Strengthening Resilience to Challenges Ahead

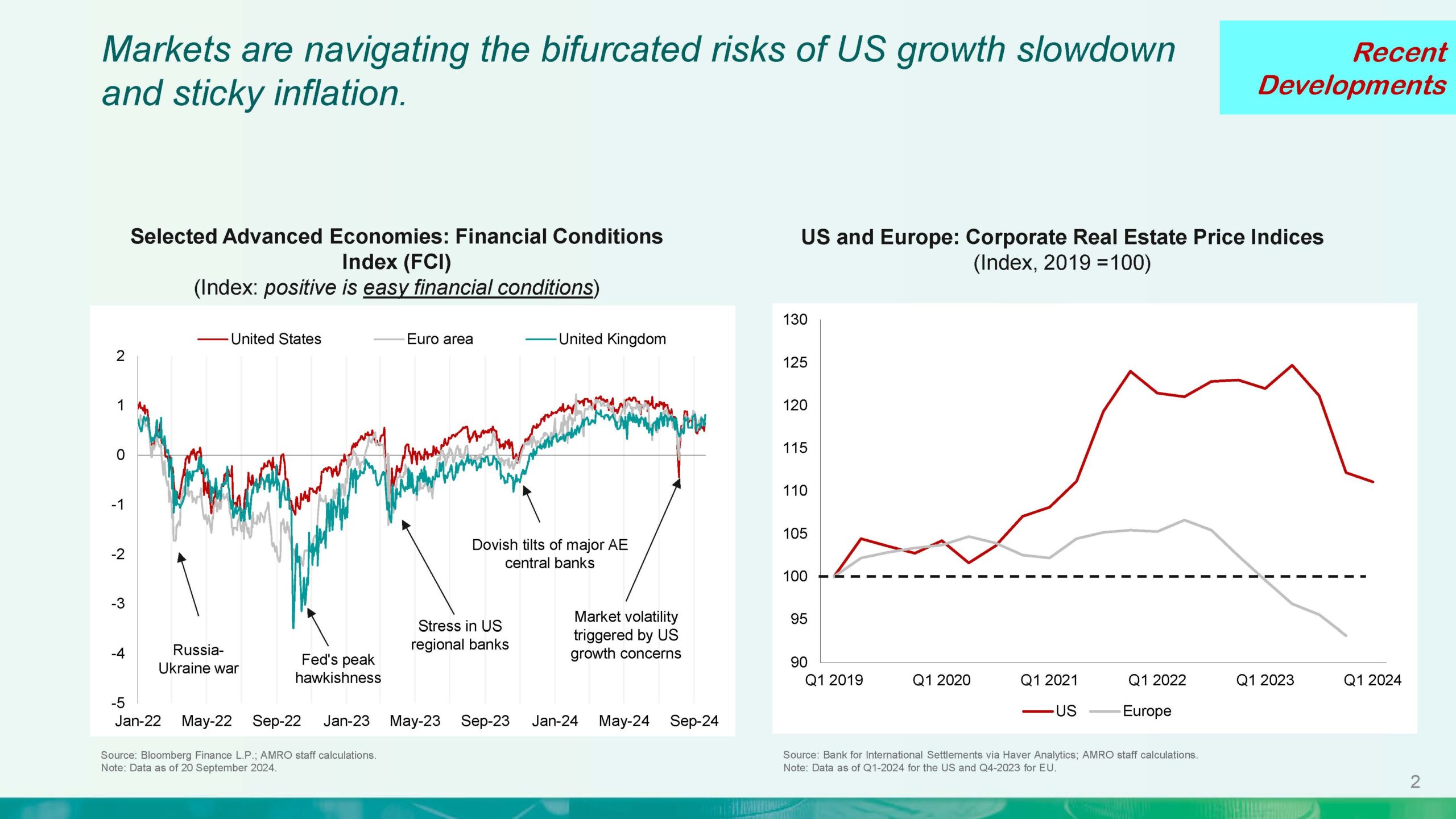

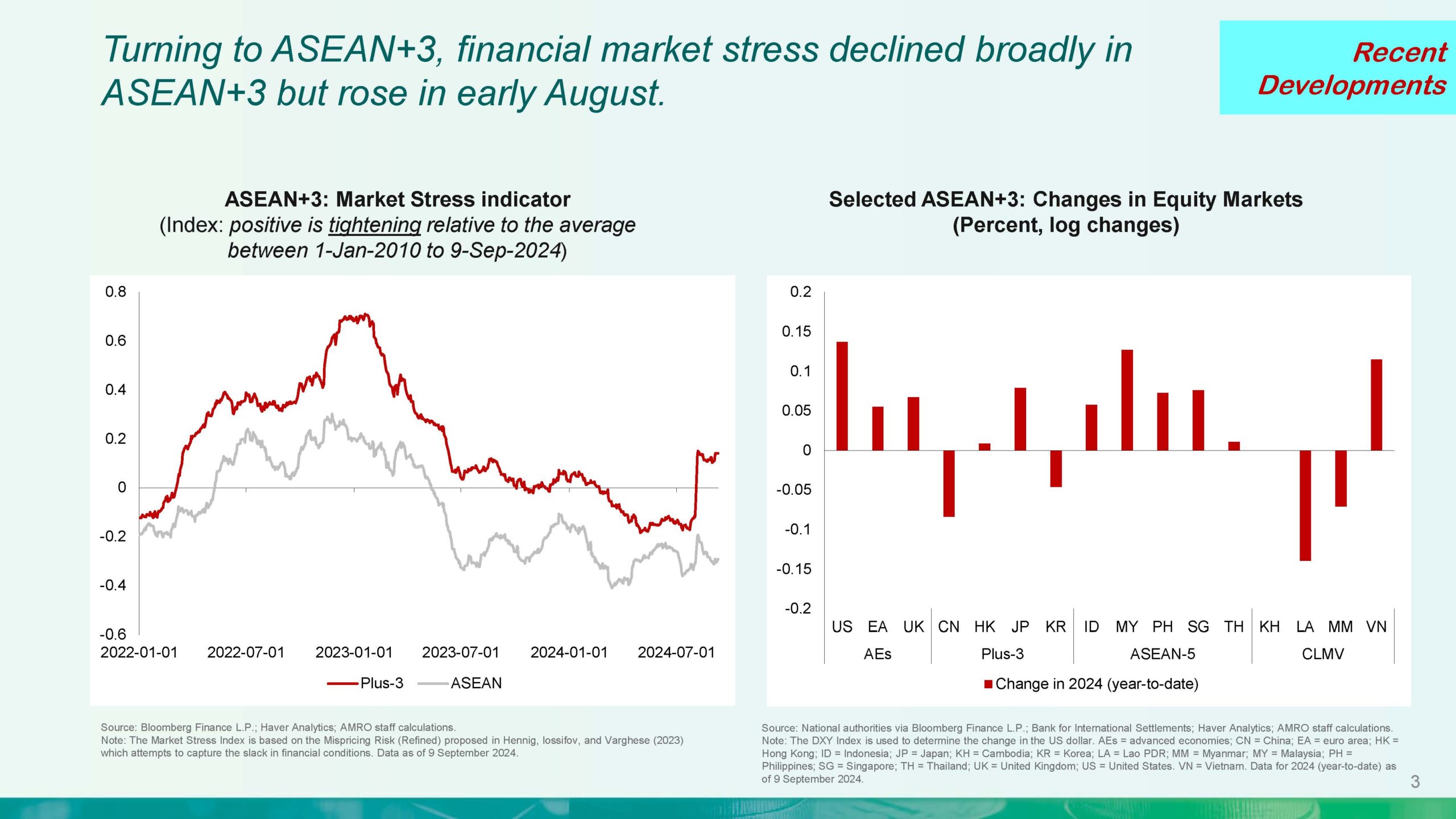

