Japan’s economy is deeply connected to global trade, making the movement of the Japanese yen (JPY) a key factor in shaping inflation, trade competitiveness, and economic growth. In recent years, the yen has been weakening and becoming more volatile. While a weaker yen helps Japanese exporters by making their goods cheaper, it also increases the cost of imports. Let’s explore how these exchange rate movements influence the Japanese economy, based on insights from AMRO’s recent analysis.

The growing link between exchange rates and prices

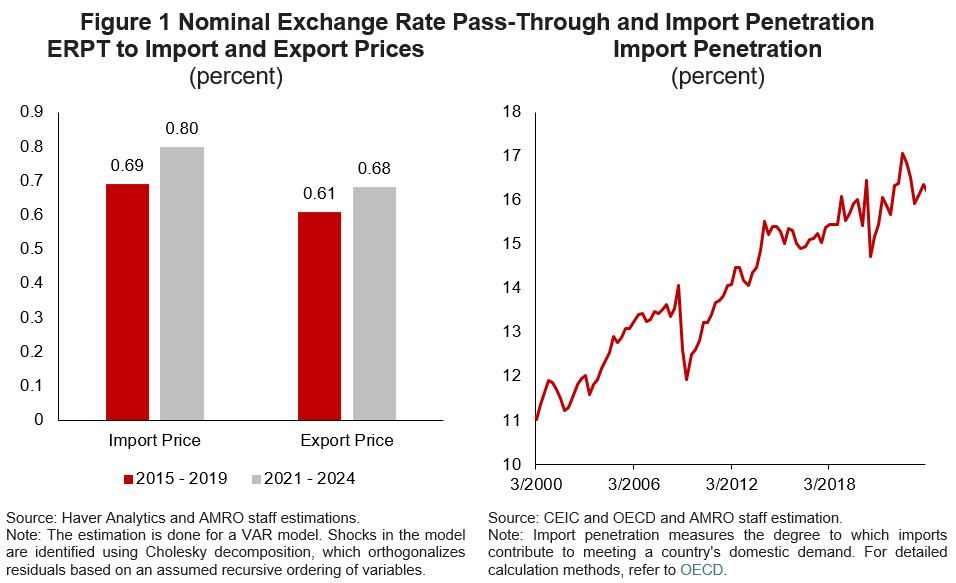

Research from AMRO shows that exchange rate fluctuations are increasingly affecting domestic prices. Between 2015 and 2019, exchange rate movements had only a mild impact on import and export prices. However, since 2021, this influence has grown, especially for imported goods (Figure 1). This stronger impact may be due to rising inflation and more frequent swings in exchange rates (Campa and Goldberg, 2002), as well as an increase in import penetration.

How businesses set their prices and which currency they use for invoicing also play a role. Japanese exports to advanced economies are often priced in the buyer’s currency, while trade with Asian markets is more frequently invoiced in US dollars rather than yen (Ito et al. 2016). This pattern, alongside the dominant currency paradigm (Gopinath et al., 2016, 2020)— the idea that a few major currencies, particularly the US dollar, dominate global trade invoicing regardless of the countries involved — helps explain why the impact of yen movements tends to be stronger for imports rather than exports. Since many imports are priced in dollars, a weaker yen makes them more expensive for Japanese buyers, while export prices — often set in foreign currencies, especially USD — are less sensitive to changes in the yen’s value.

