A painful lesson from the 1997 Asian Financial Crisis is capital flights and huge shifts in the holdings of financial assets, especially by foreign investors. Indeed, changes in the composition of debt holders play a crucial role in financial stability. While foreign creditors may lower government borrowing costs by broadening the investor base, they could also introduce volatility through selling off of riskier assets during periods of stress.

The September 2022 government crisis in the United Kingdom (UK) is a case in point. Unconvinced by the “mini budget” announced by the government to cut taxes and increase borrowing, foreign investors who held close to 30 percent of outstanding UK gilts sold off GBP24.2 billion gilts. The sell-off sent UK’s 2-year gilt yields spiking by 84 basis points within a week and led to turbulence in its stock and foreign exchange markets. The Bank of England had to resort to temporary gilt purchases in October to calm the markets.

Large shifts in domestic holdings of government debt can also cause instability in financial markets. Domestic banks worldwide have been accumulating government debt, a trend that intensified during the COVID-19 pandemic. This enhanced “government-bank nexus” poses risks to the banking system if a government was to default, as demonstrated by the 2010–2012 European sovereign debt crisis.

These developments prompted us to examine whether the composition in general government debt holdings has any material impact on financial stability through sovereign default risk. In AMRO’s ASEAN+3 Financial Stability Report (AFSR) 2023, we have quantified the impact of the changes in the types of government debt holders on default risk.

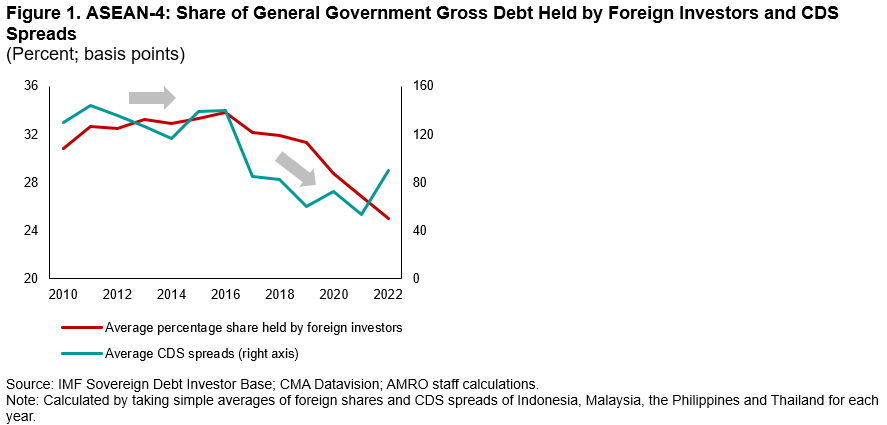

AMRO’s studies indicate that a 1-percentage point increase in the share of foreign holdings of general government debt is associated with a 1.32-basis point (bps) rise in credit default swap (CDS) spreads of seven ASEAN+3 economies (China, Indonesia, Japan, Korea, Malaysia, the Philippines and Thailand) between 2005 and 2022. The impact increased to 1.82 bps when we ran the analysis for the ASEAN-4 economies—Indonesia, Malaysia, the Philippines and Thailand—which have foreign holding shares between 12 and 38 percent.

The data did show a positive relationship between CDS spreads and the share of foreign investors over the past years. Specifically for the ASEAN-4 economies, the gradual decline in the share of foreign holdings in government debt has been matched by a decline in CDS spreads (Figure 1). While this observation highlights the potential linkage, our regression model identified other factors that could also affect CDS spreads of the region, including stock movements and current account balances alongside foreign investor share.

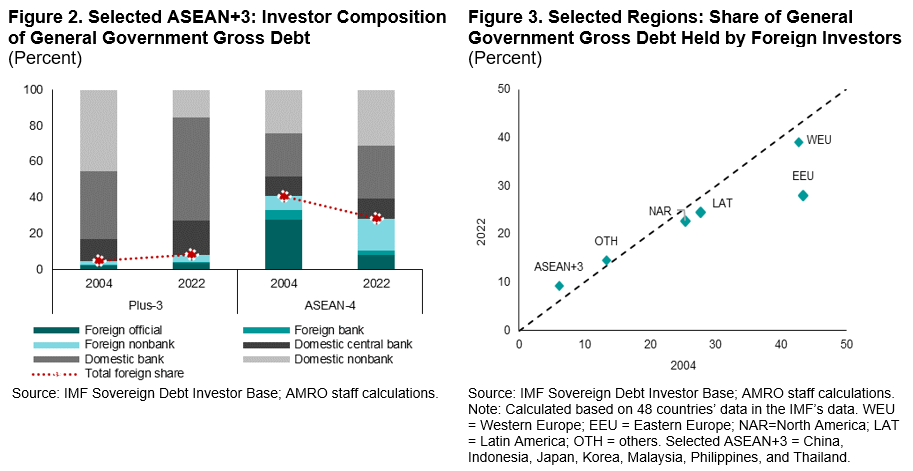

That said, the ASEAN+3 government debt market is still largely dominated by domestic investors. In particular, the share of domestic banks has expanded over the years, with their increasing role as primary market makers, notably for China, Malaysia, the Philippines and Thailand (Figure 2). While the share of total ASEAN+3 government debt held by foreign investors increased slightly from 2004 to 2022, the share is lower than other regions (Figure 3).

Diversifying the investor base of government debt would deepen the liquidity of the bond market, reduce its volatility, and mitigate the impact from adverse shocks. For example, allowing more domestic saving institutions, insurance companies and pension funds to invest in the government debt market is beneficial, as these institutions are usually stable and long-term investors, and less prone to sell-offs.

Meanwhile, countries with a high concentration of foreign investors in their public debt may be more susceptible to financial shocks as such investors tend to be more speculative. Therefore, authorities should continue to monitor foreign investor activity and associated capital flow movements to safeguard against major shifts in holdings and ensure timely response.