This note was prepared for the Bo’ao Forum

2017 In Retrospect

Asian emerging market economies (EMEs) put up a sterling growth performance in 2017, benefiting from robust world trade growth amid a backdrop of relatively ample global liquidity and subdued global market volatility. Asia’s open, trade-dependent economies have been the largest beneficiaries of the global trade upcycle, reflecting the synchronized pick up in G3 demand (U.S., Eurozone and Japan), contributing to a more balanced growth between exports and domestic demand. Although economic activities have been picking up appreciably in the U.S. with labor market conditions gradually tightening, underlying inflation (measured by the core PCE inflation[1]) came in weaker-than-expected throughout most of 2017. The subdued inflation outlook prompted markets to price-in a more dovish outlook for Fed policy, rendering a weaker U.S. dollar performance. The lack of a major upside inflation surprise in the U.S. has helped to calm global markets, with volatility largely subdued and long term borrowing cost generally stable.[2]With still positive net liquidity injections by major global central banks (ECB and the BOJ), global financial conditions remain accommodative, helping to support continuing net capital inflows to Asian EMEs. Riding on the tailwinds from the robust export-led growth and an improving macroeconomic outlook, Asian EMEs saw a year of buoyant asset markets as well as exchange rate appreciation, ignoring the lingering geopolitical tensions.

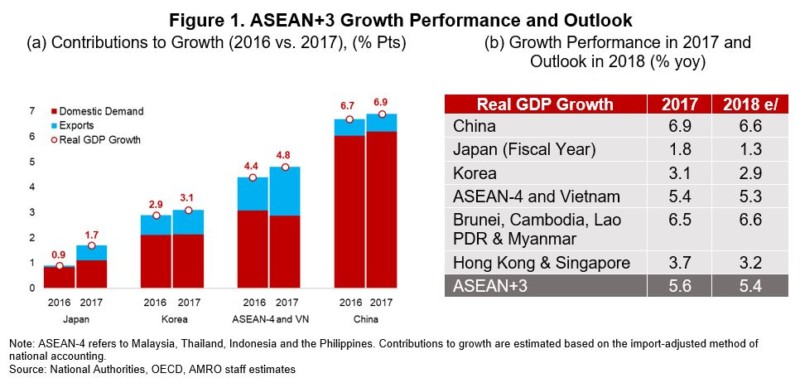

In the ASEAN+3 region, economic growth continued to be robust, with real GDP growth in 2017 growing by a stellar 5.6 percent, surpassing earlier expectations. The sustained growth performance reflects the resilient domestic demand, with added impetus from exports (Figure 1). Private consumption, in particular, continue to anchor regional growth, underpinned by stable labor markets, continuing wage/earnings growth, and the easing of household debt in some economies. The stronger-than-expected growth performance in the region was in tandem with an improvement in the external position, with robust external demand and rising global commodity prices helping to lift exports and hence, support regional current accounts. In some regional economies, the better growth outturn reflects to some extent, expansionary macroeconomic policies. On the financial side, regional equity markets outperformed relative to other EME peers in 2017, while foreign capital inflows, particularly, in the debt capital markets continued to be large, with net debt inflows[3] into ASEAN-4 and Korea amounting close to USD250 billion from January 2013 to December 2017. This partly reflects the region’s strong fundamentals and openness, which continue to attract foreign investors.

2018 – An Uneasy Global Backdrop

Unlike the generally smooth ride in 2017, concerns about escalating trade tensions and to some extent, rising inflation, particularly in the U.S., have sent global financial market volatility higher in H1 2018. Trade tensions began to heighten on 22 January 2018, when the U.S. announced global tariffs on washers and solar panels. Tensions escalated when the exemptions on U.S. tariffs on steel and aluminium imports from Canada, Mexico and the E.U. expired on 1 June 2018 without extension, attracting retaliatory tariffs from these countries on their U.S. imports. While the real sector impact is not immediately quantifiable, the mounting trade tensions between the U.S. and the rest of the world are already taking a toll on global markets alongside a sharp increase in volatility as investors fret over the outlook for consumer spending and corporate earnings. Exacerbating this volatility is the market jitters reflecting concerns about rising U.S. inflation, raising market expectations of further Fed rate hikes beyond the Fed’s forward guidance[4]. In late April 2018, the 10Y U.S. Treasury yields broke the 3 percent level for the first time since 2014, in a signal that market participants are pricing-in higher interest rates amid rising supply of U.S. Treasuries to meet spending needs. This is on the back of a robust U.S. economy, boosted by fiscal tax stimulus from the beginning of this year. Rising U.S. interest rates have also pulled up the U.S. dollar.

