When Bank Negara Malaysia (BNM) started raising the Overnight Policy Rate (OPR) in May 2022 to contain inflation, the subsequent sharp increase in the KLIBOR had sparked market concerns about a potential over-tightening in the interbank market.

Over the next 18 months since then, BNM has raised the OPR by 125 basis points (bps), allowing the OPR to return to the pre-pandemic level. For the market today, the question is then “have liquidity conditions returned to normal?”.

Decoding the spike in KLIBOR-OPR spread in 2022

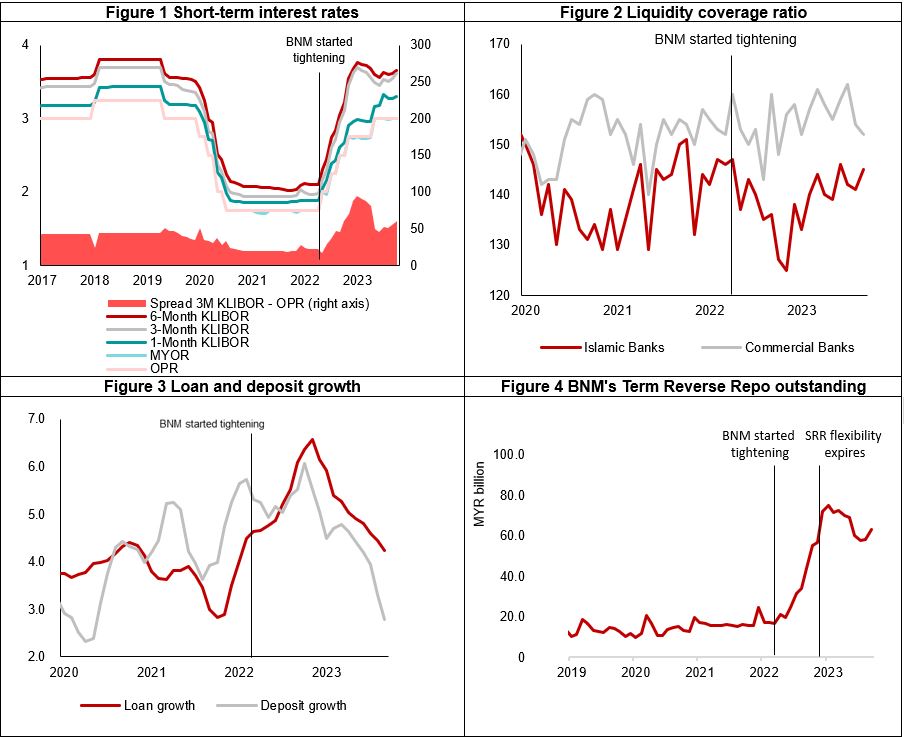

First, let’s recap what happened in Malaysia’s interbank market in 2022, when BNM started raising the OPR. The KLIBOR rates for three to six months rose sharply, showing a tightening of interbank liquidity conditions at these tenors (Figure 1). Between April and December 2022, the three-month KLIBOR surged 164 bps, while the OPR rose by only 100 bps. The spread between three-month KLIBOR and OPR widened to a peak of 94 bps in January 2023, the largest spread ever recorded and more than quadrupled that of a year earlier.

To understand what drove the demand for interbank funding higher and sent the KLIBOR surging, we look at the shifts in banking sector’s balance sheets that took place during the latter half of 2022, amid improving economic conditions and expectations of higher interest rates.

The first is on the deposit side. Anticipating higher interest rates, some interest-sensitive depositors, especially institutional ones, shortened the maturities of their term deposit placements. The higher share of short-term deposits led to the rise in the expected cash outflows which triggered a deterioration in banks’ Liquidity Coverage Ratio (LCR). The shift was most prominent among banks with a large reliance on interest-sensitive wholesale deposits, such as Islamic banks. The average LCR for Islamic banks fell from 144 percent at end-2021 to 125 percent by November 2022 (Figure 2). Meanwhile, the average LCR of commercial banks also fell, but to a lesser extent.

Although their LCR remained well above the regulatory requirement of 100 percent, banks sought to restore the ratio pre-emptively to curb any potential investor concerns. One way to do so was by borrowing term funding from the interbank market, which put upward pressures on the 3-month and 6-month KLIBOR.

Additional funding needs came from the expansion in loan demand. When the pandemic-related travel restrictions were relaxed and economic activities rebounded, loan growth started to accelerate from decade-low levels and began outpacing deposit growth for the first time since mid-2020 (Figure 3).

A rebound in loan growth meant that banks needed more liquidity to finance them. Such demand for liquidity can be observed from the rising loans-to-deposits ratio and the falling liquid-asset-to-total-asset ratio during the second half of 2022. To boost liquidity in anticipation of faster loan growth, banks turned first to interbank borrowing, where they can obtain funding much faster than raising deposits.

Finally, the expiration of the Statutory Reserve Requirement (SRR) flexibility added more pressures to the KLIBOR at year-end. Part of a COVID-era regulatory relief, the so-called SRR flexibility rule allowed banks to temporarily use Malaysian Government Securities (MGS) and Malaysia Government Investment Issues (MGII) to meet SRR in place of cash. When the rule expired in December 2022, banks had to obtain extra cash to meet the stricter SRR, which added stress to the interbank market at year-end and in January 2023.

Interbank funding conditions today

The KLIBOR-OPR spread revealed that funding conditions for banks have been returning gradually to the normal level. After peaking at 94 percent in January 2023, the spread has narrowed to 60 bps in October 2023, slightly above the pre-COVID average of around 45 bps.

The most obvious explanation for the improvement is that Malaysia is now approaching the end of the post-pandemic normalization phase that drove up banks’ demand for funding. Currently at 3 percent, the OPR is expected to be near its peak, with inflation moderating. Similarly, credit growth has passed its peak and softened to 4.2 percent in September 2023.

However, also critical to the improvements were the ample and prompt liquidity provisions by the BNM. In response to signs of an interbank market tightness, the central bank supplied more liquidity to meet banks’ demand through open market operations. For example, the outstanding lending via the Term Reverse Repo tripled from 21 MYR billion in April 2022 to 63 MYR billion in December 2022 (Figure 4). In addition to the Term Reverse Repo, BNM also used foreign currency swaps to supply additional liquidity.

Banks have also boosted their liquidity positions by raising term deposits over time. The outstanding term deposits in the banking system expanded in 2023, thanks to the attractive rates and the recovery in investors’ appetite as the hiking cycle matures. BNM’s liquidity provision and the expansion in term deposits helped banks meet their liquidity needs during this normalization period.

Although the interbank market conditions have improved, it would be wise for all parties to remain vigilant in case of a possible tightening in the coming months. There is still a possibility of further OPR increases in 2024 if upside risks to inflation, such as the cuts in price subsidies or higher global commodity prices, were to materialize. Such policy rate uncertainties could prompt another round of interbank market tightness. In addition, seasonal year-end funding demand may add temporary pressures to the market.

The BNM has been vigilant and should continue to monitor the interbank market funding conditions and ensure sufficient liquidity buffers to withstand potential shifts in demand. Finally, it should also make repo market development a key priority. A more liquid and accessible repo market will allow banks to meet their liquidity needs in an efficient way, and reduce reliance on central bank support.