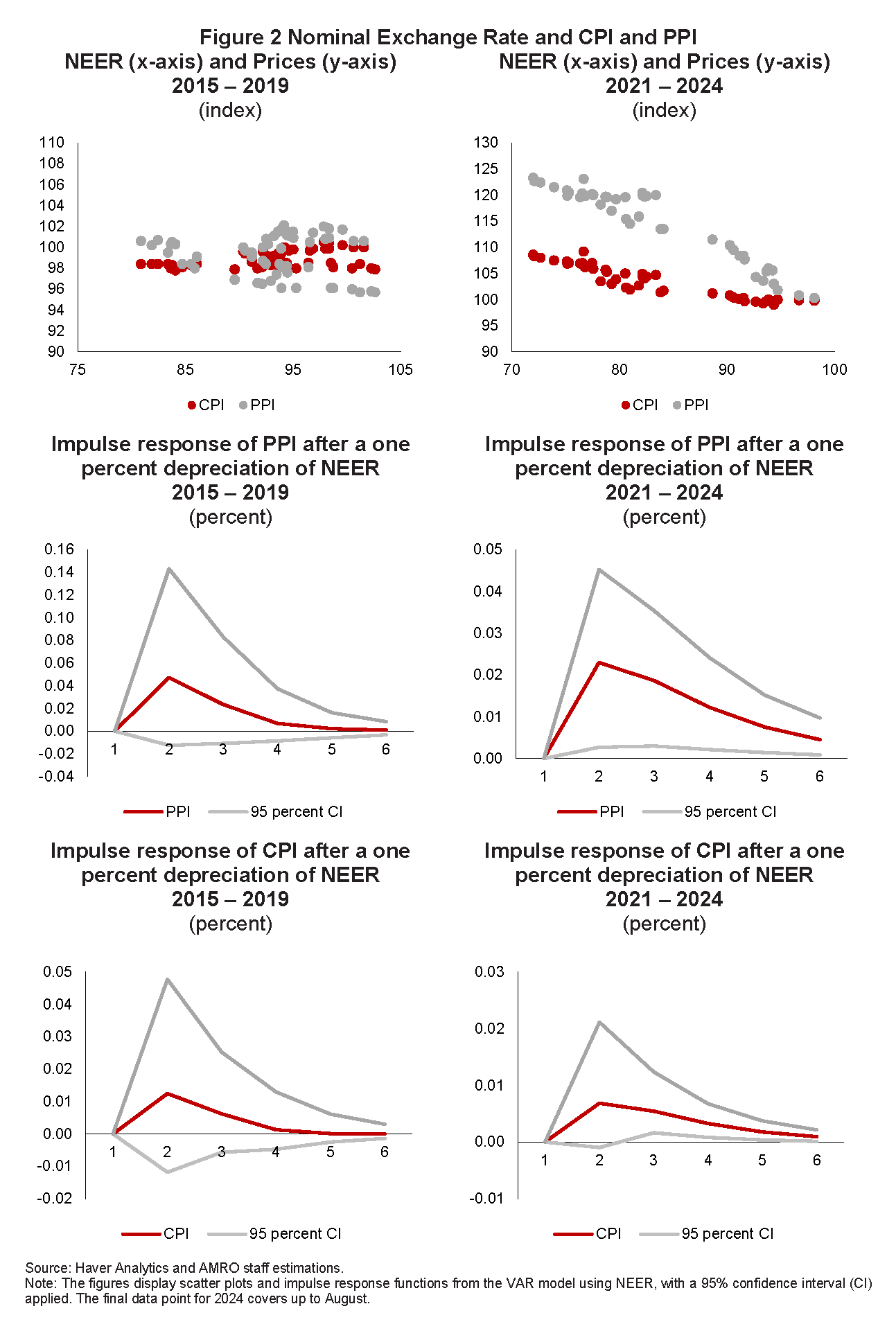

A similar trend is seen between producer and consumer prices. While the link between the exchange rate and domestic prices was previously weak, a clearer pattern has emerged in recent years. When the yen weakens, producer prices (the costs businesses pay for materials and goods) tend to rise due in part to higher import prices. While consumer prices are also affected, the overall impact remains moderate. Between 2021 and 2024, the effect of exchange rate changes was estimated at 0.023 for producer prices and 0.005 for consumer prices (Figure 2), confirming that while the influence of exchange rates on both producer and consumer prices has grown, it remains relatively contained, particularly in the case of consumer prices.

Several factors help limit the effect of yen movements on consumer prices. Many businesses, particularly those operating in foreign markets, hedge against exchange rate risks, reducing the need for full cost pass-through. Additionally, domestic producers absorb some of the higher costs due to competition, especially during the period of near-zero inflation. Companies also use profit margins as a buffer against price fluctuations.

While exchange rates are playing a larger role in price dynamics, businesses and market forces are keeping the overall impact in check. However, the sustainability of hedging strategies and cost absorption through shrinking profit margins remains an open question, particularly in the case of persistent yen depreciation.

The Economic Effects of Real Exchange Rate Movements

When Japan’s real exchange rate takes a hit, its effects ripple across the economy—but not everything reacts the same way. For exports and investment, a weaker yen makes Japanese goods cheaper abroad, boosting exports and encourage investment in production. This supports economic growth (Brito, Magud and Sosa 2018; Habib, Mileva and Stracca 2016; and Rodrik 2008). For household consumption, the impact is more limited—likely reflecting the previously discussed moderate effect on consumer prices.

At the same time, currency fluctuations contribute to economic uncertainty, playing a significant role in shaping trade and investment patterns as businesses adjust their strategies in response to shifting costs and global market conditions.

Thus far, despite fluctuations in the exchange rate, domestic consumption has remained resilient. Over time, however, this influence may gradually shape Japan’s economic trends.

What Lies Ahead?

Going forward, as exchange rate changes increasingly influence domestic prices and economic activity, fluctuations in the yen could play a more important role in shaping inflation dynamics and Japan’s growth outlook. As the role of exchange rates evolves, closely monitoring their impact will be essential for shaping effective economic policy, fostering sustainable growth, and navigating risks in an increasingly uncertain global landscape.