This article was published in The Korea Times on May 30, 2024.

Inflation is making a comeback in Japan, with a significant rise in consumer prices since the start of 2022. In an era defined by economic shifts and global uncertainties, a pivotal question emerges regarding the prospect of inflation in Japan: Is this time different? Will Japan finally be able to break free from years of deflation and achieve sustainable inflation through an upswing in economic activity?

The prevailing market viewpoint posits that Japan, faced with challenges of population aging, is in dire need of a significant wage increase to combat deflation and achieve sustainable inflation. Mired in a prolonged deflationary quagmire, the Japanese economy requires a robust upswing in wages to invigorate consumer spending and to catalyze broader economic expansion.

In general, consumers experience more purchasing power with higher wages, fostering a more resilient and self-sustaining economic ecosystem. The higher purchasing power, in turn, propels demand, fuels production, and ultimately contributes to a healthier inflationary environment. The Bank of Japan (BOJ) Governor and board members have consistently reiterated the importance of the wage-price spiral, emphasizing that wages and prices can mutually drive each other.

Latest wage trends

In recent months, Japan has experienced a simultaneous upswing in both wages and prices, instilling optimism for sustainable inflation dynamics in the country. Since the early 1990s, the average wage growth rate in Japan has remained around 0 percent per annum. However, there is now a significant rise in wage growth.

As reflected in the increased Google Trends activity in Japan related to rising wages, the public’s interest in this economic indicator has heightened. Understanding the potential impact of wages on prices is pivotal in forecasting future inflation dynamics and determining an appropriate monetary policy stance.

The recent surge in wages can be attributed to a combination of labor shortage and annual wage negotiations between management and unions in Japan. The outcome of these negotiations has led to a rise of the agreed-upon wage growth from 1.8 percent in 2021 to 3.6 percent in 2023. This marks a significant shift as shunto had typically resulted in a wage growth of below 2 percent in 2010s. The initial result of the 2024 shunto spring wage negotiations saw the union securing the biggest pay rise for Japanese workers in three decades of 5.3 percent.

Moreover, labor shortage across various industries further amplifies the demand for wage hikes. BOJ’s Tankan surveys reveal shortages in both the manufacturing and non-manufacturing sectors, affecting enterprises of different sizes. As a result, Japan’s employment rate has registered a substantial increase, and the influx of foreign workers has nearly quadrupled since 2008.

Interplay between wage growth and CPI inflation.

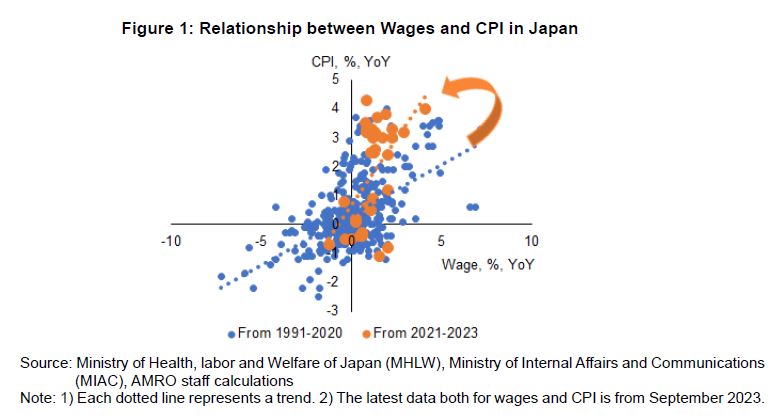

The wage growth and CPI inflation in Japan had a strong and consistent relationship from 1991 to 2020, and the relationship was even stronger from 2021 to 2023 (Figure 1). The correlation coefficient, measuring the statistical relationship between two variables, also indicates an increasing correlation between wage growth and CPI inflation, especially in recent years. These results remain robust even when core CPI (excluding fresh food) or core-core CPI (excluding both fresh food and energy) were considered.

AMRO’s preliminary empirical analysis suggests that wages have a statistically significant impact on not only headline CPI but also on core CPI and core-core CPI, with the most pronounced effect observed on core CPI. When the data is broken down into goods and services, the analysis suggests that wages have a more substantial impact on CPI goods. We found that one percentage point increase in wages would only translate into one-third of a percentage point increase in prices. This correlation implies that wages may need to rise by more than 3 percent in order to achieve the 2 percent inflation target when other factors remain constant.

Policy implications

Looking forward, the strengthening of the wage-price spiral hinges on the interplay of wage increases and improvement in labor productivity.

However, caution is warranted in extrapolating Japan’s persistent wage effects on inflation. As the wage increases have gained momentum only recently, relying solely on analyzing past data may not help to accurately predict future trends.

Japan is lagging behind other advanced economies in labor productivity. In addition to boosting stagnant wages, policymakers must also look for ways to enhance labor productivity, such as introducing structural reforms in education and the labor market to expand skill sets.

The Japanese government’s labor market reform guidelines, announced in May 2023―including re-skilling, introduction of job-based wages, and facilitating the movement of labor to growth sectors ―are good initiatives.

Given the increasing number of non-regular workers, it is also crucial to foster work motivation through education investment and performance-based salary initiatives (Aoyagi and Ganelli, 2013). Furthermore, Japan should leverage the country’s high educational attainment and match talents desired by businesses through industry-academic collaborations to raise productivity.

While a strong relationship exists between wage growth and inflation, there is more work to be done on promoting labor productivity and relevant market reform for Japan to achieve and sustain its 2 percent inflation target.