Lao PDR’s challenging macroeconomic environment demands bold and decisive policy actions. Over the past three years, the sharp depreciation of the Lao kip has fuelled soaring inflation and created a shortage of foreign currency in the domestic market. In response, the Bank of the Lao PDR (BOL) announced regulations in March 2024, requiring exporters to repatriate and convert a portion of their foreign earnings into the kip. These measures mark a critical step in BOL’s efforts to boost foreign currency liquidity and strengthen international reserves. However, as AMRO’s analysis reveals, the road ahead remains uncertain and challenging.

Rising import bills and a struggling kip

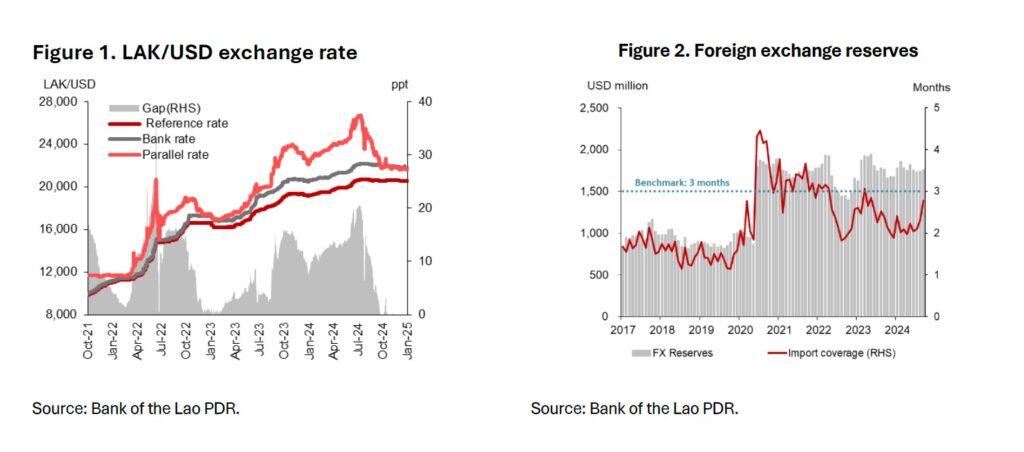

Lao PDR is facing a series of economic challenges. Chronic fiscal deficits, primarily financed through foreign borrowing, had fuelled an increase in external debt. The COVID-19 pandemic hit tourism revenues hard, adding to growing vulnerabilities. In February 2022, the onset of the Russia-Ukraine conflict caused a surge in global food and energy prices, driving up import bills and exerting downward pressure on the kip (Figure 1).

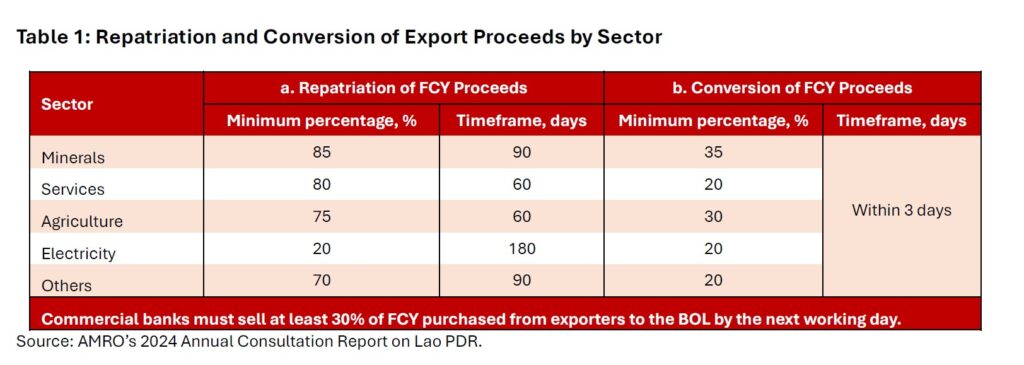

A rapid expansion of the monetary base has also exacerbated the depreciation of the currency. As a result, the Lao kip has lost half its value since 2022. Inflation soared to a staggering 31 percent in 2023, far exceeding the average of 3.0 percent in the preceding five years. By the end of 2023, BOL’s foreign exchange reserves stood at USD1.67 billion, covering only 2.3 months of the country’s total imports (Figure 2).

This rapid depreciation has worsened Lao PDR’s external debt burden, further straining fragile government finances. With limited foreign exchange in the domestic market, thin foreign reserves buffer and persistent currency depreciation, the risks of a self-reinforcing cycle have grown.

