The ASEAN+3 region remained resilient in a challenging global landscape in 2023. Growth momentum is expected to remain favorable in 2024 and 2025, with robust domestic demand and exports forecast to turn around. While external headwinds could weigh on growth, the baseline positive outlook offers the region a good opportunity to rebuild policy space lost since the COVID-19 pandemic.

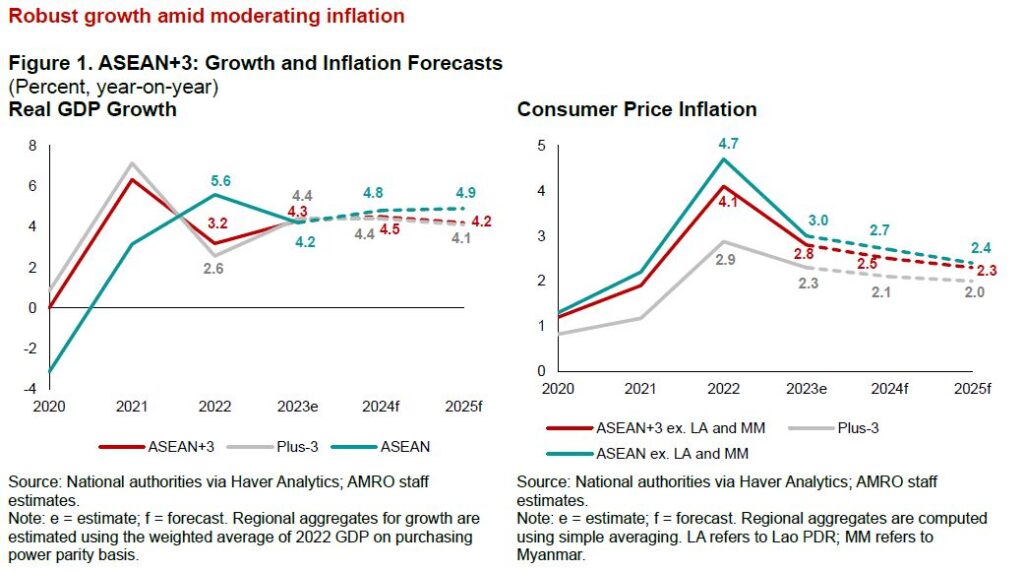

Despite a challenging global economy, ASEAN+3 registered a growth of 4.3 percent in 2023, a significant increase from 3.2 percent in 2022.

Domestic demand underpinned growth, with robust consumer spending spurred by improving labor market conditions and moderating inflation. Investment activities saw some tentative pickup toward the end of the year. Exports, however, remained weak following lackluster global demand.

This year, the ASEAN+3 region is expected to grow at a faster rate of 4.5 percent before moderating slightly to 4.2 percent in 2025 (Figure 1). Growth would be lifted by the turnaround in exports, while domestic demand is expected to remain robust.

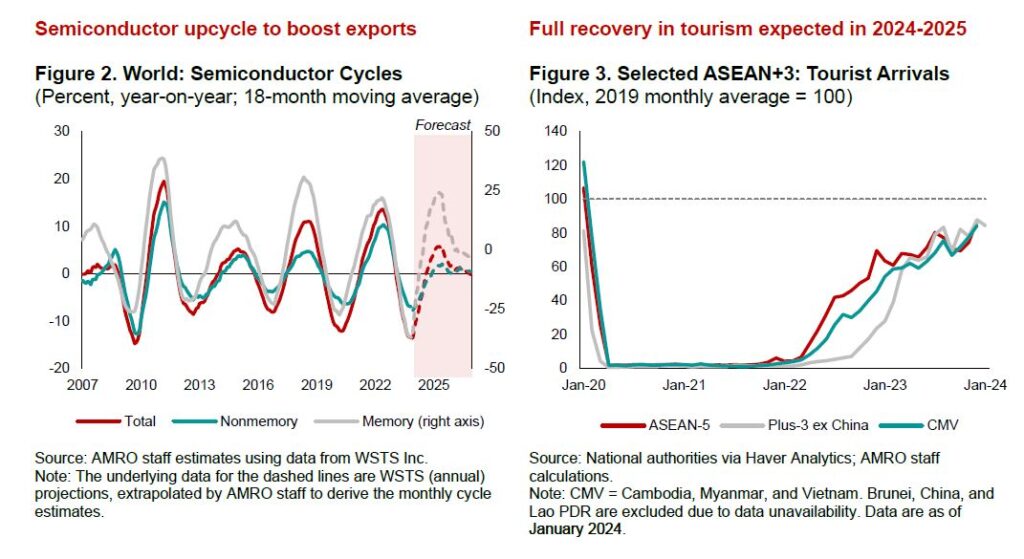

Goods exports will benefit from the upturn in the semiconductor cycle, boosted by increasing demand for advanced chips (Figure 2). Strengthening goods consumption in the United States, a major trade partner for most regional economies, will further support exports.

