For decades before the COVID-19 pandemic, ASEAN+3 economies enjoyed remarkably low and stable inflation, supported by credible policy frameworks and deepening global integration. This era of stability came to an abrupt halt with the outbreak of the COVID-19 pandemic and the Russia-Ukraine conflict, ushering in a fundamental shift in inflation dynamics.

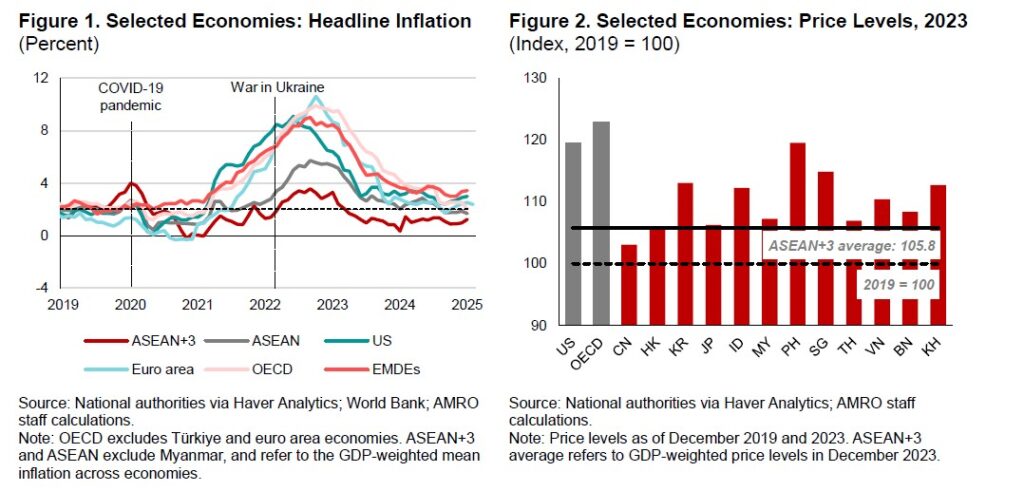

Inflation surged across ASEAN+3 economies in 2021 with the outbreak of the war in Ukraine, driven largely by supply-side factors such as global supply chain disruptions and spikes in fuel and food prices (Figure 1). The price of goods and services, particularly fuel, food, and transportation, rose rapidly. However, the price increase was relatively moderate and short-lived compared to the US and other major economies, helping to limit potential welfare losses (Figure 2).

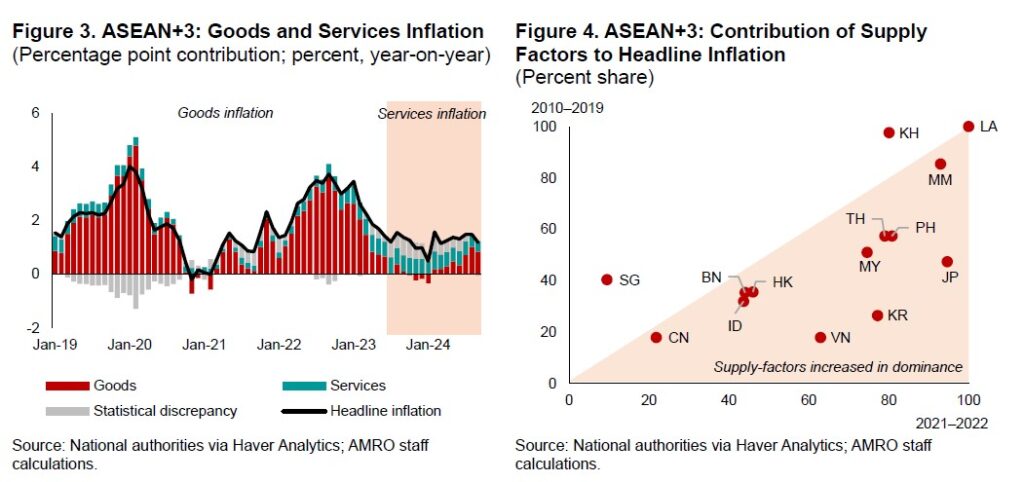

By late 2022, as supply-side pressures began to ease and economies reopened, demand-side factors increasingly took center stage. Robust economic recoveries and higher consumer spending across the region contributed to higher inflation, even as global commodity prices declined and supply chains normalized. As a result, services inflation emerged as a more persistent source of price pressure during the disinflationary period, driven by tight labor markets and elevated operating costs (Figure 3).

Although overall inflation moderated by 2023, supply-driven factors remained a more prominent driver of core inflation than in the pre-pandemic period (Figure 4). This partly reflects the lingering effects of supply side shocks from the pandemic and war in Ukraine, as well as more subdued demand in the Plus-3 economies.

Rethinking policy approaches

Despite facing several inflationary shocks over the past four years, ASEAN+3 economies succeeded in maintaining lower and less volatile inflation than many other regions, offering valuable lessons for future policymaking.

Policymakers in the region employed a mix of monetary and non-monetary measures to manage inflation effectively (Table 1). Monetary policy played a central role in managing demand pressures and anchoring expectations, with interest rate hikes across ASEAN+3 economies beginning in 2022. Complementary non-monetary tools, including energy and food subsidies, targeted cash transfers, and price regulations helped alleviate cost-of-living pressures and support vulnerable groups without undermining central banks’ inflation-fighting mandates.

The region’s experience underscores the necessity of using a well-calibrated policy mix of both monetary and non-monetary measures to effectively control inflation. Accurately diagnosing the underlying drivers of inflation—clearly distinguishing between supply- and demand-side factors—is critical. Misdiagnosing can lead to inappropriate or delayed policy responses, both carrying significant economic risks.

Preparing for future inflation shocks

Looking ahead, inflation management is likely to become more challenging. Structural shifts—including climate transition, geopolitical fragmentation, and population aging—are likely to increase the frequency and persistence of supply-side shocks. In such an environment, central banks may need to respond more decisively if inflation expectations risk becoming unanchored. However, such interventions must be carefully balanced to avoid triggering unintended economic slowdowns.

Additionally, policymakers should prioritize building strong policy buffers. A key reason ASEAN+3 economies were able to navigate recent inflation shocks effectively was their discipline in building up strong policy buffers. Preserving these buffers will ensure the flexibility needed to respond swiftly and decisively to future shocks.

Finally, greater coordination across monetary, fiscal, and structural policies will be essential. As inflation becomes more complex and multifaceted, no single policy tool will suffice. Well-targeted fiscal support can mitigate distributional impacts and support the economy, while structural reforms—such as enhancing logistics infrastructure, diversifying energy sources, and boosting productivity— can enhance the economy’s resilience to future shocks.

In many ways, the ASEAN+3 region’s inflation story since the pandemic is a testament of skillful macroeconomic management. The region avoided the worst of global inflation, succeeded in keeping inflation well-anchored, and limited welfare losses. Nonetheless, the road ahead will be more complex. Successfully navigating this new inflation landscape will require not just vigilance but will demand an integrated, forward-looking policy approach to sustain long-term economic stability and growth.