During 2022, the Korean won (KRW) exchange rate was highly volatile as the U.S. economy emerged from the pandemic and the U.S. dollar (USD) strengthened following the hawkish policy stance of the U.S. Federal Reserve. The KRW depreciated against the USD by 17.4 percent in late October 2022 at the peak and by 6.0 percent at the end of December 2022, compared with the end of December 2021.

Given Korea is an open economy with deep integration into the global supply chains and a high degree of free flow of capital, the KRW is naturally sensitive to the shift in global economic and financial conditions. However, excessive foreign exchange rate volatility could have negative impacts on the Korean economy given that many Korean manufacturers have a global footprint and Korea has become a creditor country. In this context, it is imperative to first understand the underlying economic drivers of the KRW/USD exchange.

Key economic drivers

In the AMRO 2022 Annual Consultation Report on Korea, we used a vector autoregression (VAR) model and a historical decomposition over a sample of 1999-2022 to estimate the impact and contribution of each factor on the movements of the KRW against the USD. Overall, our results suggest that interest rate differentials, changes in risk perception, and the performance of the Korean equity market have more significant impacts on the USD/KRW than the current account balance.

When the three-year interest rate differential between the U.S. and Korea widens, investors tend to move money to U.S. markets in search of safe assets and higher yields. Such pressure on capital outflows can exert depreciation pressure on the exchange rate.

The KRW is also sensitive to changes in global investor sentiment proxied by the VIX index. This corroborates the long-held market view that generally sees the KRW as a global “high-beta” currency due to Korea’s strong exports and deep integration into the global supply chain.

In addition, the KRW is highly responsive to the buying and selling of stocks by investors. Foreign investors owned more than 30 percent of Korean stocks at the end of 2022. As they buy and sell equities in the Korean market and reallocate money in and out of the country, the exchange rate reacts.

Lastly, although the effects of current account are less significant, improvements in the current account can lead to an appreciation of the KRW. However, the impact dampens quickly.

Dynamic effects of economic drivers

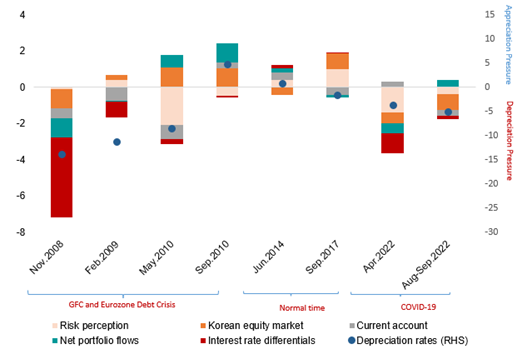

Our estimate also shows that drivers of the KRW/USD exchange rate vary over time (Figure 1).

The depreciation of the KRW in November 2008 during the Global Financial Crisis was broad-based, including widening interest rate differentials, deterioration in the current account balance, the equity market downturn, and portfolio outflows. Comparatively, depreciation during the pandemic was mostly due to increased risk aversion and a weak domestic equity market.

Likewise, during periods of appreciation pressure on the KRW, portfolio inflows and an increase in the equity index were the main drivers in September 2010, while improvements in risk sentiment and the booming equity market drove up the currency in September 2017.

Figure 1. Drivers of KRW/USD Rate in Selected Months

Note: The figure was estimated from a VAR model and historical decomposition to disentangle the contribution of each factor to the exchange rate movement. The selection of episodes is based on those months when the won rose or fell sharply against the dollar. The blue dots denote the actual monthly depreciation or appreciation. The cumulative impacts of these factors do not add up to the actual monthly depreciation or appreciation as, due to data limitations, the model does not capture some of the depreciation or appreciation pressure, such as intervention by the authorities and investor positioning.

Source: Bloomberg; Haver Analytics; national authorities; AMRO staff estimates

Near-term outlook

The near-term outlook for the KRW/USD exchange rate remains highly uncertain. Interest rate differentials and the resultant concerns over capital flows are likely to continue to be the main drivers behind the near-term movements of the KRW. However, uncertainties surrounding monetary policy paths in Korea and the U.S. are expected to remain high in 2023. Risks to a weaker KRW could also come from the softening trade balance. This would in turn be due to high import prices and subdued external demand, a rebound of residents’ overseas direct investments or portfolio investments, and worsening global investor sentiment triggered by, for instance, a deterioration of China-U.S. relations.