Singapore’s economy showed resilience in 2024, with growth accelerating to 4.4 percent on the back of a strong upturn in electronics exports and robust domestic demand. However, growth is expected to decline to a more sustainable rate of 2.7 percent in 2025 amid mounting challenges from an increasingly uncertain global environment.

Of particular concern is the aggressive protectionist policies of the new US administration, which could significantly impact a highly open economy like Singapore. For a city-state that has built its success on global connectivity and trade, these developments demand careful navigation of both risks and opportunities.

Singapore’s current economic resilience provides important buffers against these challenges, supported by strong policy frameworks and economic fundamentals. However, this period of external uncertainty comes at a time when Singapore is managing significant economic transitions, from persistent labor market pressures to structural economic reforms.

The labor market remains tight, especially for skilled labor despite moderate employment growth following the reopening of the foreign workers market post-pandemic. Strategic programs like SkillsFuture are crucial in addressing these skill mismatches and ensuring workforce adaptability.

Singapore’s manufacturing sector is showing clear signs of recovery, led by a rebound in the semiconductor industry. After contracting by 4.2 percent in 2023, the manufacturing sector turned around in 2024, buoyed by an upswing in the global electronics cycle. This rebound is particularly significant given that semiconductors account for nearly 40 percent of Singapore’s manufacturing output and contribute to 7 percent of GDP.

The services sector is also resilient, particularly in tourism, following the visa-free arrangement with China. Transportation services, however, remain affected by weaker trade activity.

On the domestic front, Singapore is managing a delicate balance between growth and inflation. While headline inflation has moderated to 1.2 percent as of January, the upside risk for inflation remains a concern. Past high inflation and the risk of resurgent inflation are affecting business decisions, even as the economy undergoes structural transitions, while overall policy stance is cautiously optimistic on inflation outlook.

Innovative approaches, such as the Future Energy Fund which allocates S$5 billion for critical energy infrastructure, reflect Singapore’s commitment to long-term sustainability. Strategic initiatives like the Johor-Singapore Special Economic Zone represent innovative solutions to addressing land and labor constraints, while programs like SkillsFuture aim to ensure workforce adaptability.

However, these domestic adjustments are taking place amid increasing global trade uncertainty, with potential disruptions from protectionist policies and geopolitical tensions threatening to reshape traditional trade and investment patterns. As trade patterns shift and supply chains evolve, maintaining Singapore’s position as a key Asian financial and trade hub has become increasingly complex. The effectiveness of policy responses will be crucial in balancing external and internal challenges.

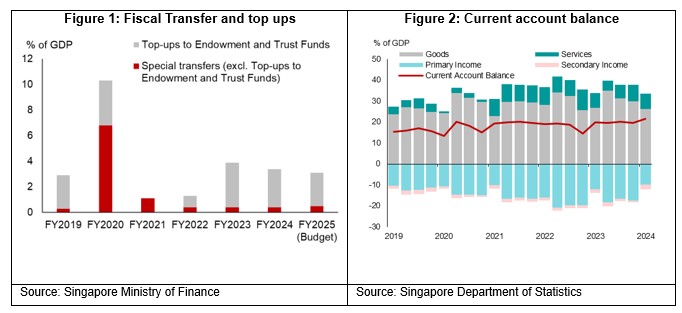

In 2025, Singapore policymakers face the critical task of navigating heightened global uncertainties. The combination of a tight but flexible monetary stance and a prudent fiscal position should provide flexibility for macroeconomic policy to respond to future external shocks (Figure 1). The banking sector remains well-capitalized with low non-performing loan (NPL) ratio at 1.3 percent, while international reserves are ample. Foreign direct investment (FDI) inflows reached a historic high of 31.8 percent of GDP in 2023.

These strong fundamentals, combined with the gradual recovery in commercial bank lending and stable housing market, suggest Singapore’s financial system is well-prepared for potential turbulence.

While the growth forecast of 2.7 percent for 2025 reflects continued resilience, Singapore faces multiple challenges that require careful policy calibration. As Singapore faces an increasingly fragmented global economy in 2025, its demonstrated resilience and adaptive policy framework will be essential in maintaining its position as a trusted global financial and business hub while securing domestic economic stability.

By leveraging its strong fundamentals and innovative policies, Singapore has the opportunity not just to weather the storm but to emerge stronger as a leader in sustainable and inclusive growth.