ASEAN+3 economies face a fiscal policy crossroads as they confront both external headwinds and domestic structural challenges. Heightened global uncertainty—driven by shifting US trade policies and rising geopolitical tensions—poses risk to regional growth prospects. At the same time, narrowing fiscal space and elevating debt servicing burdens underscore the impetus for continued fiscal consolidation.

Against this backdrop, policymakers in the region must strike a delicate balance between maintaining near-term fiscal flexibility and committing to long-term discipline. Agile and responsive fiscal management is essential to deploy temporary and targeted measures to cushion against external shocks. At the same time, sustained efforts toward medium-term fiscal consolidation are crucial to rebuilding buffers and addressing growing expenditure needs, particularly those associated with aging population and climate change-related demands.

Boosting growth and productivity through smarter structural reforms

Structural reforms are key to complementing fiscal consolidation efforts and unlocking long-term growth potential. Enhancing competition, streamlining regulations, and promoting technological adoption can significantly boost productivity and improve competitiveness. For economies facing aging demographic pressures, productivity gains will be vital to offset the adverse effects of shrinking labor force.

Stronger, more sustained growth not only supports fiscal consolidation by improving debt dynamics but also helps to ease the trade-offs between fiscal sustainability, inclusive growth, and long-term development. For example, labor and product market reforms can help offset some of the contractionary effects typically associated with fiscal consolidation.

However, structural reforms must also be designed to address potential downsides of the reforms. For instance, while AI adoption offers significant productivity and innovation gains— stimulating investment and job creation, it also poses risks of job displacement. To manage this trade-off, reform strategies must simultaneously promote AI readiness and safeguard vulnerable workers.

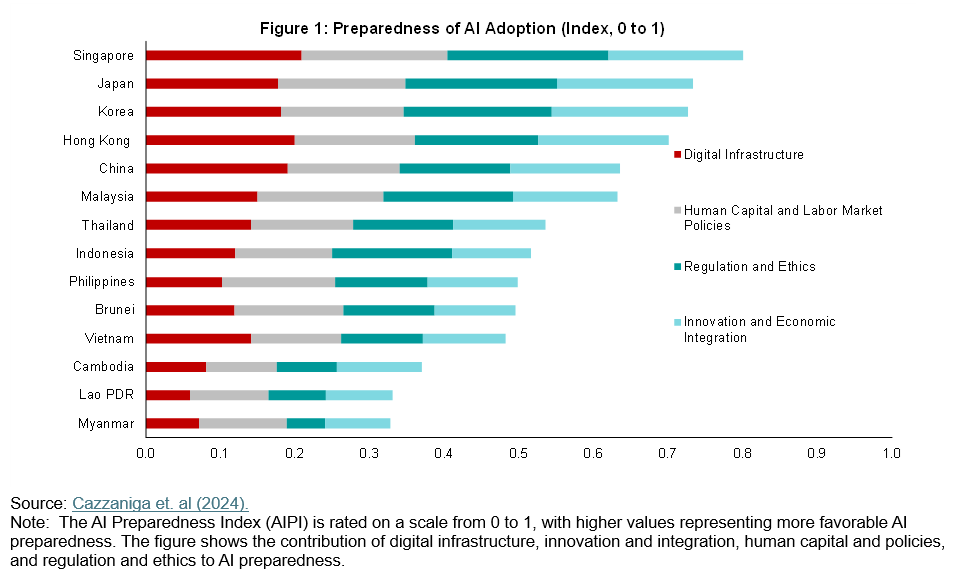

Economies better equipped for AI adoption should focus on enhancing regulatory frameworks, fostering innovation ecosystems, and promoting integration. Others may need to prioritize foundational investment in digital infrastructure and human capital (Figure 1).

Across all economies, active labor market policies—such as upskilling initiatives and workforce re-training—combined with stronger social protection systems, will be essential to support a smooth transition.

Enhancing revenue potential and spending efficiency

Higher and more resilient economic growth contributes to stronger revenue performance, lowering the fiscal cost of responding to future economic downturns through repeated counter-cyclical intervention. For instance, structural reforms aimed at increasing labor force participation, improving productivity, or streamlining regulatory frameworks can strengthen and broaden the sources of growth—thereby easing fiscal pressures.

Improving the efficiency of high-expenditure sectors is essential to contain spending growth in a more sustainable manner. For the ASEAN+3 economies facing rapid population aging, healthcare reform is particularly vital to rationalizing public healthcare expenditure.

Structural reforms in the healthcare sector, such as those targeting long-term care (LTC) and enhancing preventive care, would be beneficial to alleviate fiscal pressures from rising healthcare costs. One approach is to leverage digital healthcare records to better target those in need of LTC; another is to enhance preventive care to reduce future demand for more costly LTC services.

For example, Singapore’s Healthier SG program, launched in 2023, aims to transform the healthcare sector by focusing on preventive care and affordable primary care. By keeping the population healthier, the Singapore government aims to moderate the rising demand and costs associated with LTC services.

Robust fiscal institutions play a pivotal role

Improvements in fiscal transparency and institutions are particularly critical for successful fiscal consolidations among low-income economies, where weak fiscal institutions are often associated with higher corruption.

Moreover, a well-designed medium-term fiscal framework—anchored by realistic fiscal targets, clear rules, and transparent well-communicated implementation plan—can support consolidation efforts and strengthen public trust.

ASEAN+3 economies should complement fiscal adjustment with reforms to improve institutional capacity. Stronger fiscal institutions enable fiscal policymakers to develop credible consolidation strategies, assess fiscal risks transparently, and implement policies with greater flexibility and accountability. Clear and consistent communication of reform efforts is also key to fostering public understanding and support.

The time for reform is now

ASEAN+3 economies face dual challenges of maintaining short-term fiscal policy flexibility to respond to immediate risks while ensuring long-term fiscal sustainability. Advancing structural reforms and strengthening fiscal institutions are essential to building resilience, sustaining growth, and managing long-term fiscal risks. Timely action today will lay the foundation for a more stable and prosperous future.