While Asian EMEs have benefited from foreign capital inflows, helping to ease the rebalancing from export-led to domestic-led demand growth, the region is susceptible to vulnerabilities from large capital flow reversal and the attendant volatility spikes, amplifying the risks to financial stability. Massive monetary policy stimulus by the U.S. and the Eurozone post-Global Financial Crisis in 2008/09 and the European Sovereign Debt Crisis in 2010, has contributed to an extended period of ultra low global interest rates amid unprecedented injection of global liquidity. Given the sluggish exports, the region shifted to domestic and intra-regional demand for sources of growth. The inflows of foreign capital facilitated the rebalancing process by keeping global monetary and financial conditions very easy, allowing the regional central banks to maintain accommodative monetary conditions. To manage the financial stability risks while reaping the benefits from capital inflows, policymakers in the region have been among the most active in the world in deploying macroprudential measures. However, going into 2018, in an environment where global interest rates are rising in earnest (with the risk of market expectations being frontloaded), the risk of capital flow reversal has increased in recent period. This is exacerbated by the possibility of withdrawal of quantitative easing by the ECB in 2019. The tightening global condition and risk aversion towards emerging markets could potentially complicate policy management for regional economies especially those which are in the late business cycle with emerging signs of inflation and external imbalance, or where domestic indebtedness is relatively high or the external position is relatively weak.

A. Equity and Bond Market Developments in Asian EMEs

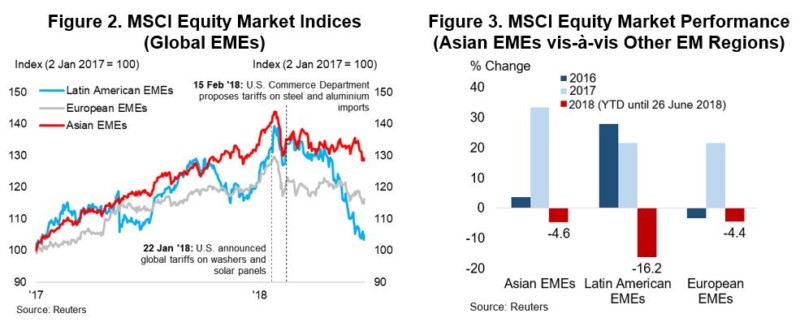

After a period of relative calm, global stock markets including in Asian EMEs[5], have tumbled since 15 February 2018, with the risk-on sentiment triggered not only by uncertainties posed by trade protectionist threats, but also driven by the tightening of global financial conditions and a strengthening U.S. dollar. Benchmark stock markets in Asian EMEs have been trending lower since 15 February 2018 – the day before the U.S. Commerce Department proposed tariffs on steel and aluminium, with the MSCI Asia ex-Japan stock price index shedding close to 5 percent (YTD until 22 June 2018). However, Asian EMEs fared much better in comparison with Latin American EMEs, which saw close to 22 percent drop in the stock market index (Figure 2, 3), led by a selloff in Argentinian equity market.[6]

