Image: Kristi Blokhin / Shutterstock.com

SINGAPORE, November 17, 2023 – The Japanese economy has recovered well from the pandemic, driven by strong investment and resilient consumption. Consumer price inflation has moderated but remained relatively high mainly due to underlying pressures that have proven to be more persistent than anticipated. The confluence of robust economic growth and persistent inflation of well above 2 percent could potentially lead to a sustained rise in wages and a wage-price cycle of high inflation. At this crucial juncture, it is imperative to implement timely policy adjustments to manage such an increasing risk of high inflation and provide effective communication regarding the future path of monetary policy. For fiscal policy, emphasis should be on fiscal prudence as the large-scale fiscal stimulus in the past three years has pushed up the public debt to historical levels.

This preliminary assessment was made by the ASEAN+3 Macroeconomic Research Office (AMRO) after its Annual Consultation Visit to Japan from October 24 to November 8, 2023.

The mission was led by AMRO Lead Economist, Jae Young Lee. AMRO Director, Kouqing Li and Chief Economist, Hoe Ee Khor participated in the policy discussions. The talks focused on Japan’s economic recovery, persistence of inflationary pressures, appropriateness of fiscal monetary policy mix, reform of monetary policy framework, fiscal consolidation, and structural reforms to enhance labor productivity, digitalization and green transformation.

Economic developments and outlook

“The Japanese economy is projected to grow by 1.9 percent in 2023 and 1.1 percent in 2024,” said Dr. Lee. “Despite high inflation, the improvement in business sentiment and the high profitability of Japanese firms, coupled with resilient consumption, are anticipated to bolster growth for the rest of the year. Although growth is expected to moderate in 2024, investment will remain strong, reflecting ongoing efforts toward digitalization, labor-saving technologies, and investments in strategic sectors.”

Consumer price inflation has remained high in 2023, with CPI (excluding fresh food) inflation at 2.8 percent (yoy) in September 2023, albeit moderating from its peak of 4.2 percent in January, due mainly to a decrease in energy prices. Looking ahead, although CPI (excluding fresh food) inflation is decreasing, it is expected to remain elevated at 3.1 percent in 2023 and at 2.6 percent in 2024.

Japan’s external position has stayed strong, supported by a large primary income surplus and a steadily narrowing trade deficit. In 2022, the current account posted a surplus of 2.1 percent of GDP. In H1 2023, the current account surplus rose to 2.8 percent of GDP, as the trade deficit narrowed. The current account surplus is projected to steadily increase to 2.8 percent and 3.2 percent of GDP in 2023 and 2024, respectively, due to the narrowing of the trade and service deficit, while the primary income surplus remains sizable.

Credit growth has remained stable despite the termination of most pandemic-related financial relief measures, with bank lending expanding by over 3 percent (yoy) in the first nine months of 2023, a rate higher than the pre-pandemic 2-3 percent level.

Strong tax revenue growth has played a key role in reducing the fiscal deficit from 5.9 percent of GDP in FY2021 to 4.9 percent of GDP in FY2022. Looking ahead to FY2023, the fiscal deficit is estimated to fall to 3.6 percent of GDP as government expenditure is projected to decline with the termination of COVID-19 related measures. However, the anticipated improvement could potentially be set back by the recently announced economic stimulus package valued at JPY17 trillion.

Risk, vulnerabilities, and challenges

Key risks to Japan’s economy in the short term stem mainly from the external sector, including a spike in global commodity prices as a result of geopolitical events and a sharp slowdown in major global economies. The central role of trade and deep integration of Japan in the global supply chains also make the economy vulnerable to deepening economic fragmentation over the medium-to-long term. However, the risks are balanced by opportunities that could offset some of the adverse effects.

On the domestic front, a potential risk in the short term is a resurgence in inflation well above the central bank’s 2 percent target, which may require sharp monetary tightening with potentially adverse consequences. Meanwhile, other longer term vulnerabilities and challenges stemming from domestic sources include weakening fiscal discipline, side effects of prolonged monetary easing, and the demographic drag caused by population aging and low fertility rates, including its impact on the future profitability of regional banks.

Policy recommendations

In light of the uncertainties surrounding Japan’s inflation outlook, particularly over wage growth and commodity prices, the BOJ’s current accommodative monetary policy stance remains appropriate for now. Given the increasing risk of high inflation becoming entrenched, the BOJ should implement timely policy adjustments to manage the risk. Due to the complexity of its monetary policy framework, effective communication by the BOJ can help guide market expectations and contain market volatilities.

