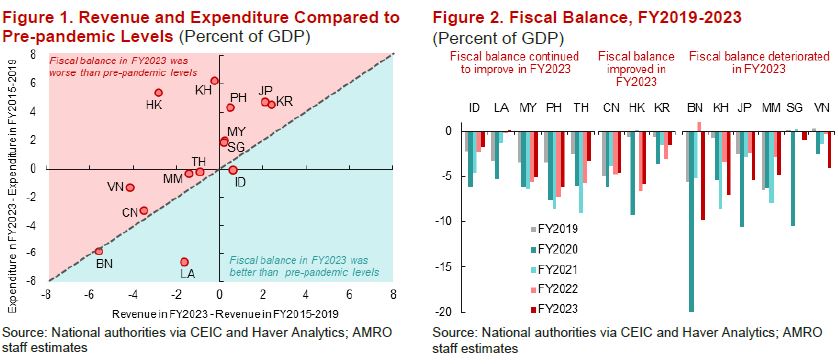

After a few years of fiscal expansion to fight the economic fallouts from the COVID-19 pandemic and inflationary pressure arising from the war in Ukraine and El Niño, fiscal deficits have not returned to pre-pandemic levels in most ASEAN+3 economies (Figure 1).

Revenue collection exceeded the pre-pandemic averages only in six out of 14 ASEAN+3 economies, namely Indonesia, Japan, Korea, Malaysia, the Philippines, and Singapore. Concomitantly, the fiscal deficits of these economies have remained higher than the pre-pandemic averages due to their still elevated spending needs.

Nonetheless, in general, the fiscal positions of ASEAN+3 economies continued to improve in 2023 (Figure 2). The recovery in domestic demand and employment amid a high inflation environment has bolstered revenue collection, although resource-based revenue in commodity-exporting economies moderated due to lower commodity prices. On the expenditure side, ASEAN+3 economies continued to phase out temporary supportive measures related to the pandemic and high inflation.

This positive trend of improving fiscal balance is expected to continue in 2024. The budget plans of ASEAN+3 economies aim to further improve their fiscal positions in 2024, with robust revenue growth expected to offset the pick-up in expenditure. Most member economies intend to maintain a contractionary or neutral fiscal stance, reflecting the positive swing in the output gap.

Although ASEAN+3’s government debt-to-GDP ratio continued to rise in 2023, the pace of increase has slowed in most economies. However, the maturity of the massive debt issued during the pandemic is projected to keep the region’s gross financing needs elevated for a while.

Challenges and opportunities

Substantially higher debt levels and elevated gross financing needs indicate that the fiscal spaces of ASEAN+3 economies are significantly narrower than the pre-pandemic period. Given the risk of recurrence of large-scale economic crises, such as the 2008 global financial crisis and the recent COVID-19 pandemic, and the massive fiscal expansion needed to counter these shocks, restoring fiscal buffers should be one of the region’s top policy priorities before another crisis hits.

The region’s positive economic outlook in the near term, with stronger growth and moderating inflation, offers an opportunity as well as a rationale for fiscal policy to start transitioning from crisis response mode to its fundamental role in promoting economic stability, growth potential, and income redistribution. However, elevated uncertainty in the near term outlook implies that fiscal policy should be flexible and agile during the transition.

From a longer-term perspective, fiscal policy should also play a crucial role in addressing structural challenges, particularly from population aging and climate change.

Striking a balance in the transition to fiscal normality

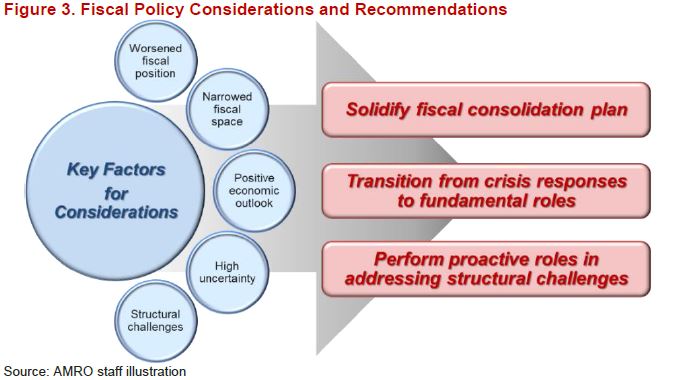

In the coming years, the biggest policy challenge for ASEAN+3 policymakers lies in striking an appropriate balance between restoring fiscal buffers and carrying out an active fiscal policy to support sustainable and inclusive growth. In light of the challenges and opportunities, ASEAN+3 economies should consider three policy initiatives – solidifying fiscal consolidation plan, transitioning from crisis response mode to peacetime fundamental role, and proactively addressing structural challenges (Figure 3).

Rebuilding fiscal buffers is a challenging task, but it could be facilitated with a solid plan and supporting institutions. Fiscal consolidation plans should be supported by strong commitment and solidified with clear targets and path. Fiscal rules will help anchor and operationalize fiscal targets, while mitigating any political pressure for spending that could derail the fiscal consolidation path.

Enhancing the medium-term fiscal framework will help support specific paths of fiscal aggregates to achieve targets, while aligning fiscal resource reallocation with national strategies.

When pursuing fiscal consolidation measures, it is crucial to focus not only on reducing fiscal deficits. Achieving favorable debt dynamics conditions, particularly in terms of interest rate and growth rate differentials, also plays an important role in a successful fiscal consolidation plan.

While consolidating the fiscal position at the aggregate level, the fiscal policy’s focus should transition from crisis response mode to its fundamental role. Extensive and repeated ad-hoc fiscal support measures should be phased out in tandem with strengthening economic recovery and subsiding inflationary pressure.

At the same time, fiscal policy should resume its fundamental role of supporting economic transformation aimed at strengthening growth potential and enhancing economic resilience, which will, in turn, contribute to reducing the size of fiscal consolidation needs and enhancing fiscal sustainability.

To address structural challenges, fiscal policy should take a proactive role in developing long-term sustainable solutions. Amid rapid population aging, ASEAN+3 economies should intensify policy efforts to establish an adequate and sustainable support system for the elderly. This entails carefully assessing the effectiveness and fiscal implications of introducing or expanding social protection and healthcare programs.

Climate change adaptation requires public investments to minimize the impact of climate-related natural disasters, while climate change mitigation involves government policies to prevent or reduce the emission of greenhouse gases in achieving Nationally Determined Contributions commitments.

Fiscal stimulus and targeted fiscal responses have helped ASEAN+3 economies address the unprecedented health crisis and subsequent inflation surge. With regional growth gaining momentum and inflation moderating, the time is ripe for ASEAN+3 economies to transition to fiscal normality by striking an appropriate balance between rebuilding fiscal space and supporting sustainable and inclusive growth.