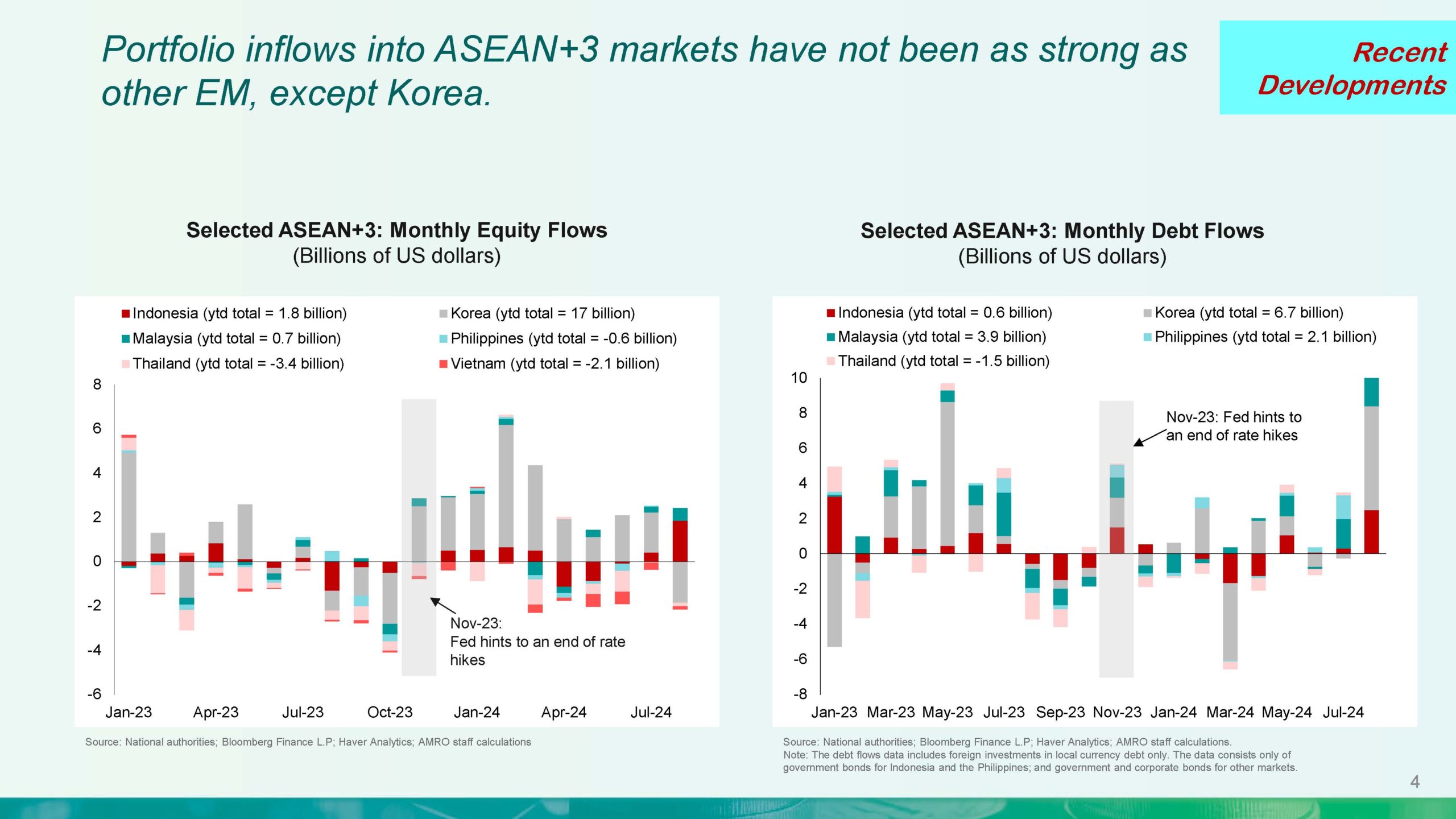

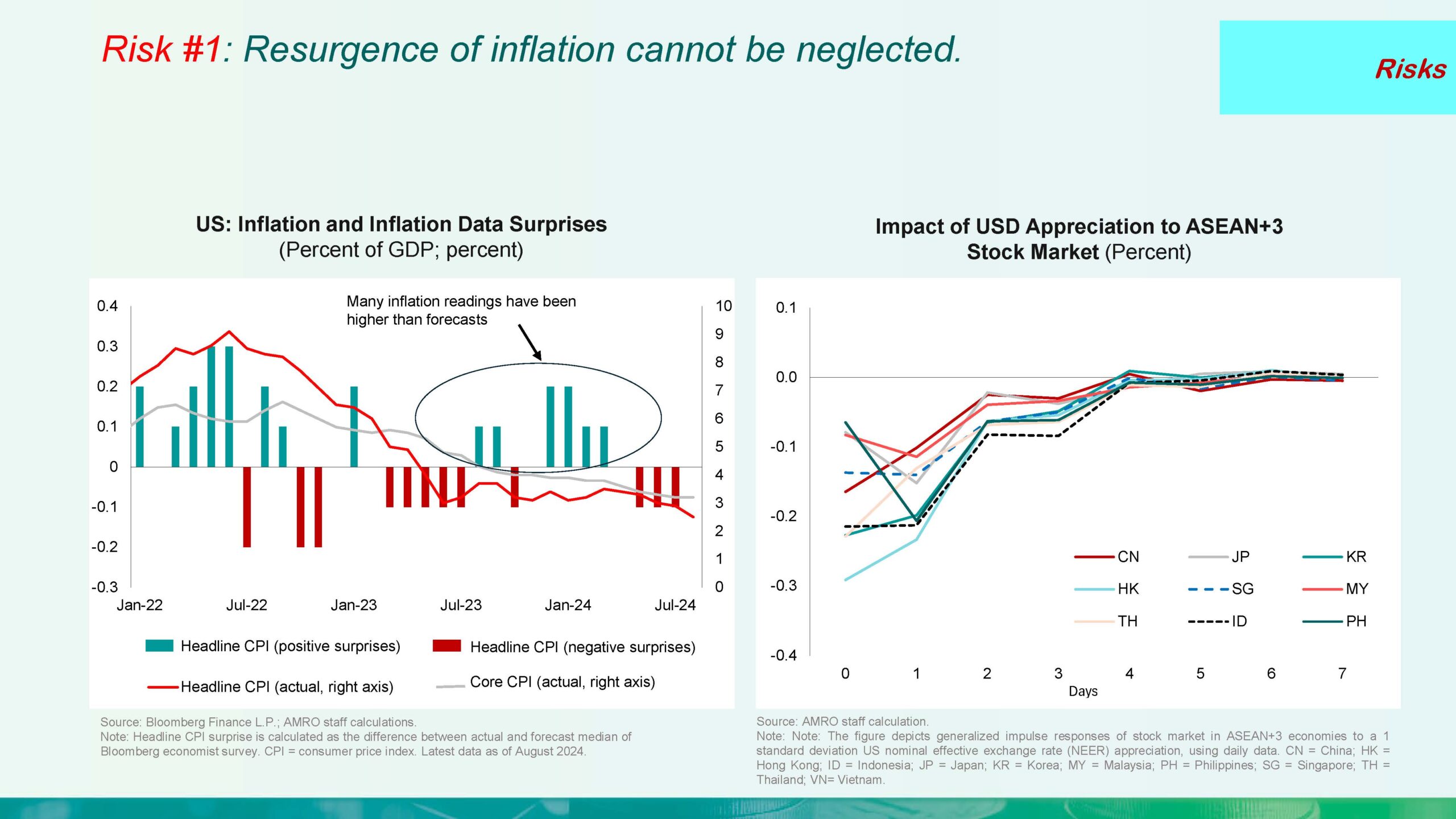

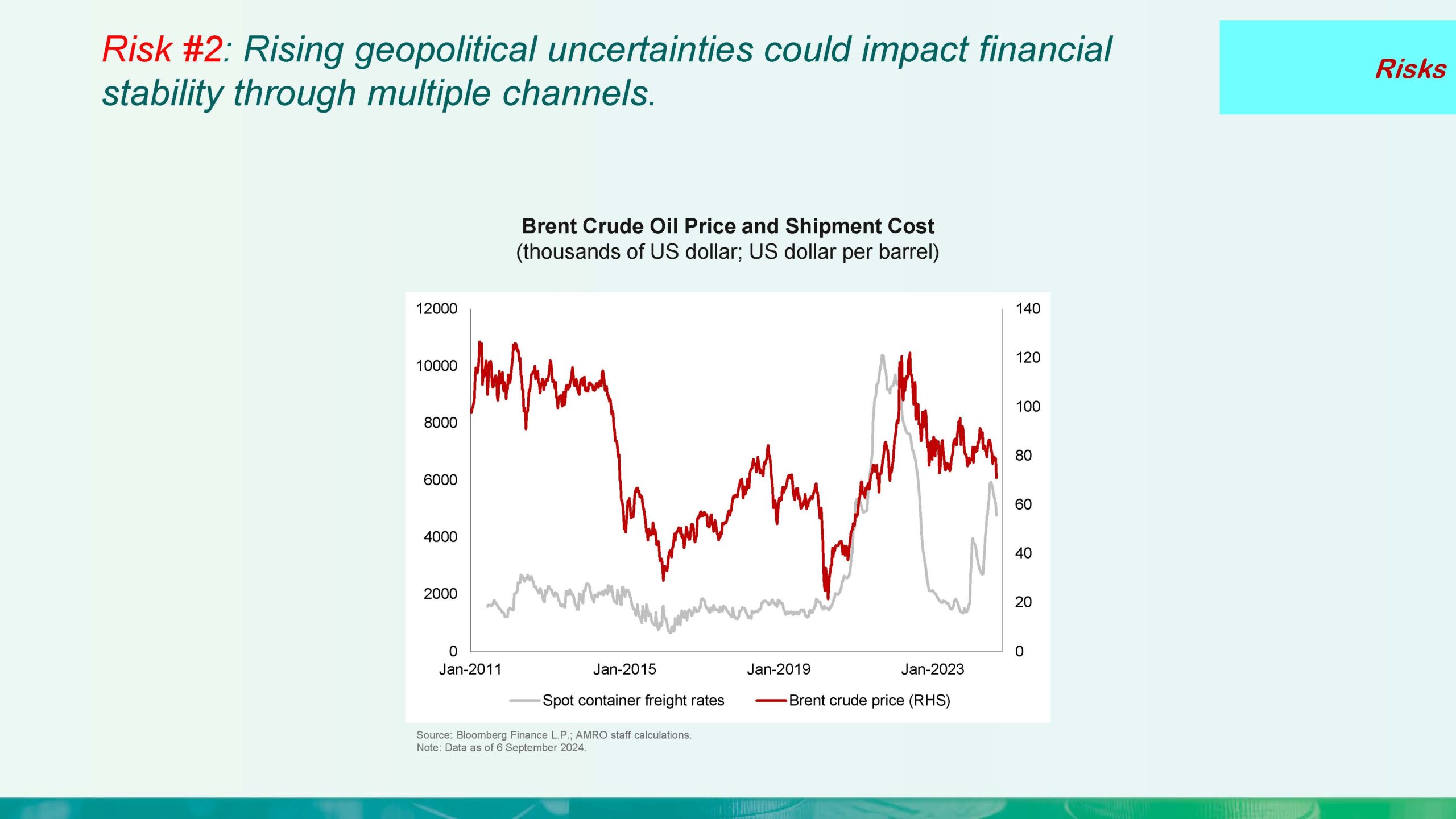

