Public debt-to-GDP ratio in the ASEAN+3 region has risen sharply during the COVID-19 pandemic. It remains elevated above pre-pandemic levels, despite decreasing slightly to 100.4 percent in 2022 from 104.4 percent in 2020. Debt-to-GDP ratio by country increased in all except four ASEAN+3 economies from 2020 to 2022.

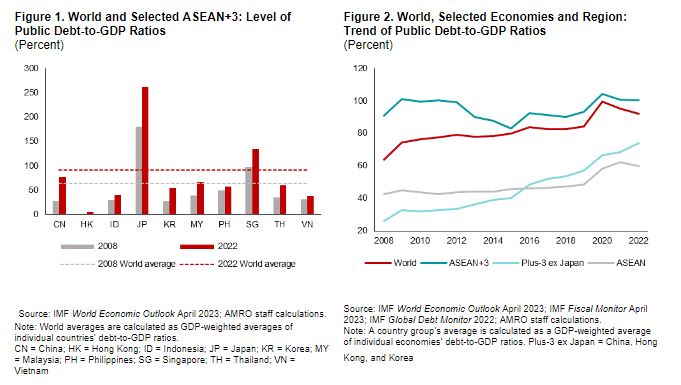

ASEAN+3 economies generally have moderate public debt compared with global standards (Figure 1). The only exception is Japan, which has a debt of 261.3 percent of GDP as of the end of 2022. However, Japan’s debt is predominantly domestic and denominated in Yen, limiting balance of payments risks. Singapore’s debt ratio is also high, but most of its debt is issued for non-budgetary purposes, such as for T-bills and SGS bonds to develop the capital market.

Despite the recent moderation, public debt-to-GDP ratios in ASEAN+3 are still rising, especially in the Plus-3 economies (China, Japan, Korea and Hong Kong, China). The ratios for several ASEAN economies jumped during the pandemic and remain elevated (Figure 2).

A high level of fiscal debt can create an adverse feedback loop, if the debt is held mostly by the banks. A high level of debt can undermine investor confidence and cause the value of debt to plummet if doubts about the government’s debt repayment capacity arise, causing investors, including banks, to face losses on their government debt holdings. This unsettling situation, called sovereign-bank nexus, could prompt foreign investors to sell the bonds and exit the market, triggering capital outflows. The resulting surge in exchange rate volatility and increased capital flight intensifies the challenges.

As the economy takes a hit, the government would be faced with lower tax revenue, a larger deficit and a potential need to bail out financial institutions, which could trigger a downward spiral. The spillovers and feedback loop could be amplified through the nexus between the government and the financial sector, resulting in a vicious cycle.

Indeed, many fiscal crises have coincided with financial crises, underscoring the connection between fiscal and financial stability. Out of 75 episodes of sovereign debt crises between 1970 and 2017, 33 of them (44 percent) coincided with financial crises such as banking or currency crises (Laeven and Valencia 2018).

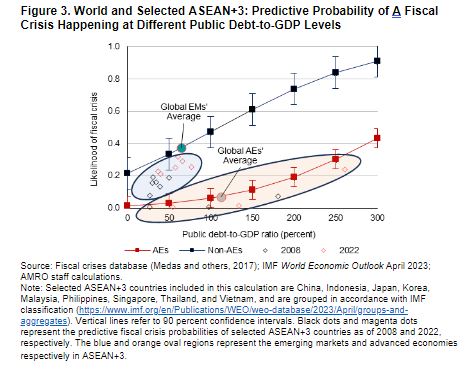

AMRO’s empirical analysis in the ASEAN+3 Financial Stability Report (AFSR) 2023 showed that increases in the debt-to-GDP ratio raise the risk of a fiscal crisis. The analysis suggests that as the debt-to-GDP ratio increases, the likelihood of fiscal crises increases also, with emerging market economies being more vulnerable. The average probability of a fiscal crisis is estimated to be 37 percent for global emerging market economies and 7 percent for global developed economies, as of 2022.

Although the average probability of a fiscal crisis for the ASEAN+3 region’s emerging market economies is estimated to have increased from 15 percent in 2008 to 26 percent in 2022, it is still lower than the average of global emerging market economies (Figure 3). Among the region’s developed economies, the probability of a fiscal crisis also increased from 3 percent in 2008 to 9 percent in 2022, which is around the global advanced economies’ average.

In conclusion, a big increase in government debt can not only hamper economic growth, but also heightens the risk of fiscal crises. Determining the optimum size of public debt is a critical decision that should balance the need for more fiscal spending on infrastructure investment and social needs with the higher risk of running into debt servicing difficulties.

ASEAN+3 economies should implement medium-term fiscal consolidation to control the rise in public debt, which increased sharply as a result of the COVID-19 pandemic fiscal stimulus programs. This would mitigate financial stability risks arising from high public debt. Possible solutions include boosting revenue, optimizing expenditures, and adopting fiscal rules.