ASEAN+3 delivered a resilient performance in 2024, growing by 4.3 percent despite an uncertain global environment. Domestic demand remained robust, inflation moderated across the region, and investment continued to flow into key sectors including semiconductors and AI infrastructure. An upturn in the tech cycle and the recovery in regional tourism added further momentum to growth.

Entering 2025, the rolling external uncertainty has given way to an unprecedented and volatile global trade environment. On April 2—now referred to as “Liberation Day”—the US announced sweeping tariffs on imports of over 60 countries, including all ASEAN+3 economies. As the US administration continually adjusts its tariff measures in response to market reactions and counter measures by trading partners, implementation details have remained remarkably fluid–creating a multilayered and unpredictable trade landscape that is continuously evolving.

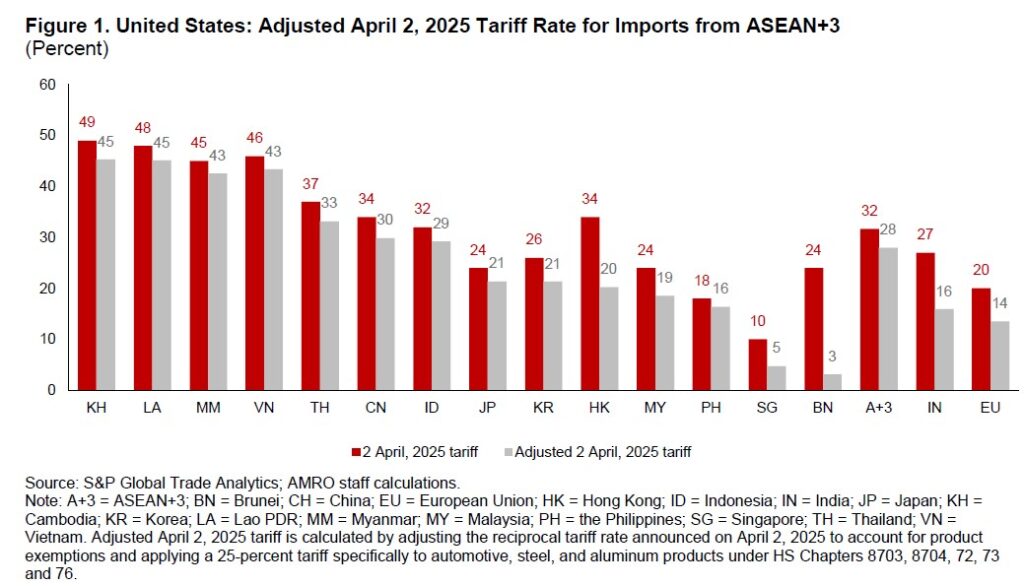

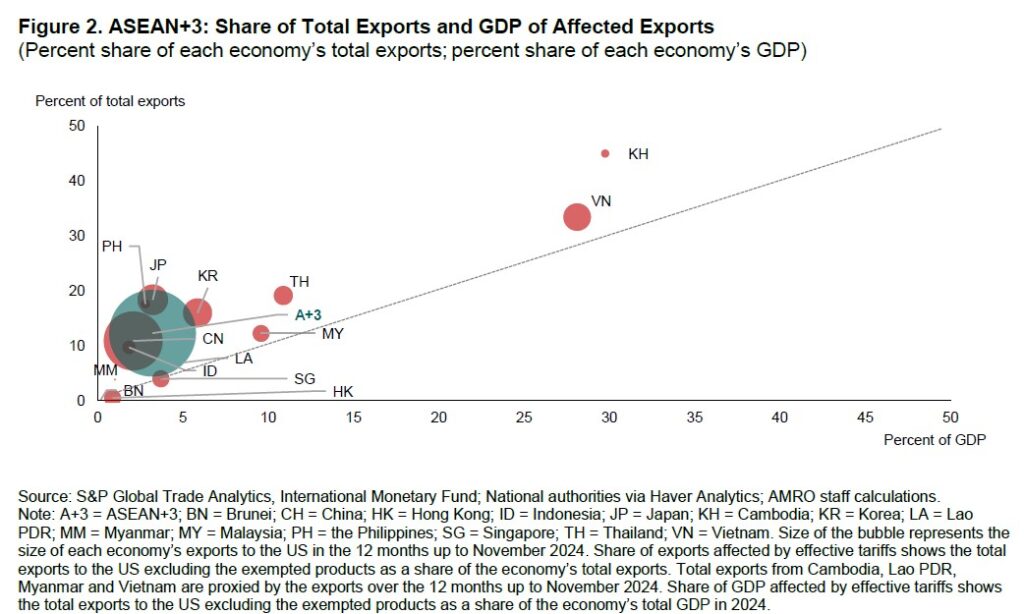

These initial tariffs, if implemented and sustained, would represent the most severe escalation in trade protectionism in recent history. With a baseline 10 percent tariff on all imports and additional punitive rates for countries with large bilateral trade surpluses, ASEAN+3 was initially subject to an average effective tariff rate of 28 percent. (Figure 1, Figure 2). While