This article first appeared in The Edge Malaysia on May 1, 2025.

By 2050, approximately one in four people in the ASEAN+3 region will be aged 65 or older—nearly three times the number recorded in 2010. This rapid demographic transition is poised to impose considerable pressure on public finances, potentially exposing vulnerabilities in the social protection systems and fiscal frameworks.

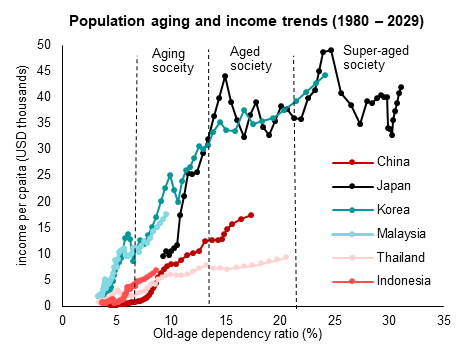

Unlike advanced economies that were able to manage demographic transition after achieving high-income status, many developing economies in the ASEAN+3 region face a dual challenge of developing social protection systems while strengthening their economic and fiscal capacities (Figure).

This challenge became particularly evident during recent crises, notably the COVID-19 pandemic, when governments needed to quickly scale up support measures to protect vulnerable households and businesses. However, many developing economies struggled to deliver these support measures efficiently and effectively due to fragmented social protection systems with inadequate coverage and limited administrative and financial capacities.

Despite significant expansion over the past few decades, the region’s social protection systems still fall short of addressing the growing demands of its fast-aging populations. This inadequacy has prompted governments to continue strengthening both tax-financed social benefits and contributory social insurance schemes. These measures are projected to exponentially increase fiscal burdens and strain fiscal sustainability in the coming decades.

According to a recent AMRO study, under existing social protection frameworks, ASEAN+3 economies will face additional fiscal pressures driven by population aging, ranging from 0.9 percent of GDP in Indonesia to as high as 9.3 percent in Korea by 2050.

The rigid nature of social protection spending further compounds these challenges. Social protection expenditures typically represent long-term commitments, often mandated by laws and politically challenging to adjust or scale back. Consequently, aging populations tend to drive up rigid spending, constraining governments’ ability to allocate funds toward other crucial areas, such as infrastructure investment and education, which are essential for boosting potential growth and economic resilience.

Addressing these multifaceted challenges calls for a comprehensive policy package to ensure the robust development of social protection systems, while maintaining sustainable fiscal management.

Building robust PFM frameworks

One critical element in effectively addressing these challenges is a robust public financial management (PFM) framework. Such a framework enables governments to strategically allocate resources effectively across different policy priorities and enhance fiscal sustainability while ensuring fiscal sustainability and long-term viability of social protection systems, particularly amid rising demographic pressures from aging populations

To better address the rising fiscal challenges posed by aging populations, governments must focus on three key areas:

1. Strengthening a long-term fiscal perspective

Fiscal management in many developing economies primarily focuses on annual budgets, with weak integration of medium- and long-term planning. Among ASEAN+3 members, only half have annually updated medium-term fiscal frameworks. This short-term focus is inadequate for addressing the fiscal challenges posed by long-term structural challenges such as demographic changes. Governments must adopt a forward-looking fiscal perspective that spans a sufficiently long period and integrate it into their annual budgets. A long-term fiscal perspective helps governments anticipate rising costs for pensions, healthcare and long-term care, as well as shrinking tax revenues. Without this perspective, countries risk overcommitting resources to unsustainable programs, further straining public finances.

2. Adapting tax systems to evolving tax bases

Population aging fundamentally alters the structure of economies and tax bases. For example, as the number of retirees grows, the active workforce shrinks, reducing labor income and, consequently, personal income tax revenues. Demographic shifts also affect consumption patterns as older populations tend to spend more on healthcare services and less on VAT-taxable goods and services.

Economies with tax systems that rely heavily on labor income and consumption taxes need to regularly adjust their tax policies to reflect these demographic changes. Governments should continue their efforts to ensure sustainable government financing by broadening tax bases, reducing reliance on distortionary revenues and exploring innovative tax measures while adhering to core tax policy principles.

3. Improving spending efficiency

As fiscal resources become increasingly under pressure, improving the efficiency of public spending is more important than ever. Digitalization and data integration in the public sector can streamline administrative processes, reduce costs and improve the delivery of social protection programs. These innovations also enhance the system’s flexibility and accessibility, enabling future scaling up as needed.

Enhancing targeting capacity ensures resources are directed to those who need them most, maximizing spending impact. This is especially important for economies facing tight fiscal constraints, where demographic changes tend to increase fiscal pressures even without significant system expansion.

Enhancing growth potential to address structural challenges

Governments must not lose sight of policies to enhance growth potential while addressing fiscal pressures. For developing economies grappling with rapid population aging and limited economic capacity, addressing structural growth challenges is critical.

Maintaining the labor force and its productivity is particularly important in economies where populations are already shrinking due to aging, such as China and Japan. Policies that encourage workforce participation—such as childcare support, vocational training programs and flexible work arrangements—are key to boosting labor supply.

Simultaneously, improving productivity and fostering innovation are essential for mitigating the economic slowdown associated with aging populations. Investments in education, technology and infrastructure are crucial for sustaining productivity gains. Growth-promoting policies not only mitigate the fiscal impact of aging, but also ensure that economies remain competitive in a rapidly changing world.

The fiscal challenges of population aging are complex and increasingly significant, requiring more proactive policy responses. Strengthening PFM frameworks, adopting long-term planning, adapting tax systems and improving spending efficiency are critical steps toward balancing fiscal sustainability with the need for robust social protection systems. Equally important, governments must invest in growth-promoting policies to offset the economic headwinds of aging populations. By addressing these issues strategically, governments can navigate the dual imperatives of supporting aging populations and maintaining fiscal stability.