The yield curve control (YCC) policy should be phased out to allow long-term interest rates to align more closely with market fundamentals, while maintaining policy flexibility to address potential future economic shocks. The BOJ may need to consider moving away from the negative interest rate policy to allow the short-term policy rate to play its traditional role in managing inflation and anchoring inflationary expectation once sustainable and sustained achievement of price stability target comes in sight.

The BOJ’s ongoing comprehensive review of the monetary policy should provide guidance for policymakers to conduct monetary policy so that it can play a more effective role in managing inflation in the post-pandemic era.

Financial regulators need to closely supervise financial institutions to ensure their financial soundness. Financial policy and measures should continue to encourage banks to adapt to the rapidly changing environment to improve their efficiency and profits.

With the shock from the pandemic fading and the economy exhibiting steady trend growth, there is no longer a need for economic stimulus policies. In this regard, the impending supplementary budget and tax cuts proposed by the government to boost the economy is risky as it may keep inflation elevated, and also set back fiscal consolidation efforts. Fiscal policy should refocus on the pre-pandemic fiscal consolidation plan to achieve a primary surplus in the medium term. The establishment of an independent fiscal institution (IFI) that can provide objective analysis and long-term projections of government debt is recommended.

To enhance the long-term growth potential of the economy, the government should continue to promote strategic sectors, revitalize regional economies, and strengthen research and development. This is essential to ensure economic resilience and support the government’s fiscal consolidation plan through a virtuous cycle of economic growth and higher revenues.

Japan has embarked on ambitious policies and initiatives to achieve net-zero greenhouse emissions by 2050, aligning itself with global climate change goals. Japan will need to make steady progress along this plan, while carefully considering the fiscal implications of large investments against offsetting revenue measures such as a carbon tax.

The AMRO team would like to express its gratitude to the Japanese authorities and other participating organizations for their cooperation and candid exchange of views. AMRO wishes to express its appreciation for the strong support from the authorities and the excellent arrangement that has made this mission possible.

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute toward securing macroeconomic and financial resilience and stability of the ASEAN+3 region, comprising 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support regional financial arrangements, and provide technical assistance to the members. In addition, AMRO also serves as a regional knowledge hub and provides support to ASEAN+3 financial cooperation.

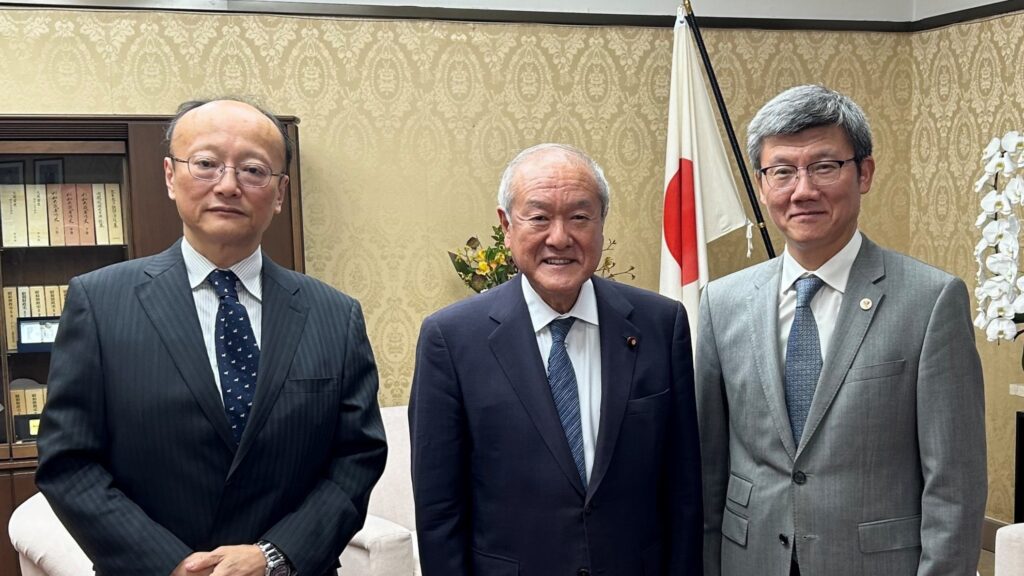

AMRO Director, Kouqing Li (right), met with Minister of Finance of Japan, Shunichi Suzuki (middle), and Vice Minister of Finance, Masato Kanda (left).