the direct impact on ASEAN+3’s total exports varies by economy and continues to vary with policy adjustments, the broader implications would be substantial. Supply chain uncertainties, heightened investor caution, and the possibility of cascading trade measures contribute to the complexity of the situation.

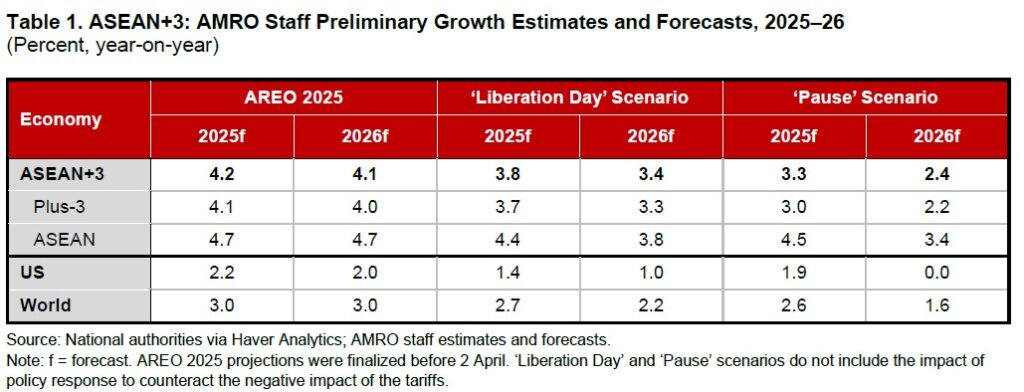

Under the initial “Liberation Day” scenario, regional growth would slip below 4 percent in 2025 and ease further to 3.4 percent in 2026 (Table 1), compared to earlier projections of above 4 percent for both years. Under the ‘Pause’ scenario—announced by the US on April 9 to delay tariffs for most countries by 90 days but with US-China tariffs above 100 percent—regional growth could reduce further to 3.3 percent in 2025 and 2.4 percent in 2026. These projections are subject to considerable uncertainty. The shifting magnitude and scope of trade measures, due to multiple rounds of actions and counteractions, and their cascading effects on growth, inflation, financial markets, and investor confidence have created an unusually wide range of possible outcomes. Downside risks to the forecast remain acute.

Positioned for resilience

While these trade shocks are undoubtedly daunting and will weigh on regional economies, the ASEAN+3 region enters this period of global trade turbulence from a position of relative strength and resilience.