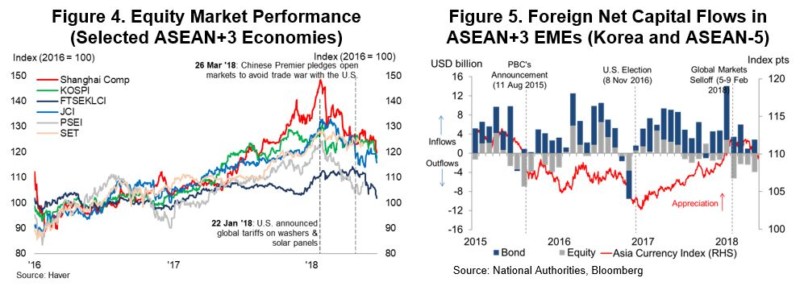

While markets continue to discriminate between Asian EMEs and other EMEs outside the region based on economic fundamentals, country-specific considerations have also warranted some degree of differentiation between EMEs in ASEAN+3. Since the Fed taper tantrum in May 2013, markets have become more discerning, and able to discriminate between EMEs based on their economic fundamentals. So far, the turmoil in emerging markets is concentrated in specific EM regions (such as Argentina in Latin American EMEs, and Turkey in European EMEs), and has not led to general contagion and capital flights across global EMEs. However, EMEs within the ASEAN+3 region do demonstrate some degree of differentiation, reflecting specific country risk factors and vulnerabilities. For instance, the Philippine stock price index has shed close to 20 percent since 15 February 2018, as the selloff by foreign investors reflects overheating risks and concerns over the current account outlook, given the sustained depreciation of the Philippine peso. China’s stock market in contrast, was weighed down by growing concerns over trade and investment tension with the U.S. [7], with the benchmark Shanghai Composite Index plunging to its lowest level in two years (Figure 4).

In contrast to equities, bond markets in Asian EMEs remain resilient, with continuing foreign capital inflows. Notwithstanding rising U.S. Treasury yields pulling up borrowing costs in ASEAN+3 EMEs (Korea and ASEAN-5[8]), foreign capital flows have remained positive, albeit at a smaller magnitude, as global financial conditions have not tightened excessively (Figure 5). This also suggests that despite the rising risk aversion, the region remains attractive to foreign investors given the sustained macroeconomic outlook.

B. Foreign Exchange (FX) Developments in Asian EMEs

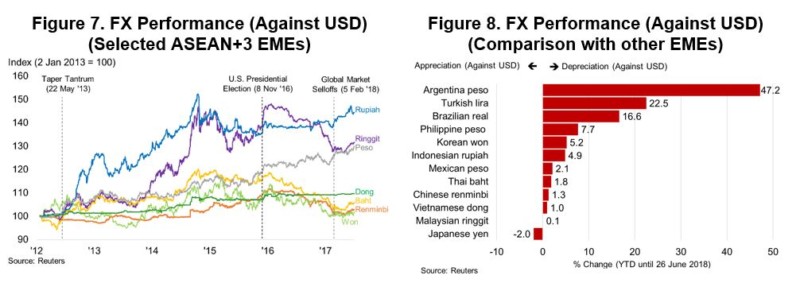

On the exchange rate front, the strong appreciation pressure of Asian currencies in 2017 have begun to unwind, with rising FX volatility in recent period. A maturing U.S. economy, and the potential return of the Phillips curve, have fuelled renewed focus on rising U.S. rates and sustained U.S. dollar strength given that the Fed has signalled the possibility of additional rate hikes this year. After the impressive gains in 2017[9], Asian currencies (against the U.S. dollar) are set on a depreciating and more volatile path in 2018, as foreign investors trimmed exposure to riskier assets given the less friendly global environment. Higher oil prices and rising U.S. Treasury yields continue to put pressure on the Indonesian rupiah and Philippine peso (and to some extent, the Indian rupee), as these economies are net oil importers, and suffer from twin deficits of fiscal budget and current account (Figure 7). The Korean won has weakened, reflecting the trade tension between China and the U.S., considering that Korea has strong trade linkages, as well as a large auto and technology sector. However, in comparison to other EME currencies outside the region (particularly the Argentine peso and the Turkish lira, Asian currencies continue to rank favorably (Figure 8).

C. Putting It All Together – Short Term Outlook and Policy Settings in Asian EMEs

The ongoing trade battles between U.S. and its major trading partners, with additional pressure from Fed policy and renewed U.S. dollar strength, are weighing on the short term macroeconomic outlook of Asian EMEs, while also posing significant policy challenges. An escalation of trade tensions will weigh on global trade and growth (including via supply-chain spillovers), which could be amplified by retaliatory measures. Preliminary estimates by AMRO suggest that the impact on ASEAN+3 GDP growth from a limited trade war scenario[10] would be significantly negative. The impact on the region’s economies would be transmitted mainly through the export channel given its openness to trade and the extensive trade linkages through the region’s supply chains. Likewise, the tariffs on steel and aluminium imports by the U.S. are also expected to affect a broad range of countries, including in Asia. The interactions between trade tensions and Fed policy could prompt a much more cautious investor stance, weighing on asset markets and capital flows into Asian EMEs. Throughout most of H1 2018 (and possibly in the period ahead), portfolio capital flows to Asian EMEs, as well as globally, have become considerably more volatile, posing significant policy challenges at a time when some Asian EMEs are facing overheating risks amid strong external headwinds.

