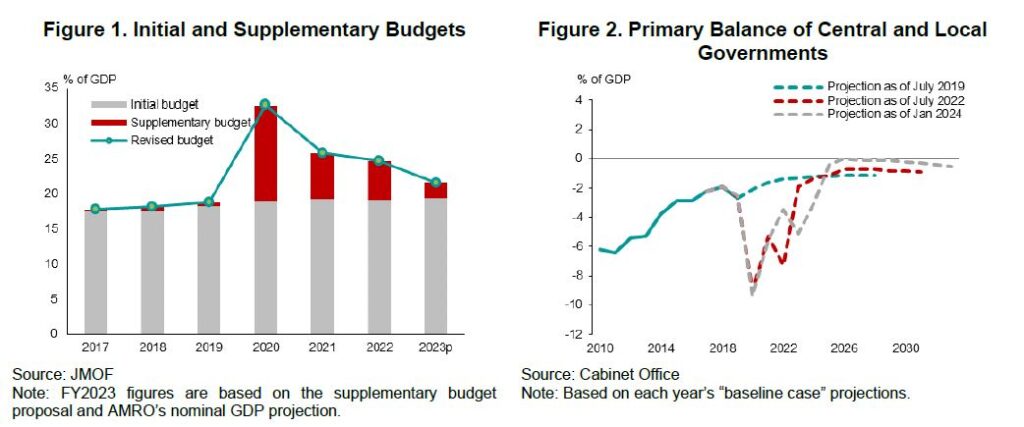

Japan has also continued to pass supplementary budgets since the start of the pandemic (Figure 1). While supplementary budgets are intended to assist the country in responding to unexpected shocks, their continuous enactment during non-crisis time could lead to a weakening of the budgetary process and affect resource allocation, accountability, and transparency.

Japan has relaxed on its fiscal commitment of achieving a primary balance by FY2025, and under the latest government baseline projection, will achieve it by FY2026 instead (Figure 2).

Second, after experiencing decades of exceptionally low interest rates, Japan has recently seen rising interest rates. This shift, together with the evolving inflation dynamics, is expected to drive further increases in interest rates. The expected rise in the interest rate will render government refinancing more costly.

Third, Japan has one of the world’s oldest populations, resulting in high pension and healthcare costs for the government. Social security spending has steadily increased from below 20 percent in the 1990s to about a third of government expenditure. The fiscal burden stemming from Japan’s aging population is projected to intensify. Adequate fiscal space must be created to accommodate the inevitable surge in expenditure associated with an aging society and to safeguard the sustainability of the social protection system.

Lastly, Japan’s very large public debt carries inherent risks. Even minor shocks could potentially be amplified due to the sizable debt stock. Japan’s debt dynamics are vulnerable to shocks related to economic growth and interest rates. According to AMRO projections, there is a risk that the public debt could surge to 290 percent of GDP in the long term under an adverse scenario marked by a combination of shocks. Such a sharp increase in public debt could erode confidence among investors, rating agencies and the public alike.

Roadmap for fiscal reform

As 86 percent of Japan’s public debt are held by domestic residents and a considerable portion of the debt has an average maturity of over 9 years, increases in interest rates would impact the debt service cost only gradually, which puts the country in a favorable position to strategically consolidate its fiscal position.

However, the debt is projected to rise in the long term, and Japan may increasingly rely on foreign sources to fund its budget deficit, making it more vulnerable to external risks.

As rising interest rates are expected to increase the cost of servicing debts in the medium to long term, making stronger fiscal consolidation efforts now is necessary to stabilize public debt and pivot toward fiscal prudence.

Short-term fiscal stimulus measures associated with the pandemic and high commodity prices should be withdrawn, allowing such expenditure to fall back to pre-pandemic levels. Similarly, supplementary budgets should be introduced and enacted only in response to unforeseen shocks.

Achieving primary surplus

Fiscal policy needs to realign with the pre-pandemic fiscal consolidation plan to achieve a primary surplus in the medium term. Given the already elevated level of public debt, it is crucial to boost revenue and reduce expenditure to finance new policy initiatives, such as those related to childcare and defense.

The establishment of an independent fiscal institution is recommended to provide objective analysis and long-term projections of government debt. Such institution can play a major role in charting the course of fiscal consolidation, bolstering its feasibility and effectiveness, and redirecting public debt to a downward trajectory.

With a sharper focus on fiscal prudence and a departure from short-term support measures, the government will be in a position to better allocate resources to structural reforms.

Delaying decisions is no longer an option for Japan. A strong commitment to fiscal consolidation and discipline is critical, and creating sufficient fiscal space for future investments is key for Japan to ensure economic resilience.