SINGAPORE, May 19, 2022 – The Vietnamese economy picked up strongly in early 2022, thanks to a strong vaccination drive, robust global demand for its manufacturing products, momentum in domestic demand and resilient foreign direct investment (FDI) flows.

This preliminary assessment was made by the ASEAN+3 Macroeconomic Research Office (AMRO) after its Annual Consultation Visit to Vietnam from May 3-18, 2022.

The mission was led by AMRO Group Head and Lead Economist, Sanjay Kalra. AMRO Director, Toshinori Doi and Chief Economist, Hoe Ee Khor participated in the policy meetings. The discussions focused on the recovery of the Vietnamese economy from the pandemic and made policy recommendations to further support the recovery while maintaining macroeconomic stability and creating conditions for sustainable and inclusive growth over the medium term.

Developments and outlook

“The Vietnamese economy is expected to grow at 6.3 percent in 2022 and 6.5 percent in 2023. Inflation is projected to remain contained,” said Dr. Kalra. “This positive outlook rides on strong external demand, a recovery in domestic consumption and healthy investments inflows, bolstered by an appropriate macroeconomic policy stance.”

The domestic outbreak of the Omicron variant receded sharply in April 2022, and border restrictions and domestic containment measures were eased. The aggregate output gap is expected to narrow significantly by end-2022. The recovery is, nevertheless, uneven across sectors. While both the manufacturing and service sector outputs have surpassed their 2019 levels, the service sector still has pockets of distress, especially in the tourism, hospitality and logistics sectors.

Consumer price inflation is projected to remain contained under 3.5 percent in 2022, as the authorities plan to utilize their oil price stabilization fund and administered prices to offset pressures emanating from global developments in energy prices.

Risks and vulnerabilities

Risks to the growth forecast are broadly balanced. The main downside risks stem from global commodity and supply chain disruptions related to geopolitical developments, flare-ups of more vaccine-resistant COVID-19 variants, China’s zero-COVID policy, tightening of financial conditions in advanced economies, and a persistent increase in global oil prices. Upside risks to the forecast spring from a faster-than-projected growth in private consumption.

From a longer-term perspective, the pandemic may have widened inequalities with longer lasting scars on the more vulnerable segments of society. In the financial sector, the deterioration in bank balance sheets from the effects of the pandemic-related growth slowdown would likely take some time to mend. Relatedly, potential risks from the real estate sector warrant close monitoring in the near-to-medium term.

Policy responses

Given the economy’s cyclical position, AMRO recommends a mildly supportive fiscal policy stance in 2022. Given the available fiscal space and the uneven recovery across economic and social sectors, policy should provide targeted support to those that continue to be dislocated by the pandemic, especially micro-, small and medium-sized enterprises (MSMEs) and low-income households.

Monetary conditions should be normalized to contain inflationary pressures and reduce financial imbalances that emerged in the environment of low interest rates. However, it is essential to ensure that financing needs of vulnerable MSMEs and households are met, and that sufficient funding is available to productive sectors. The State Bank of Vietnam should continue to allow greater exchange rate flexibility, as it balances growth, inflation and financial sector stability objectives.

On the financial stability front, efforts are needed to increase provisioning and capital buffers to prepare for an increase in impaired assets, in view of the impending expiry of the forbearance policy. A macroprudential policy framework needs to be put in place, including to address imbalances in the real estate market.

As Vietnam progresses beyond the lower middle income country status, it will need to implement reforms across a broad range of issues and sectors to mobilize financing for growth and development and to strengthen investor confidence. In this context, the Prime Minister’s directive to raise Vietnam’s sovereign rating in international capital markets to investment grade by 2030 is a step in the right direction.

Structural reforms need to be accelerated to ensure a sustainable and inclusive growth, including by expediting equitization of and divestment from state-owned enterprises (SOEs); developing domestic FDI supporting industries through training and skills upgrading programs; and strengthening the social safety net in anticipation of aging demographic trends.

AMRO’s mission team would like to express its appreciation to the Vietnamese authorities and other participating organizations for their cooperation and candid exchange of views, and to the authorities for the excellent arrangements which made this mission possible.