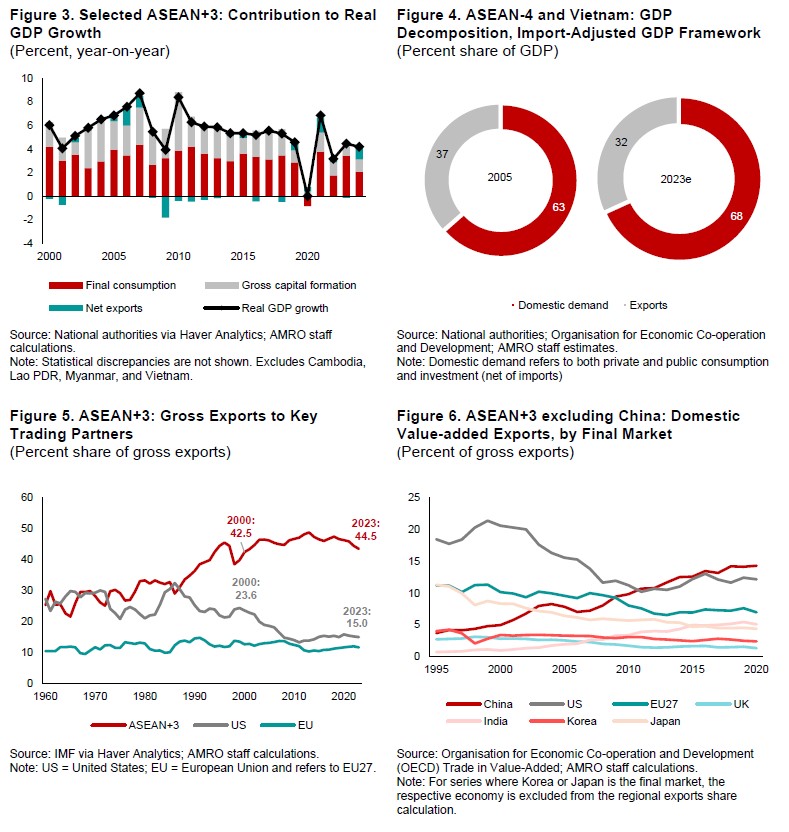

First, the region’s economies are now more balanced than before, with domestic-demand – both consumption and investment – and intra-regional trade being primary drivers of growth. (Figure 3, Figure 4). While the shock to external demand will spill over into the broader economy, robust domestic demand will likely remain, supported by policymakers’ continued focus on fiscal and structural measures to bolster domestic-driven growth.

Second, the region is now supported by a more diversified external demand structure. The share of exports going to the US has fallen steadily from about 24 percent in 2000 to below 15 percent currently (Figure 5). Meanwhile, intraregional trade now accounts for 45 percent of the total exports, with China becoming the region’s largest final demand market, helping to stabilize regional supply chains and demand flows (Figure 6).

Third, many regional economies have fiscal and monetary space, which can be used to support growth and manage downside risks as needed. Foreign exchange reserves are adequate, offering a key buffer against external shocks. Regional economies also have extensive experience from past crises in effectively combining fiscal, monetary, and other policy measures to navigate challenging economic conditions. This proven ability to calibrate policy mix will be particularly valuable as policymakers work to mitigate trade disruptions while maintaining economic stability in the months ahead.

Moving forward in strength together

As the region faces this unprecedented trade disruption, ASEAN+3’s collective resilience becomes its greatest asset. The region has weathered previous external shocks—from the Asian Financial Crisis to the Global Financial Crisis and the COVID-19 pandemic—each time emerging with stronger institutional frameworks and deeper cooperation.

This latest challenge presents an opportunity to further strengthen regional collaboration. ASEAN+3’s established mechanisms for policy dialogue, financial cooperation, and market integration, provide platforms to coordinate responses and minimize negative spillovers. The ASEAN+3 Macroeconomic Research Office, Chiang Mai Initiative Multilateralisation, and other regional forums demonstrate the proven value of institutionalized cooperation.

The region’s considerable economic weight—representing nearly a third of global GDP and total trade—provides significant leverage in navigating a more fragmented global landscape. By deepening intra-regional trade, investment flows, and financial integration, ASEAN+3 economies can further insulate from external shocks while creating new avenues for growth. The accelerating digital and broader technological transformation across the region offers additional pathways for innovative collaboration.

Most importantly, the diversity within ASEAN+3 region represents a source of complementary strengths. Economies at different development stages, with varied resource endowments and comparative advantages, can forge more resilient supply chains and create mutual opportunities. This diversity, when leveraged through coordinated policies and integration initiatives, transforms potential vulnerabilities into collective resilience.

What lies ahead is, in many ways, uncharted territory. The sweeping nature of recent US protectionist trade actions has introduced a new level of uncertainty into the global trading system. While the outlook is clouded and the road ahead may be uneven, ASEAN+3 retains the macroeconomic fundamentals and policy capacity to weather this storm. More than ever, regional cooperation and policy coordination will be vital—not just to stabilize the economies, but to safeguard the region’s future in a more fragmented world.