Last year, amid news of rising inflation and the monetary policy actions from the Bangko Sentral ng Pilipinas (BSP), important developments were also taking place behind the scenes on the monetary policy operations as featured in AMRO’s 2023 Annual Consultation Report for The Philippines. Albeit less visible to the public, monetary policy operations play a crucial role in determining the effectiveness of monetary policy.

Central banks carry out monetary policy operations such as lending or borrowing liquidity in the market to align the movements of short-term market rates with that of the policy rate set by the Monetary Board. With effective monetary policy operations, changes in the policy rate can be transmitted fully to short-term market rates, which are factored into bank lending rates and bond yields that drive the funding costs of firms and individuals in the broader economy.

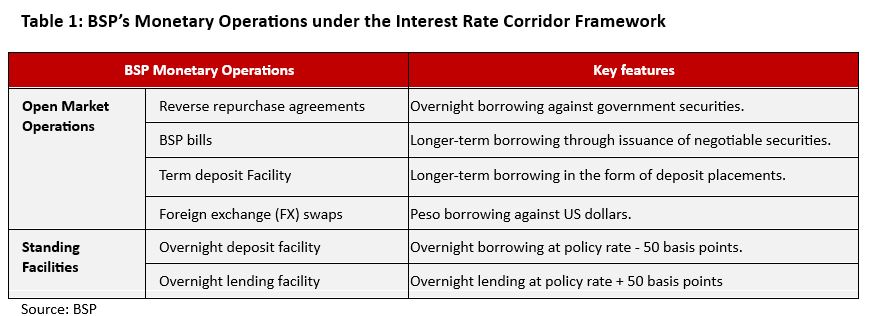

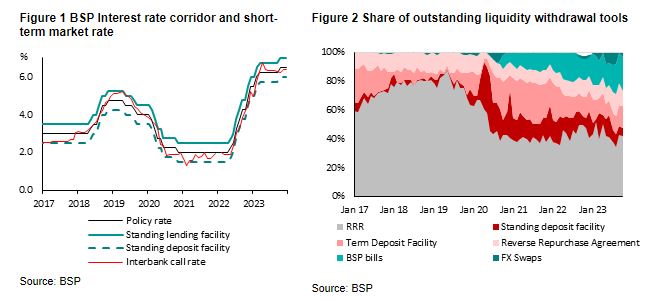

With excess liquidity in the Philippine banking system, the BSP must borrow or ‘withdraw’ liquidity from the market to prevent market rates from falling below the policy rate. It does so through the Interest Rate Corridor System, which is a common framework among emerging market central banks where the movement of short-term market rates is contained within a band or ‘corridor’. At the heart of this corridor system are the Open Market Operations, with which the BSP withdraws most of the excess liquidity at interest rates close to the policy rate (center of the corridor); and the Standing Lending and Deposit Facilities, which serve as the safety valves limiting overnight interest rate fluctuations within the ceiling and the floor of the corridor. (Table 1 and Figure 1)

Monetary operations are not only important for guiding the short-term rates, but also for financial market developments. Given the central role of monetary operations in the banking system’s liquidity management, how these operations are carried out can shape market participants’ behaviours and practices. For example, central banks can choose to withdraw funds through repurchase agreements to foster secured borrowing market (repurchase or repo market), which is a building block of a deep financial system.

Since the BSP adopted the Interest Rate Corridor System in 2016, it has been refining the framework to improve the effectiveness of monetary policy transmission and further financial market development. Last year, it took the following steps to further these efforts.

- Reserve Requirement Ratio (RRR) cuts. The Reserve Requirement mandates banks to set aside a certain percentage of their liquidity in deposits with the BSP. The RRR has served as a main liquidity management tool for decades. However, unlike Open Market Operations, they do not pay interests; thus, high level of RRR can incur significant costs to the banking system and dampen policy rate transmission. Moreover, RRR balances are passive accounts that limit market activities. Recognizing the drawbacks, the BSP has made a strong commitment to reduce the use of RRR and shift toward more market-based tools. From 20 percent at the beginning of 2018, the RRR has since been gradually reduced. The latest round of cuts in June 2023 brought the ratio down to 9.5 percent for commercial and universal banks. However, the current level remains high compared to international standards and is expected to be cut further over time.

- Introduction of the new 56-day BSP Bills. Affirming its commitment to move toward market-based liquidity withdrawal instruments, the BSP added the 56-day BSP bills to the toolkit (Figure 2). The new bills give BSP more flexibility to respond to changes in liquidity conditions, and therefore greater ability to guide the short-term interest rates.

- Reforms to Overnight Reverse Repurchase (RRP) Facility. The RRP Facility is the primary short-term borrowing window that plays a central role in guiding short-term market rates. Last year, the BSP introduced two changes to boost the role of the market mechanism in RRP facility. First, it shifted from a fixed-rate fixed-volume format, in which both the interest rate and the volumes are set by the BSP, to a variable-rate auction format, in which the interest rates are determined through auctions. With price signals from the market, BSP can better gauge the prevailing liquidity conditions, adjust the RRP volumes, and steer the market rates toward the policy rate. In addition, the auction time of the RRP was shifted from late afternoon to morning, which encourages more interbank market activities throughout the trading days.

The continued improvements to the BSP’s monetary policy operations like those made last year are crucial to the effective policy rate transmission seen in the past tightening cycle. Going forward, we expect the BSP to continue expanding its arsenal of market-based tools and enhancing the existing ones to support a deeper and more efficient financial market.