Under the Bretton Woods system established in 1944, the U.S. dollar was made the global reserve currency convertible to gold, underlining post war U.S. economic dominance. Even after the Nixon shock that ended US$-gold convertibility and triggered the collapse of the Bretton Woods system in early 1970s, the U.S. dollar has remained the dominant currency for denominating trade and investment globally, including within East Asia.The dominance of the US$ is not just limited to trade and investment between the U.S. and its trading and investment partners, but also in transactions among third parties in which the U.S. is not involved, including within East Asia. For example, in 2017, 66.3% of Thai export to the EU was denominated in US$, a currency that was neither a local currency for the EU or Thailand. Similarly, 58.5% of Thai export to Japan was denominated in US$.

The dominance of the U.S. dollar means that the region will continue to be exposed to U.S. policy and problems. The negative impacts of such exposure has been evident in the past, such as the time after the collapse of Lehman Brothers when there was a shortage in U.S. dollar, the volatile capital flows from excess liquidity created by Quantitative Easing (QE) policies and their tapering, and the current upward interest rate path of the Federal Reserve. The greater use of local currency (LCY) in intra-regional trade and investment can better shield the region from these shocks emanating outside the region.

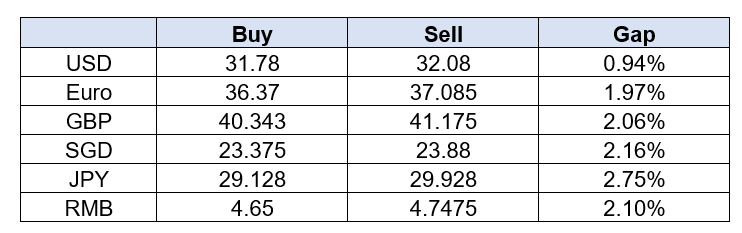

Dominance of U.S. dollar$ usage for trade and investment is not because people are forced to denominate their transactions in U.S. dollar$, but because, In most cases, the U.S. dollar is considered the best currency to use for trade and investment thanks to lower risks, low transaction costs and potential investment benefits. Particularly noteworthy are the much lower exchange rate spreads for bank transfers between the U.S. dollar and most LCYs in the region, which results in lower exchange rate transaction costs (see rates from Bangkok Bank in Table 1, where the spreads for the US$ is less than half that for any other currencies).

Table 1: Bank Transfer Spreads for Bangkok Bank

Source: Bangkok Bank. Available online at: https://www.bangkokbank.com/th-TH/Personal/Other-Services/View-Rates/Foreign-Exchange-Rates. Rates as of 11 January 2019, 08:30 am

The reason for the large spreads of many currencies in many countries is the lack of a direct currency exchange market between them. For example, trading baht for yen in Thailand and vice versa has to go through the U.S. dollar, that is changing baht for yen involves the bank implicitly changing from baht to U.S. dollar and then changing from U.S. dollar to yen. The outcome is that the spread between the baht and the yen 2.93 times that between the baht and the U.S. dollar.

Information from Japanese banks in Thailand as to why they don’t operate a direct exchange market between the baht and the yen indicate that they want to be able to square their exchange rate risk position daily, but this is not possible because there are no forward markets between the yen and the baht. Clearly, if there is no spot market, then there will not be a forward market. So this is clearly a case of market failure and government interventions will be required to establish these markets. The lack of direct currency markets also make hedging costs through forward contracts much more expensive as these also need to go through the U.S. dollar. Therefore, denominating trade contracts in the U.S. dollar is a good way to share exchange rate risks among the trading parties.

Recently, authorities in the ASEAN+3 region have been making increasing efforts to promote the use of LCY in the region.

As part of China’s policy to internationalized the RMB, China has been particularly active in this area, setting up many RMB offshore clearing banks and direct currency exchange markets through out the world, including in Asia. This has led to significant reductions in the buy-sell gaps between the RMB and currencies with direct exchange markets with the RMB, such as the Thai baht.

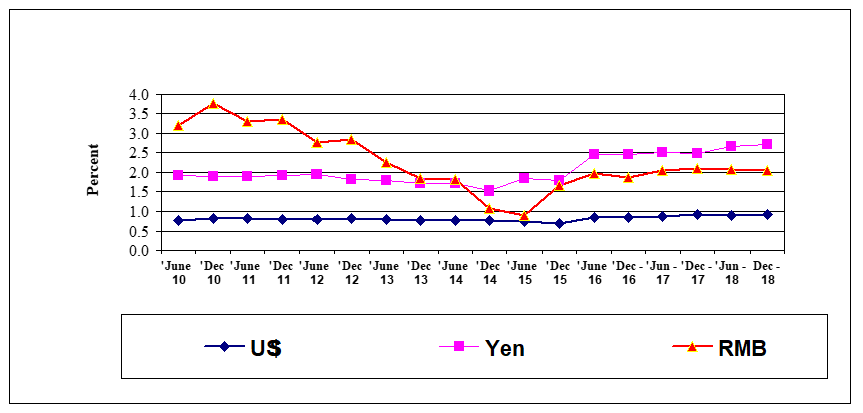

Prior to the policy to internationalize the RMB, the exchange spread between the baht and the RMB was very high, at around 3.5 percent. More recently, with RMB internationalization and the appointment of the Industrial and Commercial Bank of China (Thai) Public Company Limited (ICBC Thai) as an RMB Offshore Clearing Bank, the baht/ RMB spreads have declined significantly, and are now lower than the spreads for bath/ yen (see Figure1). This should encourage greater use of the RMB in regional trades. However, the successes notwithstanding, RMB internationalization must proceed with appropriate sequencing to avoid situations of large and rapid capital outflows that could drain substantial reserves, such as in the past.

Figure 1: Buy Sell Gap versus the Baht (%)

Note: Data is from last business day of the month.

Source: Bangkok Bank

In the case of Japan, the Japanese Ministry of Finance announced in mid-2017 a comprehensive plan to launch direct currency trading with other regional partners. The ministry plans to first enter talks with Thailand, where about 48 percent of its bilateral trade is settled in the yen or baht, compared with 51 percent in the U.S. dollar – this was sealed by a Memorandum of Cooperation to promote the use of LCY between the two countries, signed in March 2018.

In the ASEAN region, the Local Currency Settlement Framework (LCSF) is an initiative between Indonesia, Malaysia and Thailand to promote the wider use of local currencies to facilitate trade and investment in these countries. The LCSF between Malaysia and Thailand came into operation in March 2016, covering bilateral trades between the two countries. With the framework, Malaysian and Thai businesses will be able to effectively source ringgit and baht from banks in their home countries to settle trade transactions. This was expanded to cover direct investment at the beginning of 2018 when Indonesia also joined the framework. As the LCSF has only come into effect recently, it is too soon to evaluate its effectiveness. But it is worth pointing out that promoting the use of local currencies will only work if the transaction costs involved in changing one local currency to another becomes low enough to be worthwhile. This involves setting up direct exchange markets between various major currencies, as well as ensuring that there is sufficient liquidity and turnover, This still needs to be developed further. For example, at Bangkok Bank (11/1/2019) the spread between the baht and the ringgit was about 2.6% compared to the USD spread of 0.94%, while that between the baht and Rupiah was large, at about 8.5%. Clearly these need to be reduced to encourage businesses to use LCY to denominate their trade and investment. Therefore, the LCSF needs to be developed together with the development of efficient currency exchange markets among the three currencies.

* This article is the third part of a blog series that explores the possibility of local currency contribution to the CMIM in the ASEAN+3 region. Read Part 1 and Part 2 of the series.