Faced with a confluence of structural challenges, the Thai economy is likely to experience continued decline in its long-term trend growth, trailing behind regional peers. Against this backdrop, it is critical that priority be given to growth-enhancing investments in human capital, infrastructure, and strategic industries rather than direct broad-based cash handouts to citizens.

Thailand’s economic growth has fallen short of expectations in the last few years, averaging 2.2 percent in 2022-2023, well below pre-pandemic levels and lagging most regional peers. To revive growth momentum, the government plans to introduce the Digital Wallet Scheme, a 500-billion-baht (approximately 3 percent of GDP) initiative that involves distributing 10,000 baht (around $275) to 50 million citizens. The handouts are expected to begin around the fourth quarter of 2024.

However, caution should be exercised when using short-term cash handouts to stimulate a sluggish growth as it is akin to alleviating the symptoms of an illness without addressing its underlying causes.

While Thailand’s slow growth in recent years is partly due to transitory factors that may warrant counter-cyclical policy measures, these growth numbers reflect a more daunting challenge: a persistent decline in long-term trend growth.

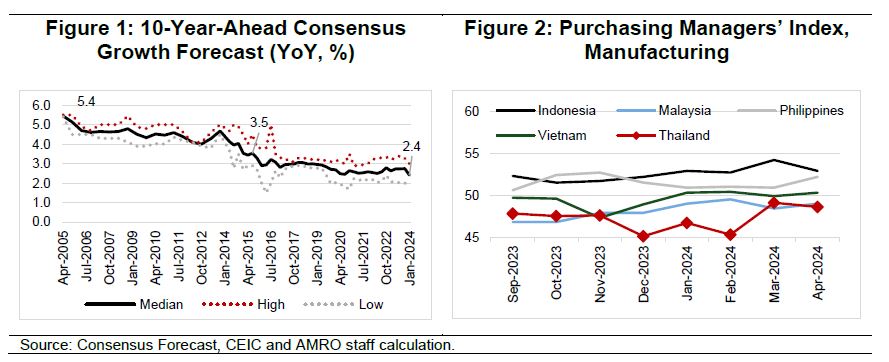

The long-term growth expectation for Thailand has been declining over the years. The consensus forecast for Thailand’s 10-year-ahead growth rate is about 2.4 percent, less than half of what it was 20 years ago (Figure 1), and well below the average of about 4 percent among ASEAN countries. This suggests that the current subpar growth figures are likely to be underscored by more pressing structural headwinds.

The manufacturing sector’s protracted weakness, for instance, has been a major drag on Thailand’s growth momentum. Manufacturing production in Thailand has contracted over the past six quarters due to both cyclical factors (i.e. weak exports and inventory drawdown) and structural shifts in the global demand for manufacturing products.

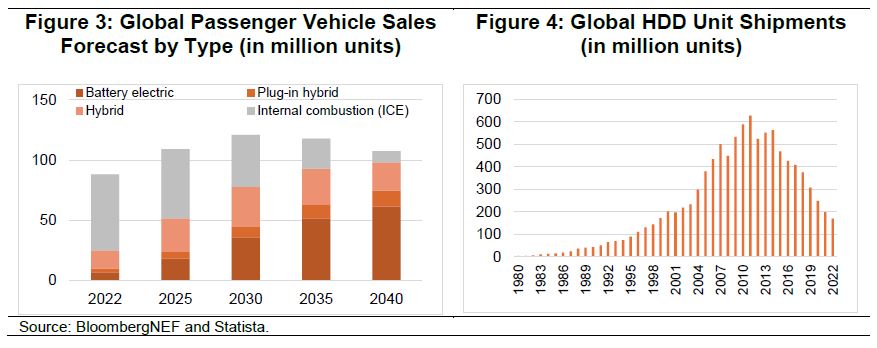

Many goods in which Thailand has a comparative advantage, such as hardware disks and internal combustion engine vehicles, are facing a structural decline in global demand (Figures 3 and 4). Consequently, Thailand’s response to the recent global trade recovery in manufacturing, especially for high-tech and renewable energy products, has been sluggish relative to regional peers (Figure 2).

The Digital Wallet Scheme does little to address these supply-side weaknesses. Furthermore, the substantial public funds allocated to the scheme will increase the debt burden and limit the government’s capacity to address future economic shocks.

