In today’s interconnected world, no economy operates in isolation. In the ASEAN+3 region where financial links have deepened over the decades, these connections not only offer opportunities, but also increase the risk of financial contagion. When one economy faces a financial shock, the effects can rapidly spill over across borders.

Historically, ASEAN+3 economies depended heavily on financial services from advanced economies, especially the US, the UK, and Europe. Over time, intra-ASEAN+3 financial transactions surged, reducing reliance on external players. Hong Kong and Singapore have emerged as critical hubs for cross-border investments, connecting the region with the world.

Inward spillovers to ASEAN+3

Global factors such as the VIX volatility index, macroeconomic risks, and commodity price fluctuations have significant impact on ASEAN+3 economies, notably Japan, Korea, Hong Kong, and Singapore which have greater exposure. For instance, 6.3 percent of Japan’s stock market returns are influenced by fluctuations in the VIX.

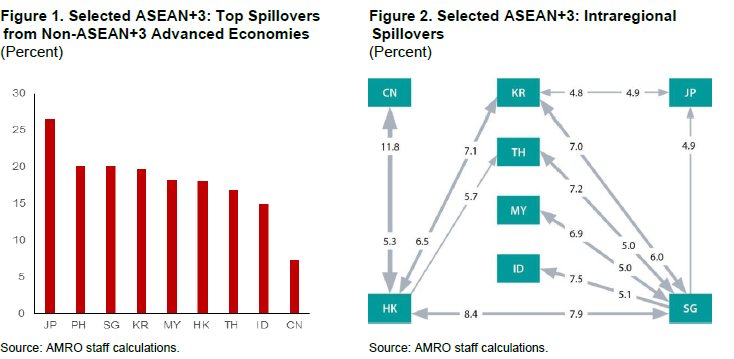

Developed markets outside ASEAN+3, such as North America and Europe, exert strong contagion effects (Figure 1). Financial hubs such as Hong Kong and Singapore, along with Japan, the Philippines, Korea, Malaysia, and Thailand, are especially sensitive to these shocks.

One key factor affecting ASEAN+3 stock markets is the US dollar. Hong Kong, with its currency pegged to the US dollar, is especially susceptible to fluctuations in the US dollar. A strengthening US dollar can lead to capital outflows and negative stock market impacts across ASEAN+3. Conversely, a weakening of the US dollar, as the Federal Reserve cuts interest rates, offers potential for higher stock prices in the region.

Intraregional spillovers

Financial links among ASEAN+3 have strengthened, with Hong Kong and Singapore playing key intermediary roles. Hong Kong has robust financial ties with China, while Singapore serves as a financial bridge among ASEAN countries like Indonesia, Malaysia, and Thailand. Other notable connections include Hong Kong-Singapore and Hong Kong-Korea (Figure 2). In contrast, Japan and the Philippines remain more aligned with advanced economies outside the region.

Outward spillovers from ASEAN+3

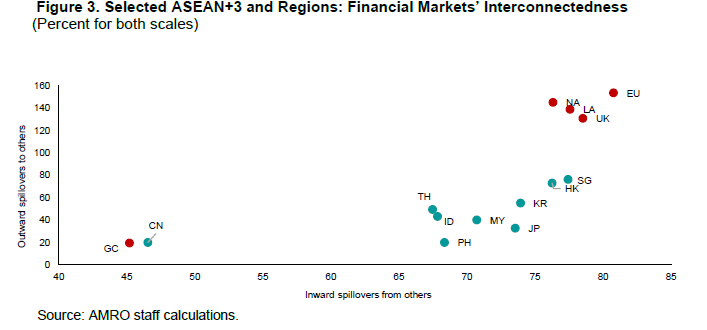

ASEAN+3 economies not only experience spillovers from external shocks, but also generate outward spillovers on other economies. Hong Kong and Singapore, as international financial hubs, lead in outward spillovers, affecting global markets and other ASEAN+3 economies (Figure 3). Hong Kong’s stock exchange, ranked fifth-largest globally in 2020, is heavily influenced by China-related companies, amplifying these spillovers.

Strengthening ASEAN+3 financial systems

The growing financial interconnectedness of ASEAN+3 economies heightens the risk of cross-border shocks. Singapore and Hong Kong, with their extensive global and regional links, are particularly susceptible to spillovers and could act as sources of contagion for the wider region.

To safeguard against these vulnerabilities, ASEAN+3 economies need robust surveillance and cooperation. Adopting a comprehensive macroeconomic and financial surveillance approach can enhance resilience and protect against systemic risks.

Key areas to focus on include:

- Cross-border surveillance and data sharing to help identify vulnerabilities early, enabling coordinated responses.

- Regional stress testing to assess the resilience of financial institutions and the transmission channels of shocks.

- Harmonizing regulatory frameworks between home and host jurisdictions to reduce regulatory arbitrage and improve stability.

In addition, ASEAN+3 economies must remain vigilant to shocks from global factors as well as financial market volatility and spillovers from the US, UK, and Europe. Monitoring global financial volatility and strengthening supervision are crucial for mitigating external risks and ensuring financial stability in the region.

To tackle the near- to long-term risks and challenges to ASEAN+3’s financial stability, the region must come together as one and strive for resilience and stability. In times of financial distress, regional financing arrangements can stabilize markets and prevent crises from spreading, providing a financial safety net for the ASEAN+3 region.