The bond market in Lao PDR remains in its early stages of development. Despite government efforts to expand and deepen the market, it continues to be small, with limited liquidity and a narrow investor base. As of 2024, outstanding bonds issued domestically only accounted for less than 4 percent of GDP, significantly lower than in other ASEAN economies. With a nascent corporate bond sector, the market is largely dominated by government bonds.

The Lao Securities Exchange (LSX), established in 2010, is the country’s main platform for bond issuance and trading, with the first government bond issued in 2018.

Recent market trends

The Lao PDR government has issued both local currency (LCY) and foreign currency (FCY) bonds through the domestic capital market. Coupon rates and tenors are determined based on market demand surveys conducted by securities firms. Government bonds are offered twice a month on the LSX.

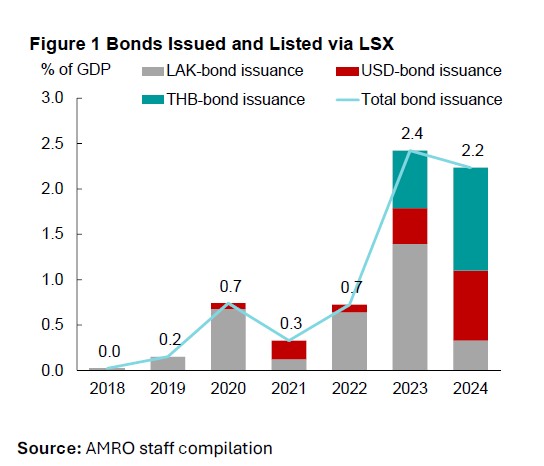

Between 2018 and 2022, bond issuance averaged a modest 0.4 percent of GDP per annum. However, issuances rose significantly to 2.4 percent in 2023 and 2.2 percent in 2024, driven mainly by higher coupon rates and the government’s consistent record of making full and timely payments at maturity (Figure 1).

The sovereign credit rating downgrade by Thai rating agencies in late 2023 further limited Lao PDR’s access to international capital markets. As a result, the government relied more heavily on the domestic market to raise funds in both local and foreign currencies. In 2024, the government issued sovereign bonds in three currencies—LAK, THB, and USD—through the domestic market to meet financing needs. The total amount listed on the LSX during 2024 reached LAK 1 trillion, THB 5.4 billion, and USD 113.4 million, respectively. In addition, a CNY-denominated bond was introduced for the first time and was listed on the LSX in January 2025.

Obstacles to further development

Developing a vibrant bond market in Lao PDR has proven challenging. Prolonged macroeconomic challenges, including high external debt, have affected investor confidence and raised concerns over debt sustainability. Furthermore, the secondary market liquidity remains limited, with few recorded transactions since its establishment in 2018. This lack of liquidity encourages a buy-and-hold strategy among investors, reducing overall market dynamism.

Another key barrier is the lack of domestic expertise and technical know-how. Lao PDR continues to rely extensively on technical assistance from international organizations, including through the Asian Bond Market Initiative launched by the ASEAN+3 economies, to build the capacity needed for a more developed bond market.

Deepening secondary market, expanding investor base

To enhance the appeal of government bonds, deepening the secondary market to improve trading efficiency and offering tax incentives are essential. The LSX’s efforts to develop user-friendly platforms, such as the Mobile Trading System, represent significant steps toward facilitating government bond trading and providing accessible information. These initiatives would make investing in government bonds more convenient and cost-effective for investors.

Efforts to broaden the investor base are ongoing. The government is collaborating with securities companies to conduct information campaigns and promote international standards for bond issuance, with a particular focus on the government bond market. The Lao Social Security Organization which manages pension and provident funds has remained cautious in its approach, allocating most of its portfolio to fixed deposit accounts rather than government bonds. As a result, its share of investments in government securities remains relatively limited compared to that of commercial banks. In this regard, the introduction of regulations that require non-bank financial institutions to allocate a certain share of their assets to government bonds would further stimulate investment in government bonds.

While addressing debt sustainability concerns remains the most urgent policy priority, developing the domestic government bond market should be pursued over the medium to long term. A stronger bond market would not only diversify investment options and enhance public sector financing but also contribute to the country’s financial system. Strengthening market infrastructure, improving transparency, and fostering investor trust will be key to transforming Lao PDR’s nascent bond market into a robust pillar of economic growth.