Policymakers should be more vigilant and continue to build policy space to prepare for future risks. The policy mix of fiscal, monetary and macroprudential policies would depend on where each economy is currently in its business and credit cycle. Considering the benign domestic inflation, regional economies have largely kept monetary policy accommodative. While policy interest rates have been adjusted upwards and normalised in some regional economies, the monetary policy stance for the region still remains accommodative. While some Asian central banks have been able to resist tightening for now, the leeway to keep policy rates accommodative is narrowing, as global cyclical recovery firms up and inflation continue to edge higher. Regional economies that are growing robustly above potential and where output gaps are positive and inflationary pressures are building, may consider signalling a tighter monetary policy bias. Regional economies that are in late business cycles could consider a tightening monetary policy bias, in view rising inflationary pressure or widening external imbalance. Even though most regional economies are in early- to mid-business cycle, given the build-up of credit over the past years, the financial stability objective should be prioritized in the near future over economic growth, with monetary policy on a tightening bias. For some economies, monetary policy space may be constrained, given the impending tightening of global financial conditions, with possible shocks if global financial conditions were to tighten faster-than-expected. Where pockets of vulnerability have built up in sectors such as the property markets, maintaining or tightening macroprudential measures can help safeguard financial stability, and most regional economies have already tightened macroprudential measures proactively.

Policy will have to be calibrated taking into account constraints from domestic and external vulnerabilities such as debt, and degree of reliance on external financing. Economies in which financial vulnerabilities have built up, with high leverage or external debt, will face the sharpest trade-off in maintaining an accommodative monetary policy to support growth while maintaining financial stability, especially as global financial conditions tighten. Economies relying on capital markets to finance both the current account and the fiscal deficits (“twin deficits”) may face financing constraints when trying to maintain an easy monetary policy or an expansionary fiscal policy. However, the scope for more active use of fiscal policy is subject to available fiscal space, which has generally narrowed. Fiscal expenditure should be reprioritised to support structural reform to build future economic capacity.

—

[1]The core personal consumption expenditure (PCE) inflation is the preferred measure by the U.S. Fed in gauging underlying price developments.

[2] Developments in long term borrowing costs are proxied by the 10-year U.S. Treasury yields, averaging 2 percent level in 2017.

[3] Foreign capital inflows in the debt markets are mainly in sovereign debt instruments.

[4] An escalation of global trade tensions continues to be a risk weighing on global and regional growth performance, as highlighted in the AREO 2018 by AMRO. The near term risks could be mutually reinforcing, reflecting the interaction of one or more risk events materializing. For instance, the escalation of global trade tensions triggered by the imposition of tariffs by the U.S. could interact with the faster-than-expected tightening in global financial conditions, and/or escalation of geopolitical risks in the region.

[5] Based on MSCI classification, where Asian EMEs refer to China, Korea, Malaysia, Thailand, Indonesia, the Philippines, Taiwan Province of China, India, Pakistan, Hong Kong China, and Singapore.

[6] Argentina has been identified by markets as being more vulnerable to rising borrowing cost and appreciating U.S. dollar, given the large twin deficits (current account and fiscal deficits).

[7] The U.S. House of Representative passed a bill on 25 June 2018, to allow the Committee on Foreign Investment in the United States (CFIUS) to expand its reviews to minority stakes in U.S. companies. It also puts a focus on investments that may expose sensitive data about Americans to foreign governments or reveal information about critical infrastructure, like the telecommunications network.

[8] ASEAN-5 refers to Malaysia, Thailand, Indonesia, the Philippines and Vietnam.

[9] The Bloomberg JP Morgan Asia Dollar Index, which measures 10 of the region’s currencies against the greenback, climbed 6.7 percent in 2017, the biggest annual advance in data that started in 1994.

[10] See Box B – The Winds of (a Trade) War, AREO 2018.