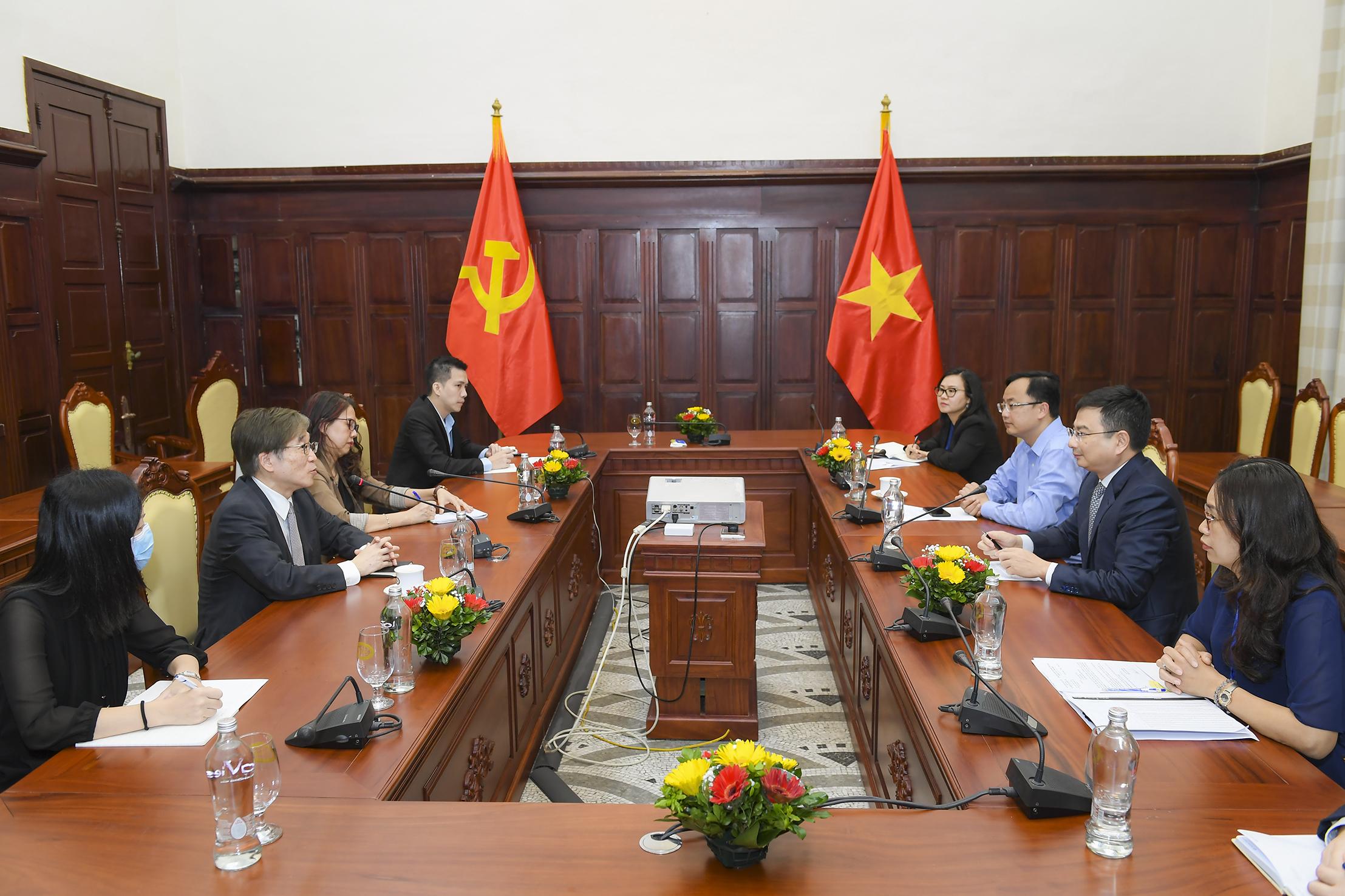

AMRO Director Toshinori Doi meets with officials from the State Bank of Vietnam.

AMRO Director Toshinori Doi meets with officials from the State Bank of Vietnam.

AMRO Chief Economist Hoe Ee Khor and the AMRO Vietnam team meet with senior officials from the Vietnam Ministry of Finance.

AMRO Chief Economist Hoe Ee Khor and the AMRO Vietnam team meet with senior officials from the Vietnam Ministry of Finance.

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute towards securing macroeconomic and financial stability of the ASEAN+3 region, comprising 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support the implementation of the regional financial arrangement, the Chiang Mai Initiative Multilateralisation (CMIM), and provide technical assistance to the members.