The Chiang Mai Initiative Multilateralisation (CMIM), with a financing capacity of USD240 billion, aims to provide emergency financing for ASEAN+3 economies in the event of short-term financial shocks. The CMIM is supplemented by a network of bilateral swap agreements (BSAs) between regional economies, which amounts to a total value of USD331 billion. With the COVID-19 pandemic putting a spotlight on international financial assistance in times of crisis, it is worth exploring the collaboration between CMIM and BSAs to strengthen the ASEAN+3 region’s financial safety net.

Part of the global network

Together with the International Monetary Fund (IMF) and international reserves, the CMIM and BSAs form the global financial safety net that buffers economies against financial crises and contagion effects.

The CMIM has two credit lines to provide both crisis prevention and resolution for its members to address balance of payment (BOP) and/ or short-term USD liquidity difficulties. A member can access up to 30%[1] of its maximum drawable amount from the CMIM without an existing IMF program (also known as the IMF-delinked portion).

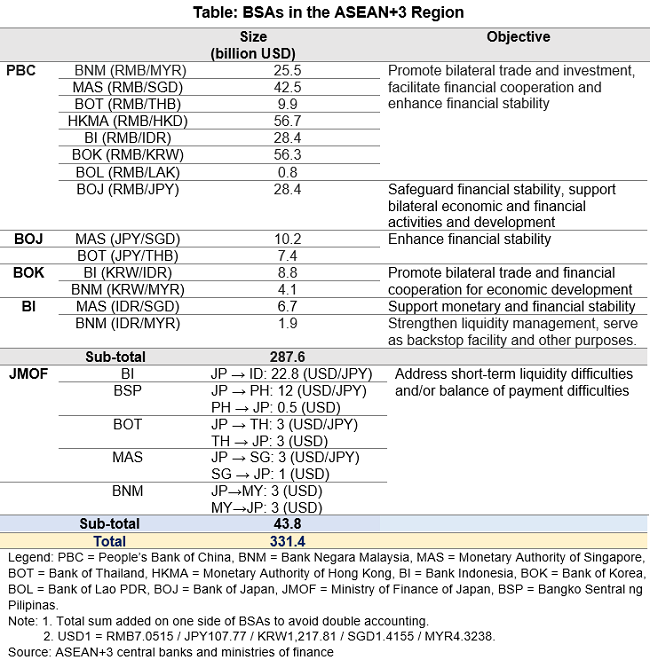

The regional BSA network is larger than the CMIM, albeit unevenly distributed. Most BSAs are either between China, Japan, Korea (known as the “Plus 3”) and the five largest ASEAN economies (ASEAN-5) or among ASEAN-5 economies. Smaller economies are not yet included in this network.

In terms of objective and currency, there are two types of BSAs in the region:

One: Address short-term liquidity difficulties and/ or BOP difficulties. BSAs in USD/ JPY between Japan’s Ministry of Finance (JMOF) and ASEAN-5 central banks belong to this category. These BSAs share similar objectives with the CMIM and are linked to CMIM arrangements. The activation of the total BSA amount requires the existence of an IMF-supported program. These BSAs amount to around USD44 billion.

Two: Promote local currency settlement in bilateral trade and investment, while in some cases, ensuring financial stability. These BSAs, which are in local currencies, amount to almost USD288 billion.

CMIM and BSAs: Two possible cooperation modalities

Given the large size of regional BSAs, it is worthwhile to explore possible collaboration between CMIM and BSAs. Dual arrangements of the CMIM and BSAs may address financing needs beyond the maximum amount available through the former.

In this context, we consider two scenarios for external shocks. First is a severe shock that needs assistance from the IMF and other international donors. In this case, the IMF will be the lead agency in its cooperation with the CMIM. There is little room for CMIM to collaborate with BSAs. Second is a mild shock where support from the CMIM’s IMF-delinked portion and BSAs alone will suffice. In this scenario, two cooperation modalities can be considered.

- Modality 1: CMIM support in conjunction with BSA activation. If the BSA request is in USD, it shares similar objectives with the CMIM, making it possible for the two mechanisms to potentially collaborate. In particular, the approval of BSA activation may depend on whether the requesting country is eligible for drawing CMIM’s IMF-delinked portion. If so, the requesting party can also unlock funding from the BSAs, which will augment the entire financing package.

- Modality 2: Close contact and information sharing with limited room for collaboration. When BSAs are activated in local currencies, the decision-making processes of BSAs and CMIM are separate. Although the objectives of CMIM and BSAs are not fully aligned, they still can maintain close contact and share relevant information while making decisions independently.

A smooth and effective collaboration between the CMIM and BSAs will allow ASEAN+3 economies to have access to a larger pool of emergency financing and strengthen the regional financial safety net in the long run.

[1] In 2020, ASEAN+3 members agreed to increase the CMIM’s IMF-delinked portion from 30% to 40%, which will come into force this year after the signing completes.