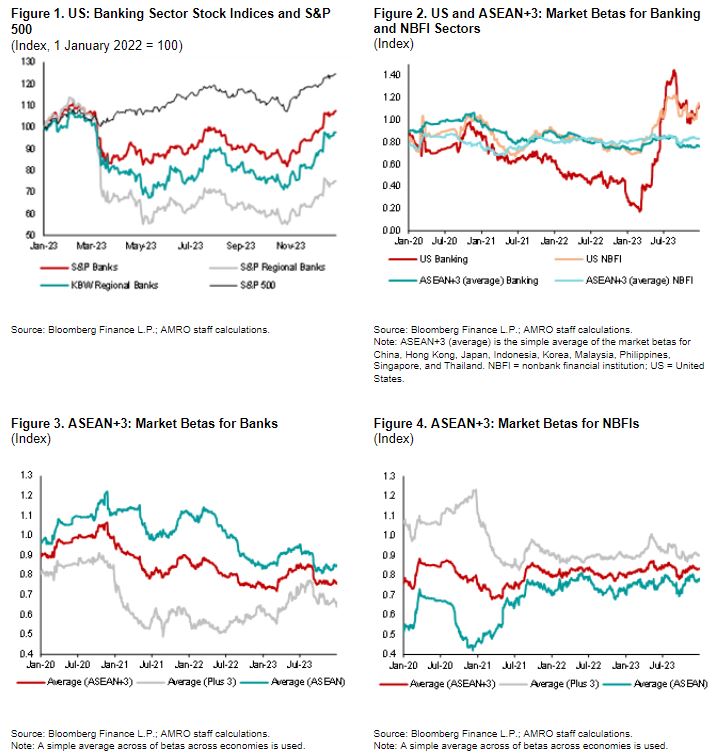

US equity markets experienced a significant rally in November and December 2023, which helped the S&P 500 end the year close to historical highs. The S&P 500 rose by around 16 percent between the last week of October and the end of the year. US banking sector stocks were important contributors to this rally, as the S&P Banking sector index rose by approximately 31 percent during this period (Figure 1).

The rally in banking stocks becomes more significant when we put it in the context of the US banking sector turmoil in March 2023. The S&P Banking sector index between March and October had traded 16 percent weaker from its end-February 2023 levels on average. This likely reflected the lack of investor confidence in the US banking sector as they remained concerned about the spillovers from higher interest rates on the banking sector.

However, the rally in November and December wiped out the weakness in the S&P banking index, which ended 2023 almost on par with its level before the turmoil. Despite trading weaker than pre-turmoil levels, the regional banking stocks saw a strong recovery in the last two months of 2023.

The rally of banking sector stocks may be triggered either by the general improvement in the aggregate financial environment or by a genuine improvement in the fundamentals of the sector. Indeed, the fall in US Treasury yields and expectations of the US Federal Reserve easing its monetary policy in 2023 may have reduced concerns around the marked-to-market losses on bank holdings of securities, which was one of the key factors that led to banking stress in March 2023. However, it may not be enough to conclude that the investors have become comfortable with the health of the US banking sector.

AMRO’s market beta analysis also shows that it might be a bit early to conclude that investor risk perceptions toward US banks have changed decisively.

The market beta is the sensitivity of a price index to the “market” – firms included in the benchmark index are typically representative of the dominant sectors and firms in the economy. A sensitivity greater than one implies that investors see the index as riskier than the market [ASEAN+3 Financial Stability Report 2023 (AFSR), Box 4.1]. A riskier asset tends to rise faster when the market rises, and vice versa.

The market beta analysis finds that the beta of the US banking sector remains elevated and has ticked higher since early November (Figure 2). The beta for US nonbank financial institutions (NBFIs) also remains elevated and has closely matched the beta for US banks over the past six months.

The recent uptick in betas can be attributed to the outperformance of banking and NBFI stocks, but it remains to be seen if the outperformance is driven by an improved outlook for these sectors, or because markets still see them as riskier-than-market, which has allowed the banking stocks to rise faster than the broader market in a positive risk backdrop. The latter scenario would also imply that these stocks will see a sharper fall when the markets weaken.

Only if US bank and NBFI stocks continue their outperformance when the broader market weakens—or, at the very least, do not strengthen—can we conclude that investor sentiment toward these sectors has changed decisively.

The spillovers from the US banking sector to regional markets remain limited. As noted in the AFSR, most banking sector indices in ASEAN+3 recovered quickly. The market beta has also remained stable, below one on average (Figures 3 and 4). This indicates that investor risk perception toward ASEAN+3 banks and NBFIs remains stable, and these sectors are seen to be less risky than the broad market.

Overall, a dovish tilt in the Fed’s policy stance may alleviate investor concerns, which caused banking stress in March 2023. However, despite the tilt, the absolute level of interest rates is still elevated, and we await further evidence before concluding that investors are confident that the worst for the US banking sector is behind us. Investor sentiment toward the ASEAN+3 banking system also remains stable and should help limit spillovers if stress reemerges in the US banking sector.