Tourism’s recovery is on track, but Hong Kong requires stronger measures to become a preferred destination of choice.

The resurgence of inbound tourism in Hong Kong has been promising since the resumption of normal cross-boundary travel in early February 2023. By December, tourist arrivals have reached 34 million, or 61 percent of the annual total in 2019. The rebound of Hong Kong’s economy to 3.2 percent growth in 2023 from a contraction of 3.5 percent in 2022 can be partly attributed to the firm recovery in tourism.

Despite the positive trend, the recovery of Hong Kong’s tourism sector lags behind other regional destinations such as Indonesia, Japan, Korea, Singapore and Thailand, primarily due to its heavy reliance on mainland tourists who held off traveling abroad after the pandemic. Since late 2023, competition would increase as Malaysia, Thailand and Singapore started to offer visa-free travel to lure mainland visitors to their shores.

Several other factors also impacted Hong Kong’s tourism recovery. The appreciation of the Hong Kong dollar (HKD), which is pegged to the US dollar, against other regional currencies has a discouraging effect on tourists. Between its full reopening and January this year, the HKD has strengthened by 6.2 percent against the renminbi, 5.7 percent on average against ASEAN-5 currencies, and 10.0 percent on average against the Japanese yen and the Korean won. Amid a high inflationary environment, potential tourists could feel their purchasing power further eroded by the unfavourable exchange rates.

Additionally, the ongoing labor shortage in the tourism and transport industries persists despite the removal of travel restrictions. Workers who were laid off or returned to their home countries during the COVID-19 pandemic have yet to return to Hong Kong, contributing to a scarcity of experienced staff in the domestic market.

Longer-term challenges

If we take a longer perspective, the tourism industry’s contributions to Hong Kong’s GDP and employment had been declining even before the pandemic. Tourism’s share of GDP fell from 5.1 percent in 2014 to 4.5 percent in 2018, and its share of total employment dropped from 7.2 percent to 6.6 percent. Per capita spending by inbound tourists also decreased from nearly HKD8,000 in 2014 to HKD6,614 in 2018. These trends highlight the need to bolster Hong Kong’s appeal amid global travellers’ evolving preferences.

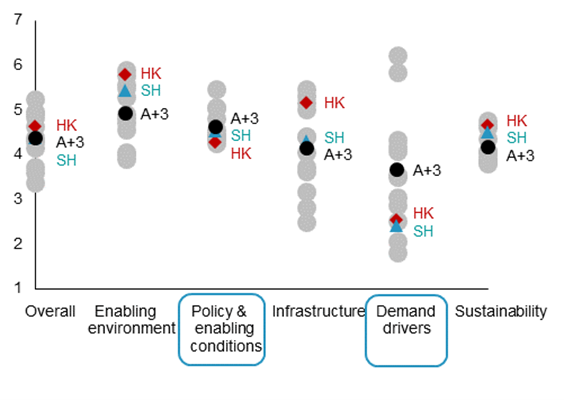

According to the World Economic Forum’s Travel and Tourism Development Index 2021 (Figure 1), Hong Kong must focus on improving “policy and enabling conditions” through enhancing price competitiveness. Furthermore, cultural and natural offerings should be expanded to enhance its attractiveness while strengthening associated protection for these “demand drivers” through achieving UNESCO inscriptions.

Figure 1. Travel and Tourism Development Index, 2021 (Hong Kong Scores vs ASEAN+3 and Other Global Small and High-income Economies)

(Scores ranging from 1 to 7, with 7 being the highest)

Note: Red diamonds represent Hong Kong (HK) scores. Grey dots represent scores of individual ASEAN+3 economies – Cambodia, China, Hong Kong, Indonesia, Japan, Korea, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. Black dots represent the average for the ASEAN+3 economies (A+3). Teal triangles represent the average scores for small population and high-income economies (SH), which comprise 26 economies including Hong Kong, Singapore, Iceland, Ireland, New Zealand, Uruguay, etc. A small population is defined as one of <10 million people. The level of income is defined by the World Bank’s income classification. High-income refers to a gross national income per capita of USD12,696 or more.

Bolstering ongoing strategies

To revive the tourism industry, the Hong Kong Tourism Board has outlined four strategic focal points in its 2023-24 Work Plan which include spearheading a robust recovery through initiatives such as the “Hello Hong Kong” and the “Events Capital of Asia” campaigns. Additionally, there is an emphasis on fostering multi-destination tourism with counterparts in the Greater Bay Area while continuously supporting the travel trade through various schemes.

While these strategies have helped to sustain a solid recovery in tourism with higher-than-expected arrivals in 2023, there is room for more support to ensure a full-fledged recovery and enhance longer-term competitiveness.

To complement existing labor importation schemes, collaboration with mainland authorities can boost the influx of workers to address labor shortages. Efficient recruitment drives could connect interested workers with prospective employers. Both the public and private sectors could also leverage artificial intelligence and digitalization to automate processes, allowing workers to focus on delivering personalized services.

In the medium to long term, Hong Kong should diversify its source markets beyond the mainland and the Asian region to untapped markets. For instance, creating more Muslim-friendly offerings could attract visitors from the Middle East who were high spenders before the pandemic. Hong Kong could also offer localized and in-depth tours to showcase unique traditions and daily activities of residents to cater to tourists’ rising demand for cultural and customary immersion.

Hong Kong should also address its weakness in price competitiveness and add value by expanding tourism potential beyond leisure. Organized trips leveraging Hong Kong’s appeal as a financial hub could encourage tourists who are visiting for financial services to extend their stay in the city. Furthermore, the continual refurbishment and development of infrastructure, such as the upcoming 50,000-seater Kai Tak Sports Park, could fortify Hong Kong’s position as a host city for major events and promote muti-purpose tourism.

Accelerating the recovery of Hong Kong’s tourism should not come at the expense of compromising growth sustainability, environmental preservation, and cultural protection. Recent measures of regional peers to restrict the number of tourists to prevent “over-tourism” underscore the need for careful consideration and strategic coordination across government agencies. Establishing a long-term framework that incorporates business continuity strategy and ensuring a sustained labor supply would be crucial in minimizing disruptions to the tourism industry should future pandemics strike.