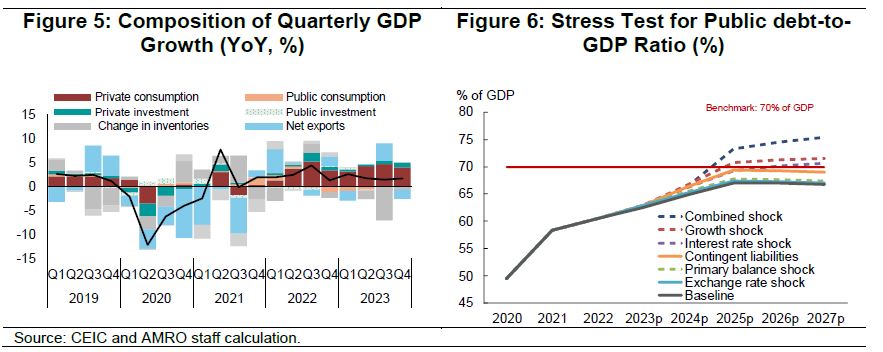

The scheme is projected to widen the fiscal deficit to 4.4 percent of GDP in FY2025, marking a record-high deficit except during the pandemic. It will push public debt to 67 percent of GDP by FY2026, nearing the 70 percent debt ceiling set by the government and the prudent international debt threshold for emerging markets. Stress tests suggest that shocks to real GDP growth or borrowing costs could push the debt ratio well beyond this ceiling (Figure 6).

The scheme’s expected short-term growth boost is uncertain. The fiscal multiplier may be limited as the scheme’s funding from FY2024-2025 budgets could squeeze other crucial public expenditures. Moreover, the scheme’s marginal impact on private expenditure may be less pronounced than expected as private consumption has shown robust growth recently (Figure 5), expanding by over 7 percent in 2023.

Despite all these concerns, public spending remains critical to reinvigorate and sustain the growth momentum in Thailand.

However, to optimize the economic impact of public spending in the face of narrower fiscal space, a more targeted approach could be considered at a considerably lower fiscal cost. For example, the Digital Wallet Scheme could be re-adapted to be more limited in nature by supporting the lower income households and synergizing with existing welfare and social protection schemes. Additionally, targeted funding from the scheme could also be used to support small and medium-sized enterprises (SMEs), which were hit hardest by the pandemic and are still struggling to recover.

More importantly, given that Thailand’s slow growth stems from weak external demand and structural decline in global demand for its export products rather than weak private demand, public spending should focus strategically on growth-enhancing investments. Upscaling public investments in human capital and infrastructure, for instance, can boost Thailand’s long-term competitiveness, better positioning the economy to attract foreign direct investment (FDI) and capture market share amid ongoing global trade reconfigurations.

Thailand boasts several key comparative advantages attractive to FDI. Its strategic location in the heart of the ASEAN+3 region, well-developed manufacturing clusters, availability of localized input sourcing, stable energy supply and 5G network, high quality amenities and appealing lifestyle for expatriates, and a sizable domestic market, have served to attract notable FDIs in cloud data storage, electric vehicles and batteries, medical services, biotechnology, and aerospace in recent years.

To maintain its competitive edge in a fast-changing global landscape, the Thai government needs to continue to strengthen existing advantages while addressing long-term concerns like aging demographics, sluggish productivity growth, as well as skill and infrastructure gaps for a new wave of technological revolution.

Thailand already has many growth-enhancing programs in place such as the Eastern Economic Corridor and the Ignite Thailand initiatives. A greater focus on implementation and a stronger commitment to “game-changing” investments to develop a strategic edge in emerging sectors are needed to fully unleash their potential.

While the Digital Wallet Scheme may provide a temporary growth boost, it is unlikely to have a durable impact on Thailand’s potential growth. Without enduring improvement to economic fundamentals boosting productivity, any growth spurts will quickly dissipate, and growth will gravitate back to the prevailing long-term trend.

To achieve sustainable and inclusive growth, public spending would be better allocated to investments in human capital, infrastructure, and strategic industries. Unlocking Thailand’s full economic potential requires policies that look beyond the near-term and instead focus on enhancing the productivity and competitiveness of both current and future generations of the people of Thailand.