This article was first published in BusinessWorld on April 11, 2024.

Over the past few years, a substantial improvement in the Philippines’ digital infrastructure has paved the way for further digitalization in both the financial system and economic activities. Despite some challenges, it is encouraging to see the authorities’ efforts to facilitate the adoption of digitalization in both the public and private sectors.

Efforts to promote digitalization

The digital economy in the Philippines contributed 9.4 percent to GDP in 2022, an increase of 11 percent from the previous year. The sector employed about 6 million people in 2022 or 13 percent of the total employment. As of end-2022, digital payments accounted for 42.1 percent of the total volume of payments. The digital banking landscape continues to expand and now comprises six digital banks and 285 FinTech companies.

Further development in the digital economy can create jobs and promote long-term growth, especially by improving productivity and competitiveness, while embracing a more technology-driven economy is essential in the longer term to improve productivity and competitiveness.

The Philippine authorities have made great strides in their efforts to promote digitalization. The Philippine Development Plan (PDP) 2023-2028 formulates the long-term economic digitalization plan. The roll-out of the National ID (PhilSys ID) system accelerates the transition to a digital economy. The central bank’s Digital Payments Transformation Roadmap 2020-2023 outlines the plan for financial digitalization with satisfactory progress. Together, these efforts can bring forth major opportunities for the people and the government in the long term.

In addition, the delivery of government services can improve and become more efficient and transparent through digitalization. With the goal of achieving “One Digitized Government” for the entire country, the e-Government Master Plan (EGMP) 2022 was introduced as the blueprint for developing a harmonized government information system through the digital transformation of all basic services.

On the fiscal front, digitalization has enabled the government to collect taxes more efficiently and generate additional tax revenue from digital service providers. In particular, the House of Representatives approved a 12 percent value-added tax (VAT) on digital services in 2021. According to estimates from the Department of Finance, VAT of digital service transactions are expected to generate PHP10.66 billion of annual revenue.

Moreover, financial digitalization could enhance financial inclusion and its further development could help Filipinos to access digital services more conveniently. Financial digitalization has progressed well during the COVID-19 pandemic. Transactions related to digital payments have grown rapidly and the creation of digital banks has led to innovative channels for payments, lending, digital banking, and insurance, etc.

Challenges to overcome

Although the authorities’ digitalization efforts promise to bring numerous opportunities to the economy, some challenges need to be resolved for digitalization to be successful. They include upgrading of labor skills and regulations, and enhancing cybersecurity against digital threats and vulnerabilities.

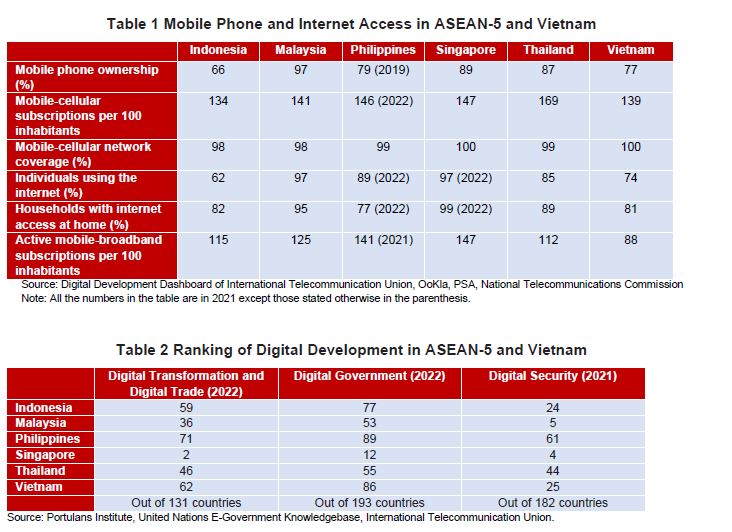

Despite significant progress, there is room for the country’s digital infrastructure development to catch up with its ASEAN peers (Table 1). The absence of reliable and high-speed internet connections in most rural and remote areas could hinder digital inclusion and economic development. Furthermore, the country lags behind its regional peers in key areas of digital development such as digital transformation and trade, digital government and digital security (Table 2).

In other aspects, it is essential for the Philippines to upgrade its soft infrastructure for economic digitalization. For example, the digital skill gaps among the labor force, people’s resistance to digital transformation, and regulatory gaps and loopholes would need to be addressed effectively.

Moreover, it is hard for the regulatory framework to catch up with the relentless development of technology, such as artificial intelligence (AI), blockchain, the Internet of Things (IoT), and big data. Developing and implementing appropriate regulations in a timely manner can be challenging.

Appropriate regulations on the use of digitalization would need to be put in place to safeguard consumers from digital threats and vulnerabilities. According to Kaspersky, a cybersecurity and anti-virus provider, the Philippines was the second most attacked nation in cyberspace in 2022. The country’s largest telecommunication company recorded 16 billion cyberattacks in 2023, nearly 90 times higher than in 2022. The country also ranks 45th among 175 countries on the 2023 National Cybersecurity Index (NCSI) of the eGov Academy.

The Philippine authorities are on the right track to formulate policies for promoting economic digitalization. To ensure a smooth digitalization process, the authorities should prioritize its investment in infrastructure development, enhance digital skills of the workforce, and strengthen the regulatory framework.

For more information on the Philippines’s economic digitalization, download AMRO’s 2023 Annual Consultation Report on The Philippines.