Elsewhere, virtual banking and open data might sound like buzzwords, but in Hong Kong, they are becoming a reality. Hong Kong has embarked on a journey of digital transformation in the financial services sector to safeguard its role as a leading global financial center.

Enabling Digital Transformation with Proper Regulations

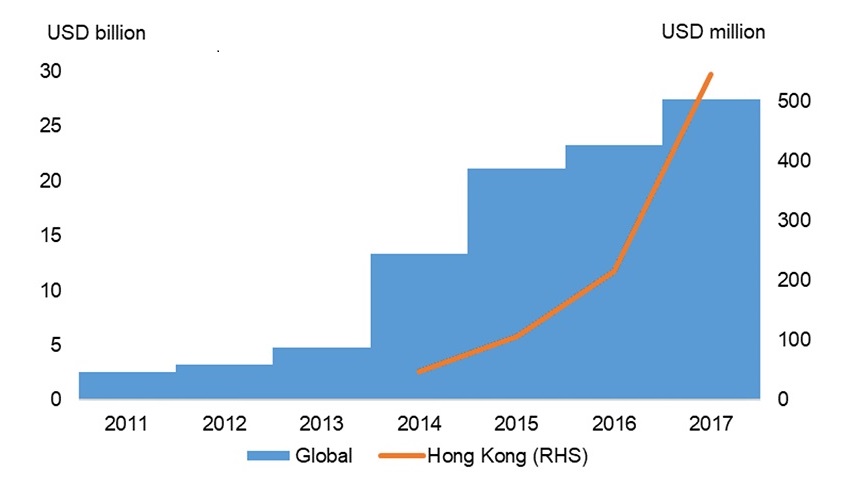

The financial services industry accounted for a fifth of Hong Kong’s economy in 2017. To transform to a digital financial center, financial services players in the city must embrace fintech fully, not only to effectively lower costs but also to achieve better customer satisfaction. As fintech has a great potential to enhance the financial sector’s productivity and consequently boost the economy, private investment has been pouring into this space since 2015, growing annually at 127 percent during 2015-2017, higher than the global average. Investments have been made in not only payments and lending but also other areas such as data and security, remittances and insurance, thereby creating a more balanced ecosystem. Blockchain and cybersecurity are also being prioritized in the efforts to develop new market infrastructure. As a result, with a more mature ecosystem, the city is hosting some of the forefront fintech startups and witnessing more applications that will affect the dynamics of financial services.

In parallel, the development of an appropriate regulatory framework is crucial to such a transformation. Hong Kong Monetary Authority (HKMA) and other government agencies have made concerted efforts in facilitation and legal alignment over the past years. Financial support through government fiscal funding has been increasingly directed to innovation and technology including fintech development, as elaborated in the new government budget in FY2018/19. To accelerate the development of mobile payment and e-Wallets, Hong Kong regulators and legislators amended the Clearing and Settlement Systems in 2015, started the licensing of Stored Value Facilities (SVF) in 2016 and launched the Faster Payment System (FPS) and the Common QR Code in 2018.

Fintech Investment in Hong Kong

Source: Accenture, CB insights, Investment HK

Hong Kong is also testing a new banking model using the latest technologies. The HKMA has introduced a new licensing regime for virtual banking business, allowing banking operations without physical branches. This can help enhance customer experience and support underserved customers including small and medium-sized enterprises and some segments of retail customers. Traditional banks will likely accelerate technology adoption and strengthen collaboration with fintech start-ups for digital transformation. Currently, the HKMA is processing license applications, and virtual banks will likely become a reality this year.

To promote data sharing and innovation, the Open Application Programming Interface (API) Framework was published in July 2018, enabling the sharing of a large set of financial data held by banks with third-party vendors. Banks in Hong Kong are expected to deploy open API within this year. This will not only help overcome data constraints faced by fintech start-ups but also benefit the development of the fintech ecosystem as a whole. Traditional banks can also benefit from stronger collaboration with fintech companies on the one hand and feel the pressure from the competition on the other hand.

As a trading hub, trade finance is critical to financial services in Hong Kong. The Hong Kong Trade Finance Platform—a platform that leverages new technologies—has started to showcase a commercial application, which digitizes trade documents and automates processes based on a blockchain Hyperledger Fabric. The underlying protocol enables a highly scalable platform with identified participants to execute smart contracts without necessarily an established trust relationship. With an agreement between the HKMA and the Monetary Authority of Singapore (MAS), the platform will be able to connect with its counterpart in Singapore.

Risks to Financial Stability

While the progress in fintech development in Hong Kong has been impressive, risks to financial stability and data security should not be underestimated. The full digitization of financial business flows and automation with 24/7 service time and real-time integration into clients’ economic activities could lead to greater sophistication, stronger interlinkages, and potentially larger systemic risks. The HKMA has emphasized the risk-based and tech-neutral principles in its regulatory role while facilitating the development of fintech. Each fintech business model and associated specific risks need to be well-understood and properly regulated.

It is worth noting that the evolution of blockchain-based fintech has been strongly associated with cryptocurrencies such as Bitcoin and other digital tokens. On the one hand, fintech business applications that take advantages of crypto technologies and underlying networks, such as money transfer, have been generally encouraged, conditional on proper Know Your Customer procedures and oversight. On the other hand, the Hong Kong authorities have been conducting fintech literacy campaigns and cautioning the public about the risks of such new instruments.

Going forward, maintaining the role of a leading global financial hub in the new digital era requires continued efforts from both the private and public sectors in Hong Kong to keep the ongoing digital transformation on the right track.