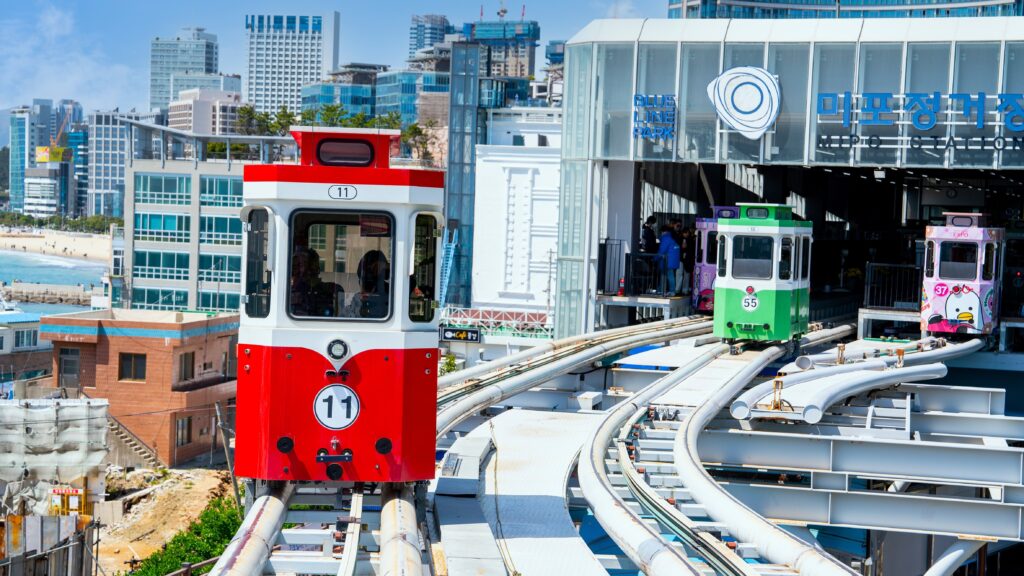

Image: Supavadee butradee / Shutterstock.com

SINGAPORE, December 27, 2023 – Korea’s near-term growth outlook is expected to continue improving, reflecting the upturn in manufacturing exports, especially semiconductors. To bring down headline inflation to the 2 percent target level and safeguard economic recovery while preserving financial stability amid significant headwinds, the Korean authorities should maintain its tight monetary policy stance and prudent fiscal policy while keeping adequately tight macroprudential measures. This is according to the preliminary assessment by the ASEAN+3 Macroeconomic Research Office (AMRO) after its Annual Consultation Visit to Korea from December 7-20, 2023.

The AMRO team was led by Lead Economist, Kevin Cheng, while AMRO Director, Kouqing Li, and Chief Economist, Hoe Ee Khor participated in the policy meetings. The discussions focused on recent economic developments and outlook, risks and vulnerabilities, and policy response.

Economic developments and outlook

“After growing at a moderate 1.3 percent in 2023, the Korean economy is expected to rebound by 2.3 percent in 2024 supported by a strong recovery in manufacturing exports,” said Dr. Cheng. “As inflation remains elevated, monetary and fiscal policies should continue to be tight to bring inflation back to the 2 percent target and safeguard financial stability.”

Real GDP growth is expected to improve in the second half of 2023 thanks to the recovery of exports, particularly in semiconductors, while private consumption and facility investments are expected to remain subdued.

Headline inflation is expected to resume the downward trend toward the 2-percent target in 2024 after rebounding to above 3.0 percent in the last few months of 2023 on account of higher commodity and food prices. Core inflation, the main driver of overall inflation in 2023, is expected to continue its steady decline. Moderate wage growth despite the tight labor market and declining short-term inflation expectations have helped limit the second-round effects of inflation.

The external sector remains resilient with recovering current account balances and ample reserves. The current account has turned to a surplus position while the financial account shows reduced net outflows due to a fall in outward investments caused by prolonged high interest rates, concerns over global economic slowdown, and high volatility in FX markets. Foreign reserves remain ample at US417 billion, covering about 6.5 months’ worth of imports and 2.9 times of short-term external debt.

Risks and vulnerabilities

The near-term economic outlook remains significantly uncertain. Key short-term risk factors include persistently high inflation leading to higher for longer interest rates, sharper economic slowdown in the U.S. and Europe, limited spillover effects from China’s recovery, and financial distress in the project finance market.

Over the medium term, geopolitical tensions could intensify leading to disruptions in manufacturing activities and weakening investment sentiment. In addition, the high level of household debt continues to pose a vulnerability in the financial system.

In the long term, the ongoing upward trend in government debt could raise concerns about fiscal sustainability. An aging labor force due to a low fertility rate and higher longevity will be a drag on potential growth.

Policy recommendations

While the current restrictive monetary policy stance should remain until inflation declines further and stabilizes at the target level of 2.0 percent, the conduct of monetary policy should continue to be data dependent hinging on the pace of disinflation. The Bank of Korea should remain vigilant and stand ready to recalibrate its monetary policy in a volatile environment, with multiple and complex risks for the economic outlook, both externally and domestically.

Amid high interest rates, the authorities should continue to safeguard financial stability. Credit support measures for small and medium enterprises and sole proprietors should be temporary and targeted. Macroprudential measures should play a role to further stabilize the housing market while additional policies can be considered to contain household indebtedness. Looking at the future development of the financial market, the temporary regulatory support to strengthen financial buffers and restore normal market functioning should be gradually unwound.

Continued fiscal consolidation in line with economic recovery in 2024 is deemed appropriate. The fiscal balance in 2023 has improved, albeit less than budgeted due to a sizeable revenue shortfall. Over the medium to long term, ensuring fiscal sustainability is paramount. A strong commitment, signaled by the legislation of a well-designed fiscal rule, will significantly enhance the credibility of fiscal policy and mitigate concerns about fiscal sustainability.

The authorities are encouraged to continue fostering innovation, human resource development, and strengthening supply chain resilience to secure long-term growth. At the same time, they should address the challenging demographic dynamics with comprehensive and proactive policies and enhance the efforts to achieve carbon neutrality.

AMRO would like to express its appreciation to the Korean authorities and other meeting counterparts for their open and constructive discussions.

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute toward securing macroeconomic and financial resilience and stability of the ASEAN+3 region, comprising 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support regional financial arrangements, and provide technical assistance to the members. In addition, AMRO also serves as a regional knowledge hub and provides support to ASEAN+3 financial cooperation.

AMRO Director, Kouqing Li and Chief Economist, Hoe Ee Khor met with the Korea Ministry of Economy and Finance Deputy Minister, Jiyoung Choi (fifth from right, second row) and Deputy Director General, Jisung Moon (fourth from right, second row).

AMRO Director, Kouqing Li and Chief Economist, Hoe Ee Khor met with the Bank of Korea Deputy Governor, Jwahong Min (third from right, front row).