By Chuin Hwei Ng, Hoe Ee Khor

As we are entering 2018, all eyes are on the economic prospects of the New Year.

Compared to this time last year, prospects for the global economy at the beginning of 2018 are improving with broad-based growth momentum across advanced and emerging economies, while inflation pressures remain subdued, according to the latest assessment released by the ASEAN+3 Macroeconomic Research Office (AMRO) in mid-January. An expansion in global trade and capital expenditure are driving global growth. Commodity prices in energy and industrial metals are also recovering, benefitting commodity exporters.

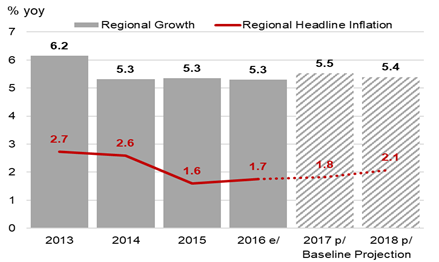

This upswing in global trade has buoyed growth in the region. In addition, growth in the two largest economies in the region, China and Japan, continues to anchor economic growth in ASEAN+3, which includes 10 members of the Association of Southeast Asian Nations, and China (including Hong Kong), Japan, and Korea. AMRO’s baseline GDP growth forecast for the region is 5.4 percent in 2018, broadly similar to the estimated 5.5 percent. Improving current account positions will allow the region to continue to build foreign exchange reserve buffers, which together with exchange rate flexibility, will help to buffer against the impact of possible capital flow volatility and external shocks.

Source: National Authorities and AMRO staff estimates

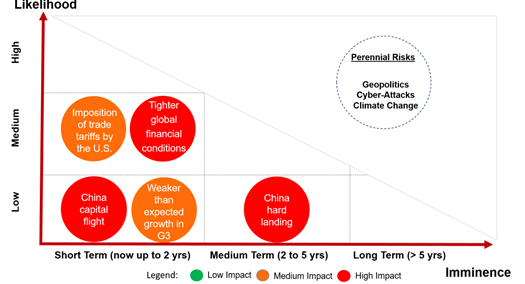

While global financial conditions remain favourable, the risks confronting the ASEAN+3 region are mainly external, tail risks with low likelihood, but with high impact. These risks are summarised in the Global Risk Map below, the first-of-its-kind matrix developed by AMRO to assess the likelihood against the imminence of risks.

- Tighter global financial conditions, from the risk of faster-than-expected Fed rate hikes, may lead to capital outflow shocks in emerging markets.

- Protectionism from U.S. imposing tariffs on targeted exports from the region would adversely impact bilateral trade and escalate global trade tensions.

- While a tail risk, a hard landing or capital flight from China, an engine of global and regional economic growth, would adversely impact market confidence in the region.

- Geopolitical events, climate change and natural disasters, and cyber-attacks are also perennial non-economic risks

Global Risk Map (Risks Facing the ASEAN+3 Region)

Source: AMRO

In response to these developments, policymakers should continue to build policy space, particularly in monetary policy. While generally benign inflation and continued low global yields have afforded monetary policy space, economies would need to take into consideration financial stability and possible external vulnerabilities following tighter global financial conditions ahead. With constraints on monetary policy due to tightening global financial conditions, fiscal policy would have to play a greater role to support growth. Macroprudential policy can also help address pockets of vulnerability in certain sectors, and most regional economies have tightened macroprudential policy pro-actively.

To increase the productive capacity in the long-run, economies in the region, especially developing ASEAN economies, should accelerate structural reforms in building necessary physical infrastructure and human capital, and economic diversification.

In this rapidly-changing world, ASEAN+3 policy makers should remain vigilant and take decisive actions where needed to mitigate risks and to sustain growth momentum going into the year of 2018.