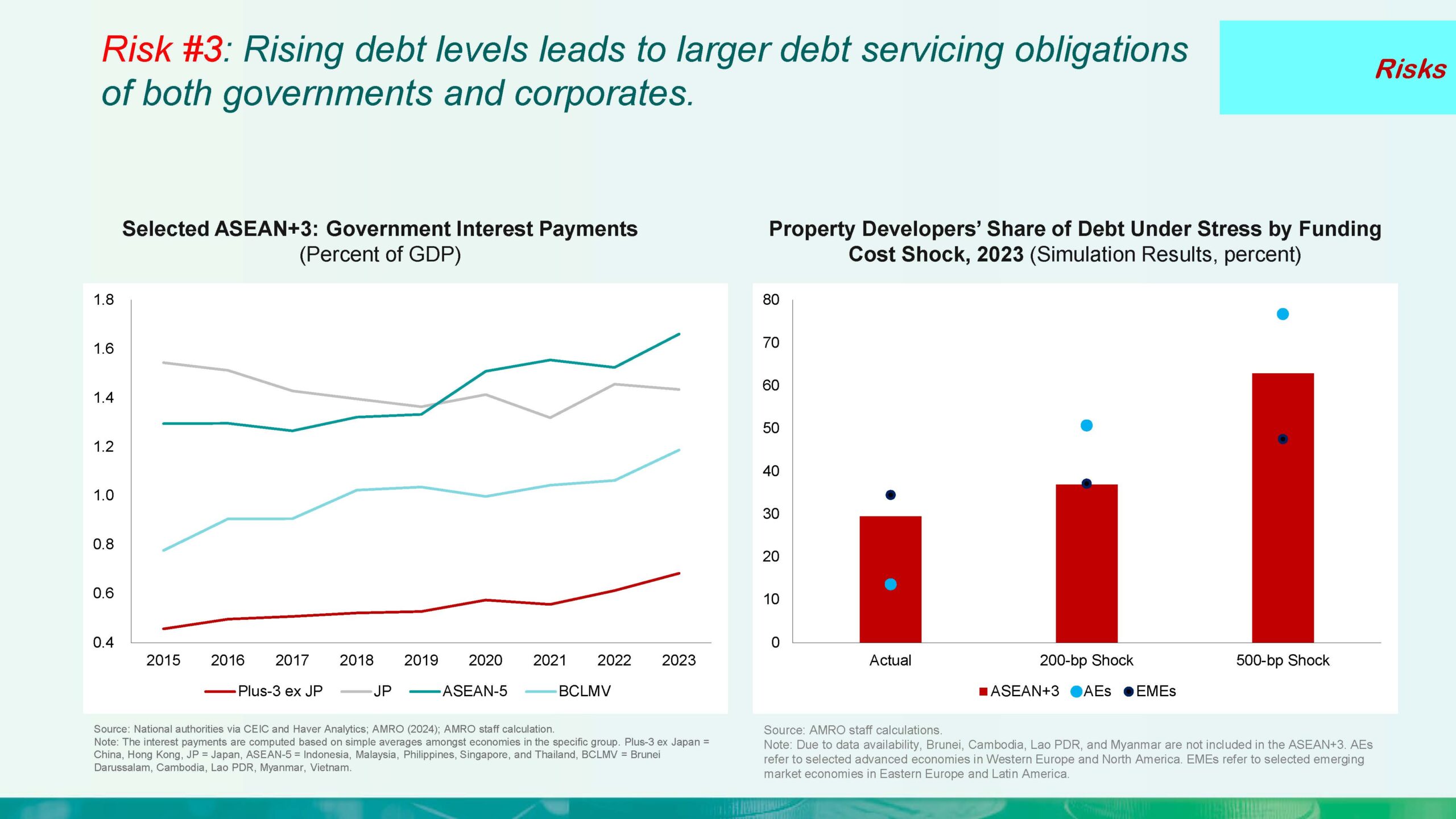

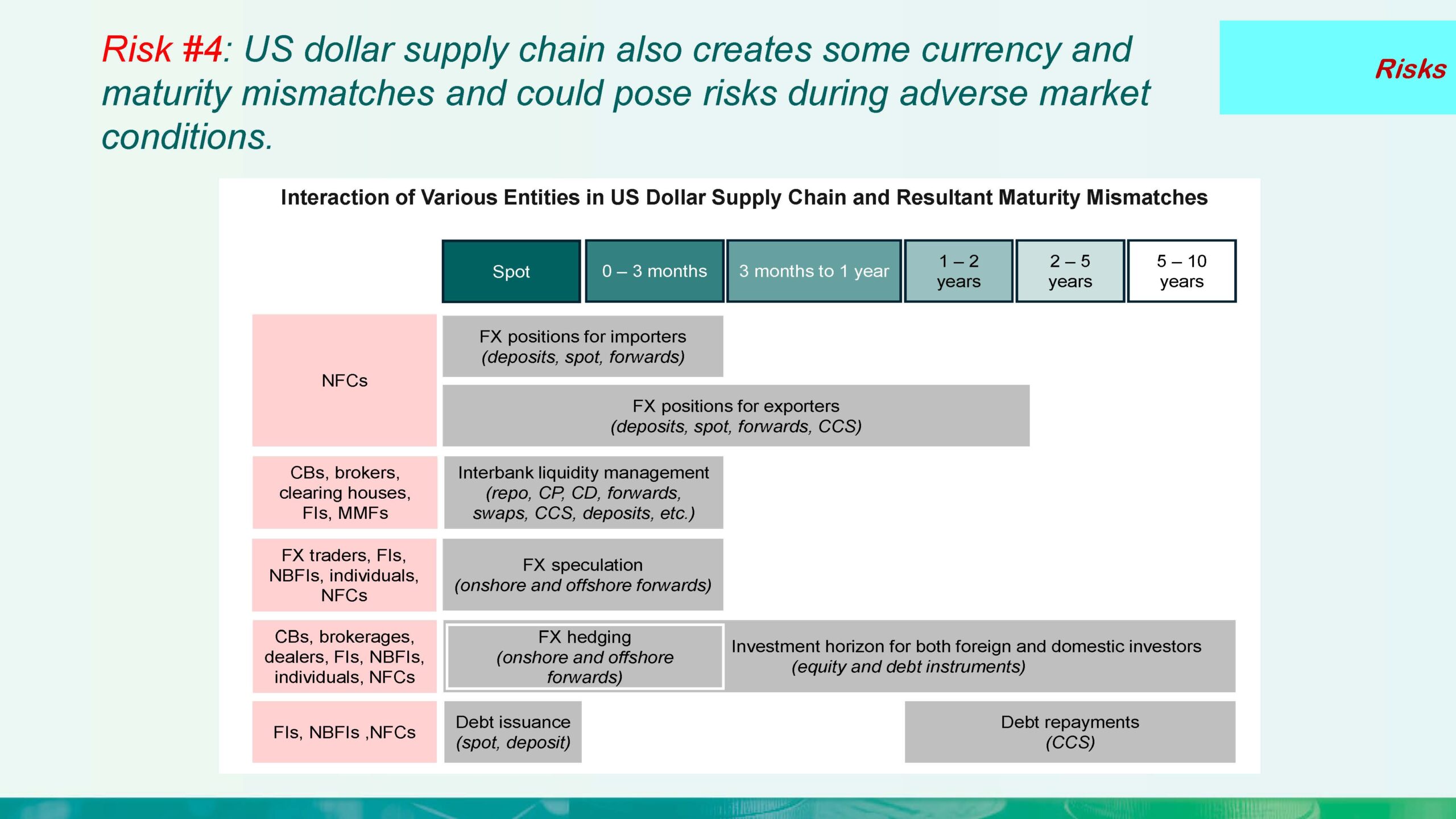

Since the publication of the inaugural ASEAN+3 Financial Stability Report (AFSR) in late 2023, some risks to the region’s financial systems have subsided, while others have intensified. This year’s AFSR takes a more comprehensive approach, addressing a broader array of risks and challenges facing the region in the coming period. It includes three in-depth thematic studies that examine key risks—financial contagion, property developer financing, and heavy reliance on the US dollar for cross-border transactions—while offering policy recommendations to address these issues.