This article was first published in The Khmer Times on February 22, 2024.

2023 was a challenging year for Cambodia’s real estate sector, marked by a decline in construction projects, excess supply, and low demand. The sustained downturn also triggered an alarm on shadow banking activities.

Market downturn

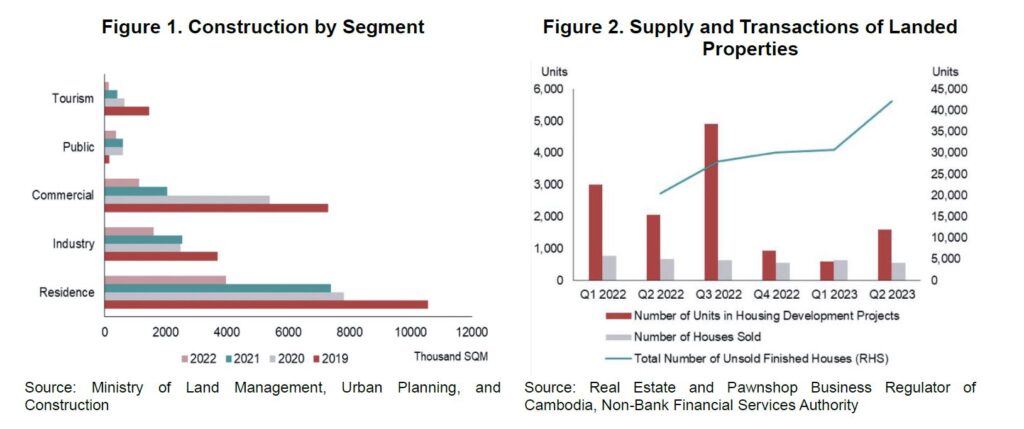

Cambodia’s real estate market has experienced a downturn since late 2022. According to the Ministry of Land Management, Urban Planning, and Construction (MLMUPC), total investment capital in real estate and construction projects fell to USD 2.97 billion in 2022, compared to USD 7.75 billion and USD 5.33 billion in 2020 and 2021, respectively. All segments including residential, industrial, and commercial projects experienced a slowdown (Figure 1). Purchasing power and readiness to buy also declined in 2023.

To make things worse, Cambodia’s real estate market is also facing an oversupply situation, especially for high-end and landed properties (Figure 2). The oversupply primarily originated from the 2019-2020 construction boom when developers raced to meet the demand of foreign investors. During the COVID-19 pandemic, foreign demand fell while most domestic buyers could not afford these properties. As a result of the low demand and excess supply, property prices came under pressure, with developers offering more discounts to sell their projects in 2023.

The rise of shadow banking

Concomitantly, the rise of shadow banking – lending activities taking place outside of the supervision of the National Bank of Cambodia (NBC) – poses a risk to the country’s financial system.

The shadow banking network was expanding before 2022 as home buyers turned to high-interest-rate instalment plans offered by developers rather than borrowing from banks who often required stricter credit assessments.

However, shadow banking activities in Cambodia led to heated disputes between developers and home buyers during the downturn. Homeownership disputes emerged as some developers initiated their projects without having full ownership of the land. Additionally, developers resorted to confiscating buyers’ properties due to late payments or defaults on instalments.

Furthermore, because developers rely on buyers’ payments as a source of funding, they also face disruptions in their cash flows. According to the Non-Bank Financial Services Authority (NBFSA), as of Q1 2023, 63 percent of developers reported negative cash flows, indicating potential liquidity shortages and the risk of defaults if market conditions do not improve.

Based on AMRO’s estimates, the size of shadow banking linked to real estate lending is about 60 to 70 percent of GDP, assuming a moderate level of interconnectedness between shadow banking and the traditional banking sector, i.e. developers lend part of their bank borrowings to home buyers. The size may go up to 112 percent of GDP if the full level of interconnectedness is assumed, i.e. developers fund their lending to home buyers from bank borrowing.

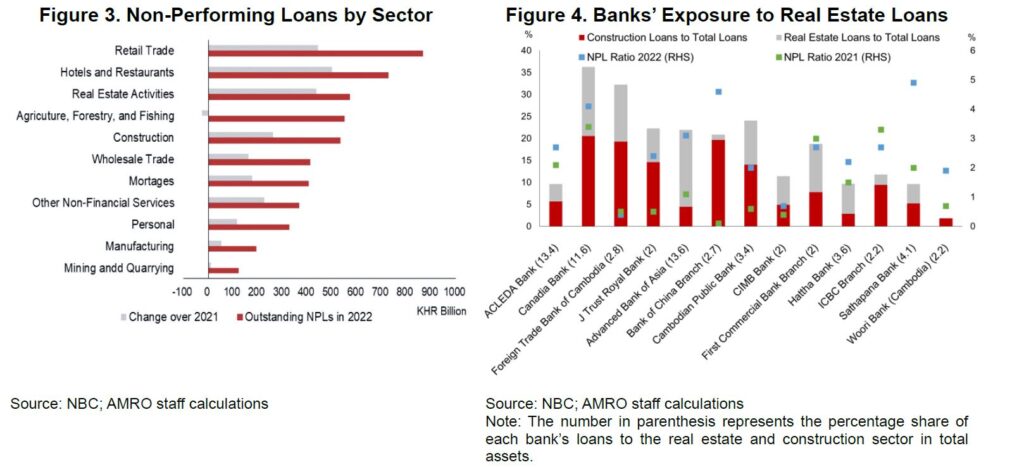

In a broader context, unregulated shadow banking raises concerns over the country’s financial stability. Credit risks linked to real estate lending through the official banking system have increased. Non-performing loans (NPLs) linked to real estate activities are ranked among the highest when compared to other sectors (Figure 3-4). Moreover, developers who are struggling with liquidity issues and delayed projects could go into default suddenly. When that happens, unreported NPLs from shadow banking could be transferred to the traditional banking sector, resulting in a jump in NPLs.

Policy recommendations

The dual challenges of a weakened real estate sector and growing financial distress in shadow banking activities can affect Cambodia’s financial stability. Thus, stringent oversight and regulatory measures are needed.

First, the authorities can consider streamlining the licensing process by implementing a single-window system or online platform for licensing where developers are required to regularly provide updates on their financial soundness. Enforcement actions such as suspension of license and business permit, freezing real estate bank accounts, and imposing stiff fines, should be taken against developers who violate the rules.

Second, the authorities can consider setting a borrowing limit between home buyers and registered real estate developers by imposing a cap on the ratio of the loan to the value of purchased property. To safeguard the homebuyers’ deposits, their deposits should be put in escrow bank accounts that can only be withdrawn after the completion of the units. Additionally, the government can consider drafting more detailed legal procedures for dispute resolution over property ownership and transactions.

Third, it is necessary to strengthen regulatory compliance on financial reporting via on-site supervision and auditing of developers. Establishing a centralized and standardized data management system for the real estate sector is essential in facilitating data-sharing across regulatory bodies. The property price index should broaden its coverage for a more accurate representation of market conditions.

Lastly, concerted and effective coordination across regulatory bodies, particularly the NBC, Ministry of Economy and Finance, NBFSA, and the MLMUPC, will play a vital role in ensuring the successful implementation of these policy measures.