When discussing economic resilience, the spotlight often falls on the robustness of a country’s financial regulatory framework and quality of its banking supervision. This is especially true for developing economies like Lao PDR, where compliance with international standards will not only help fortify the financial sector but also improve its appeal to foreign investments and allow greater integration with international markets.

However, like many other nations, Laos had to grapple with the immediate economic challenges of the COVID-19 pandemic in the past few years, while efforts toward regulatory reforms were put on the back burner. Now, as the country gradually pivots toward recovery, the urgency for regulatory reforms has resurfaced.

Roadmap for adopting international standards

The Bank of the Lao PDR (BOL) has long set its sights on modernizing the Laos banking sector. Central to this plan is the alignment of the country’s financial regulations with international standards, particularly the Basel II framework and the International Financial Reporting Standard 9 (IFRS 9).

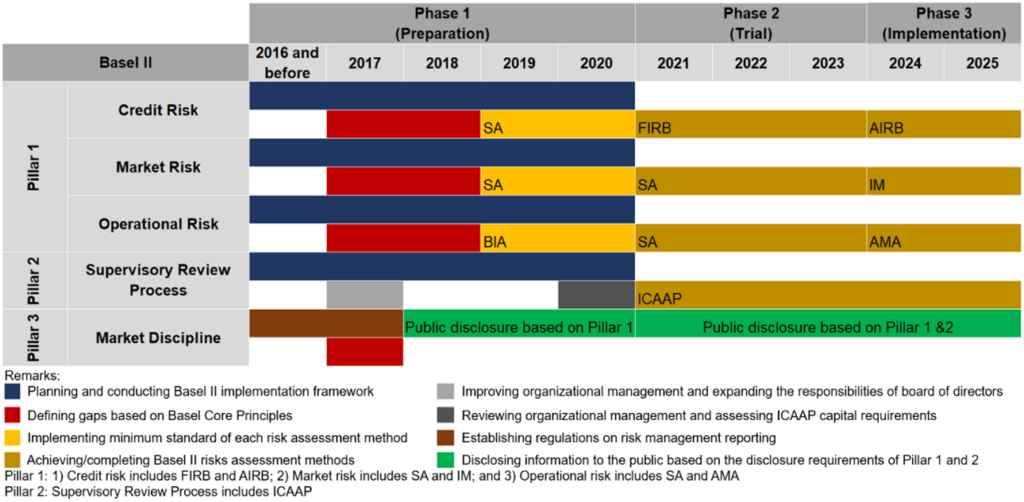

In 2017, the BOL set out its ten-year Strategic Plan for Financial Sector Development (2016-2025) to chart its course to adopt Basel II and partially adopt Basel III standards by 2025. The overarching goal is to enhance banks’ risk management by: a) aligning capital adequacy requirements with banks’ risk profiles (i.e., credit, market, and operational risks), b) move toward a more risk-based supervisory approach, and c) strengthen disclosure and market discipline.

In parallel, the BOL targets the year 2026 for full adoption of IFRS 9, which is an accounting standard for the classification and measurement of financial assets and liabilities, including the recognition of loan impairment. The IFRS 9 would introduce the use of Expected Credit Loss (ECL), as opposed to the use of incurred losses under earlier accounting standards.

When implementing the IFRS 9, loan impairment is recognized in three stages: stage one, when a loan is originated, its ECLs for the next 12 months are recognized, and a loss allowance is established accordingly. In stage 2, where credit risk increased significantly but not yet impaired, and stage 3 when a loan is considered credit-impaired, lifetime ECLs are recognized. By incorporating these forward-looking elements into the calculation of required loan loss provisions, banks will be required to set aside earlier and larger impairment allowances.

Figure 1. BOL’s Basel II Implementation Plan

Source: BOL, AMRO Lao PDR Annual Consultation Report 2019

Note: The abbreviated names are as follows: Standardized Approach (SA); IRB (Internal-Ratings Based Approach); FIRB (Foundation IRB); AIRB (Advanced IRB); IM (Internal Model); BIA (Basic Indicator Approach); AMA (Advanced Measurement Approach); ICAAP (Internal Capital Adequacy Assessment Process)

An uneven journey for local and foreign banks

The pace of Basel II adoption has not been uniform across all Laos-based banks. Some local banks find themselves trailing behind as they face the whirlwind of challenges from the COVID-19 pandemic, recapitalizations, and organizational restructurings that have derailed their implementation plans.

Most local banks now calculate credit risk based on the Basel II’s using the BOL’s guidelines on the Standardized Approach (SA) issued in May 2023, though it was initially intended for implementation in 2019. In contrast, foreign banks in Laos are ahead of the curve, frontrunning official regulatory requirements by internally adopting elements of Basel II, including their own internal credit, market, and operational risk assessments, provisioning models, and calculation of the Capital Adequacy Ratio (CAR), aided by technical expertise from their parent banks.

Likewise, the progress of IFRS 9 adoption varies across banks. Although the BOL has already kick-started the process by setting up a committee together with banks to conduct gap analyses for IFRS 9, the rollout of the relevant guidelines has been delayed, raising concerns that such delay may limit the amount of historical data needed for ECL calculation at the time of actual implementation in 2026. While most local banks are still waiting for BOL’s guidelines, several foreign banks have already implemented IFRS 9 internally on a pilot basis, in order to minimize large swings in provisioning requirements in 2026.

Challenges on the horizon

For the coming years, there remain a few challenges to be overcome for a smooth adoption of the Basel II and IFRS 9 frameworks. The BOL, despite its best efforts, is still constrained by limited capacity and resources, complicating its ability to effectively assess banks’ compliance and provide timely guidance and feedback to banks. At the same time, several local banks that underwent recapitalization and internal restructurings in 2021 had experienced disruptions in their Basel II and IFRS 9 implementation and are now facing the daunting task of starting the process anew.

Another challenge is the impact on banks’ capital buffers and balance sheet positions. Although Lao banks’ CAR has recently improved at the aggregate level following recapitalizations, local banks’ capital buffers remain thin, with the largest local bank falling below the minimum regulatory requirement. Additionally, by incorporating forward-looking elements under IFRS 9 into the calculation of required loan loss provisions, banks will, therefore, need to set aside larger impairment allowances. This will likely result in reduced profitability and lower capital in the short term, as banks adjust to the more stringent provisioning requirements, which could impact their lending capacity and overall financial stability.

The pressing question for now is: to what extent will this duo of more risk-based capital requirements under Basel II and forward-looking loss provisioning under IFRS 9, lead to even larger shortfalls in profits and capital adequacy? This will be a test of the adaptive capacity of the BOL as well as the local and foreign banks, bearing in mind that the end goal would have implications beyond merely aligning Laos’ practices with global standards. It would also pave the way toward a more resilient banking sector that is ready to support the country’s long-term economic growth and stability.