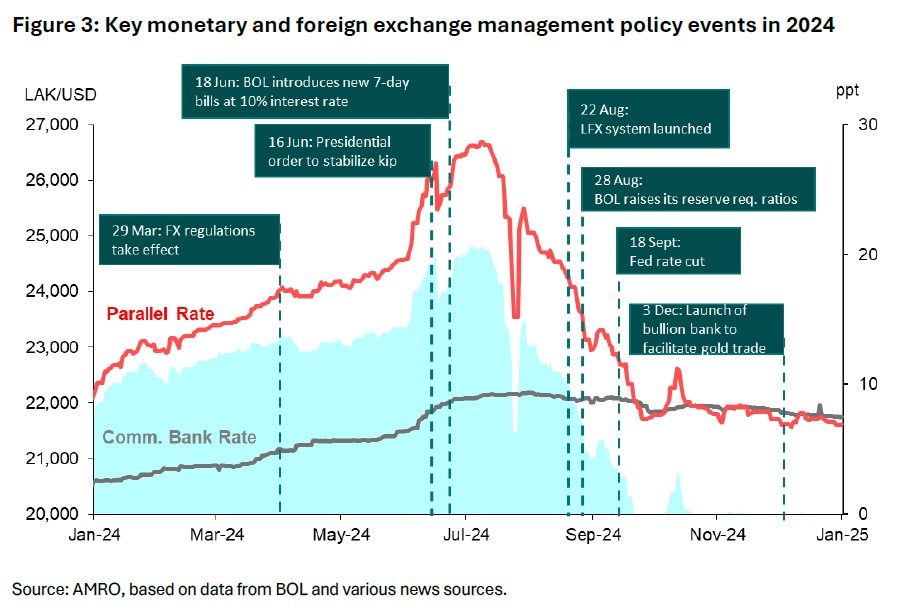

In this context, BOL’s March 2024 regulations aim to increase the availability of foreign currency onshore, stabilize the kip, curb inflation, and address the country’s external debt obligations. Under the new rules, exporters are required to repatriate and convert varying percentages of their foreign currency earnings based on sector (Table 1). For example, mineral exporters must repatriate as much as 85 percent of their proceeds and convert 35 percent into kip within three days. Additionally, commercial banks must sell at least 30 percent of the foreign currency purchased from exporters to BOL. To ensure compliance, BOL is developing a real-time monitoring system that links businesses, banks, and the relevant ministries.

These foreign currency management measures align with practices adopted by other ASEAN economies during periods of financial market turbulence and large capital outflows. For example, Indonesia, Malaysia and Thailand implemented similar foreign exchange and capital flow management policies, including mandatory repatriation and surrender requirements, to support their domestic currencies and strengthen their reserves positions when faced with severe external shocks in the past. Many of these measures were eventually scaled back or removed as financial conditions stabilized and reserves were rebuilt.

Progress and remaining challenges

While the new regulations reflect the urgency of addressing Lao PDR’s macroeconomic vulnerabilities, they also introduce risks and policy challenges. A major concern is the potential negative impact on investor sentiment, as businesses may fear limited access to foreign exchange for their operational needs. On top of misreporting possibilities, monitoring compliance could also impose significant administrative and operational burdens on both the government and businesses, potentially leading to inefficiencies and higher costs.

Despite these challenges, the regulations have shown early signs of success (Figure 3). BOL recently reported that the share of repatriated export proceeds increased to over 70 percent in 2024 from 55 percent in 2023. Other key policy actions include the tightening of monetary policy and the launch of the Lao Forex Exchange (LFX) platform, a bank-supported foreign exchange trading system. These measures have contributed to a USD200 million increase in foreign exchange reserves, which reached USD1.9 billion as of November 2024. The kip has also strengthened by over 20 percent in the parallel market, and the gap with the commercial bank exchange rate has virtually closed.

However, Lao PDR’s external position remains vulnerable. Further progress is needed to put the economy on a stronger and more sustainable path. Past country experiences have demonstrated the need for effective foreign exchange management policies during periods of adverse market pressures. These measures can improve domestic foreign currency liquidity and prevent a full-blown crisis. However, they must be implemented carefully, with clear communication and regular policy dialogues with all stakeholders. Importantly, these policy tools should be treated as temporary measures, not long-term solutions. To achieve lasting macroeconomic stability, Lao PDR must continue to strengthen its balance of payments, attract new investments, and diversify its sources of foreign currency income.