Meanwhile, services exports were lifted by continued tourism recovery, with tourist arrivals exceeding 80 percent of pre-pandemic levels on average (Figure 3). A full recovery is anticipated in 2024–2025, supported by resumption in flights, easing visa rules, and normalized travel patterns.

Inflation has moderated from its 2022 peaks. Headline inflation across the Plus-3 and ASEAN economies continued to trend lower in 2023, while movement of core inflation diverged between the two subregions—moderating for ASEAN and rising for Plus-3 economies.

The moderation in headline inflation was mainly due to declining global commodity prices, which is expected to continue as supply shocks in recent years subside. However, there is a risk that heightened geopolitical tensions may keep commodity prices at elevated levels, and strong demand pressures in some economies could keep core inflation high.

Uncertainties remain

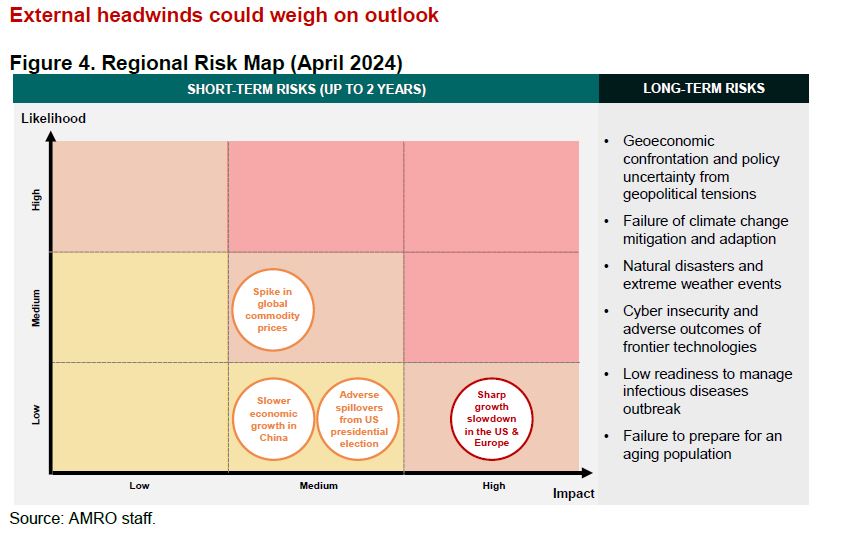

The region’s outlook could be impacted by various risks, with the balance of risks in the near term tilted to the downside (Figure 4).

The primary risk is a resurgence of commodity prices—potentially triggered by escalating geopolitical tensions and/ or El Niño weather conditions.

A slowdown in China’s growth due to weakness in the real estate sector, or that in the US and Europe due to higher-for-longer interest rates, could spill over to the rest of the region through decreases in trade, investment, and tourism.

The ongoing US presidential election may also fuel uncertainty. Heated populist rhetoric during the election campaign could lead to heightened protectionist sentiment and measures, resulting in financial market volatility.

In the longer term, ASEAN+3 faces structural and perennial challenges that could impact its economic and financial stability. Escalating geopolitical tensions would adversely impact trade and investment flows and result in a more fragmented and unstable environment. Other long-term risks, such as climate change, cybersecurity threats, and the emergence of future pandemics, also persist.

Timely opportunity to rebuild policy space

With robust growth and continued disinflation, ASEAN+3 economies should rebuild policy space to address long-term needs and bolster resilience.

Most economies continued fiscal consolidation in 2023 but have only partially recovered the policy space lost in the pandemic. Going forward, fiscal policy must balance between restoring fiscal buffers and supporting growth. Any delay could heighten public concerns about public debt sustainability given the higher debt-to-GDP ratios in most regional economies.

Meanwhile, most central banks have kept monetary policy relatively tight to contain inflation. Besides China and Vietnam, policy rates in the rest of the region remain at or above pre-pandemic levels.

Despite signs of headline inflation peaking in late 2023, uneven disinflation and upside inflation risks warrant careful policy adjustments. Economies with elevated core inflation should keep rates restrictive to anchor expectations, while those with rapid disinflation and sluggish growth can afford a more accommodative stance.

Looking ahead, policy coordination and continued structural reform would be crucial to raise growth potential, which has been dented by the pandemic, and could be weighed further by an aging population, heightened geopolitical tensions, and rapid technological changes.

Policies to boost investment in areas that improve productivity and resilience would be imperative. Strengthening regional cooperation to enhance collective resilience would also support growth, allowing ASEAN+3 to remain a bright spot in an increasingly complex global economy.