A version of this article was first published in Borneo Bulletin on June 19, 2024.

For decades, the hydrocarbon sector has been the primary driver of Brunei’s economic growth and development. Since the first oil discovery in 1929, Brunei’s oil and gas sector has expanded significantly and remained the cornerstone of the nation’s economy. In 2022, the oil and gas sector accounted for nearly half of the country’s GDP, underscoring the dominance of the hydrocarbon sector.

However, Brunei’s hydrocarbon-based economic model has come under increasing pressure in recent years. Global energy prices have become more volatile, while challenges in rejuvenating the country’s maturing oil and gas fields have resulted in more frequent production disruptions.

Global decarbonization efforts have added complexity to the sector’s development. As the world transitions from hydrocarbon to renewable energy, Brunei’s oil and gas sector, as its main source of export revenue, is at risk.

To safeguard growth and the future prosperity of the country, the government has placed economic diversification as a key policy thrust in its national development plans. Under the Wawasan Brunei 2035, tourism has been identified as one of the five priority sectors for economic diversification.

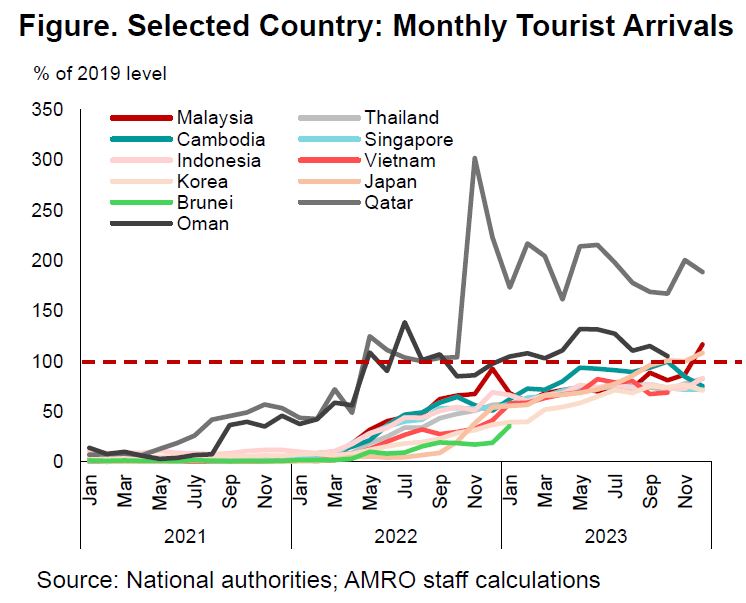

A vibrant tourism sector will not only bring in foreign visitors and forex revenues, but also foster the development of related industries and help job creation. Despite an encouraging rebound in the number of foreign visitors since 2022, the recovery of Brunei’s tourism industry lags behind that of its regional peers (Figure).

Limited activities, infrastructure

The country’s emphasis on preserving its rich cultural and natural heritage helps place Brunei in a unique position to attract visitors interested in authentic cultural experience. However, this could be a two-edged sword because new tourism activities, such as the introduction of more contemporary and diverse attractions, might be overlooked as a result. Compared to its ASEAN peers, Brunei has fewer number of tourist attractions, such as amusement parks, sporting arena, and other entertainment establishments.

Brunei’s limited tourism-related infrastructure is also a key challenge. Hard infrastructure, including airport connectivity, ground infrastructure, and tourist service infrastructure such as accommodation and car rentals, appear to be insufficient. Soft infrastructure in terms of skilled workers and labor market conditions also trail behind regional peers, reflecting some challenges in attracting and retaining talents for the sector.

Over the years, there has been also a lack of marketing and promotional campaigns to help drive the tourism sector’s growth. Furthermore, the strength of the local currency vis-a-vis regional peers’ can make Brunei look more expensive to foreign tourists and influence their decision to visit.

Investing in both hard and soft infrastructure is thus necessary to foster growth of the tourism sector. The planned establishment of a new Brunei-based airline, which is expected to enhance Brunei’s connectivity with several Chinese cities, bodes well for tourism. Enhancement of infrastructures, such as equipping hotels with better facilities and internet connection, should also be a priority.

Promote niche markets

Given the competitive tourism landscape in the region, Brunei should also focus on establishing niche markets for its tourism sector by leveraging its rich culture and biodiversity. The establishment of ecotourism resorts in Temburong district is a step in the right direction.

Another viable option to spur the growth of the tourism industry is to promote Brunei as a premier destination for Islamic tourism. Brunei has the potential to further develop this niche market, given the extensive availability of prayer facilities, Halal dining and Muslim-friendly hotels and resorts in the country.

Setting policy priority is the first step to boost the growth of Brunei’s tourism sector. Encouraging signs are emerging with the ongoing development of an industry roadmap and a database of nationwide tourism products and services. Subsequently, comprehensive strategic development plans should be formulated to unlock the potential of niche segments around eco-, Islamic and community-based tourisms. With clear directions in place, Brunei has a good opportunity to eventually become a top niche tourism destination in the region.