Global financial markets ended the year 2023 on a positive note. The easing of the US Federal Reserve’s (Fed) hawkish stance was instrumental in providing the backdrop that helped US equity move higher and US Treasury yields move lower, leading to a broad weakness in the US dollar. The easing stance also had a positive spillover to most advanced and emerging markets and assets, including the ASEAN+3 markets.

AMRO’s estimates show that market stress, which rose in 2022, broadly fell in 2023 as the Fed concluded its monetary tightening and provided indications that monetary easing could start in the next few quarters.

AMRO’s Market Stress Indicator was used to quantify the reversal in market stress over the past year and understand the factors behind the reversal. The Market Stress Index was constructed using a simple average of indicators of real price growth and volatility converted to within-country percentiles.

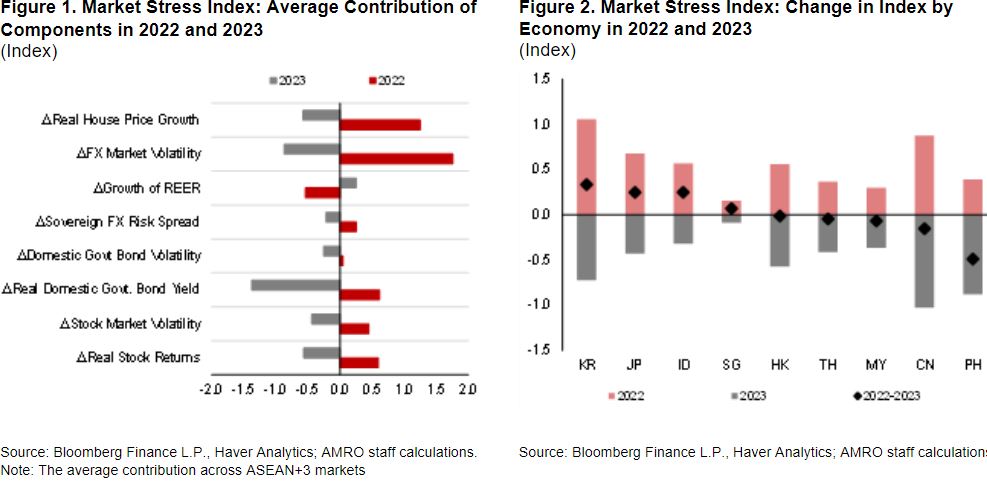

The Market Stress Index provides a simple framework for aggregating and attributing the change in market stress to various factors. The index rises with a rise in stock market volatility, real domestic government yields, domestic government bond yield volatility, sovereign FX risk spread, and FX market volatility. Correspondingly, the index falls with a fall in real stock market returns, growth of the real effective exchange rate, and real house prices (Figure 1).

AMRO analysis finds that, exchange rate volatility—against the US dollar—and falling real government bond yields were the largest contributors to rising market stress in 2022 and falling stress in 2023, respectively, on average. The rise in market stress was larger for the Plus-3 economies (China, Japan and Korea) in 2022, due to a sharp decline in real house price growth (Figure 2).

However, the stress has eased in 2023 as property prices stabilized somewhat. Market stress eased the greatest in China and the Philippines during 2023, driven by a fall in exchange rate volatility and real domestic government bond yields, respectively.

Looking ahead, market stress could fall further due to easing inflationary pressures which enhance real returns of assets, the resultant easing of monetary conditions, and a reduction in asset price volatility.

However, as highlighted in the ASEAN+3 Financial Stability Report 2023 (AFSR), inflation resurgence and the resultant hawkishness by major central banks will remain the key risks for the markets. These developments could potentially cause a rise in market stress.

While the market stress indicator is a simplistic representation of factors impacting market conditions and does not encompass all sources of market stress, the details provide insights into some of the relevant issues that policymakers have been tackling over the past couple of years.

The prudent approach of policymakers is expected to dampen any episodes of rising stress in ASEAN+3 markets. Policymakers in ASEAN+3 have directed their policies toward curbing inflationary pressures and have acted to reduce market volatility and support domestic assets—exchange rate, equities, bonds, and real estate—in various cases. This policy approach has been effective in reducing market stress and raising market confidence.