Singapore, a small low-lying island, faces an urgent need to mitigate against climate change. The city-state has launched a whole-of-nation approach to achieve its net zero target.

While the city confronts the intricacies of space constraints, import dependencies, and global market uncertainties in its pursuit of green transition, there also lie opportunities for innovation and regional leadership in sustainable financing.

Switching to clean energy is easier said than done

Physical and geographical constraints limit the viability of alternative energy adoption in Singapore. The small land mass of the city-state hinders the large-scale deployment of renewable energy infrastructure, such as solar or wind farms. Consequently, energy generation in Singapore remains highly dependent on fossil fuels, though natural gas—the cleanest type of fossil fuel– is the predominant source of energy.

While importing low-carbon electricity is one of the ways to cope with the domestic demand for energy, it could be affected by supply disruptions in source countries. Singapore is planning to import up to 4GW of low-carbon electricity by 2035, which will make up around 30 percent of the total electricity supply. In June 2022, Singapore started importing electricity from hydropower plants in Lao PDR, under the Lao PDR-Thailand-Malaysia-Singapore Power Integration Project (LTMS-PIP). This marks the first multilateral cross-border electricity trade involving four ASEAN countries.

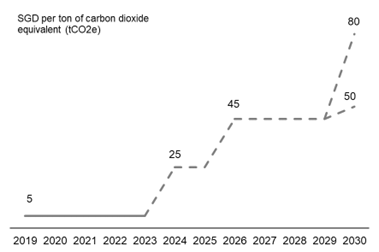

Carbon tax complements the transition to clean energy by penalizing carbon emissions, but the implementation of a carbon tax can have inflationary implications. A carbon tax was introduced in Singapore in January 2019 at SGD5 per ton of CO2 and the tax will be raised gradually to SGD50-80 per ton by 2030.

Despite the seemingly sharp increase, the proposed carbon tax in Singapore remains well below the USD200 per ton (SGD268) rate recommended by the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) in order to achieve net zero emissions globally by 2050. A carbon tax hike from SGD80 to SGD268 per ton could raise electricity tariffs in Singapore by 38 percent, which could also push up production costs for many goods and services.

Carbon Tax in Singapore

Source: NEA; AMRO staff calculations.

The surge in global demand for eco-friendly products and services places further upward pressure on inflation—dubbed “greenflation”. The International Energy Agency estimates that the world will need six times more critical minerals than it uses today to achieve its net zero goal by 2050. Price fluctuations and volatility in energy markets could exert inflationary pressure for Singapore, given the city-state’s heavy reliance on imports.

Singapore is well-positioned to seize the opportunities in green investment and financing

Despite its limited land area, Singapore has achieved a significant breakthrough: the establishment of an expansive floating solar farm with a substantial 60MW-peak capacity. This remarkable achievement highlights not only reduced carbon emissions by 32 kilotons annually but also powers all of Singapore’s water treatment plants, turning them 100 percent green. Singapore has also commenced operations of the largest battery energy storage system in Southeast Asia in December 2022. The country is also exploring hydrogen, carbon capture, and deep geothermal projects, to diversify its sources of clean energy.

Singapore has created a holistic ecosystem for green investment to further accelerate its low-carbon transformation. The country has identified the clean energy industry as a strategic growth area, attracting firms to develop, test, and validate new technologies in real-world settings. This commitment to innovation and collaboration is crucial for Singapore to overcome its unique challenges and emerge as a global leader in sustainable development.

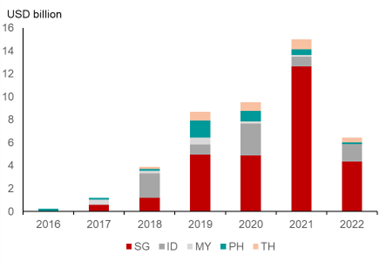

As the leading financial center in the region, Singapore is well placed to catalyze the green transition of ASEAN countries. The Asian Development Bank estimates that ASEAN will require total infrastructure investment of at least SGD3.7 trillion in the next seven years to sustain economic growth and respond to climate change, thus bringing considerable growth opportunities for Singapore’s financial sector. Financial institutions and corporations in Singapore will be able to tap on blended financing or public-private partnerships to support infrastructure development across the region.

Green Bond Issuance, ASEAN-5

Source: Climate Bonds Initiative; AMRO staff calculations.

Policies need to support the vulnerable while spearheading the green transition

Fiscal policy will play an important role in supporting the vulnerable groups during the green transition. The implementation of carbon pricing can raise inflation by increasing costs for carbon-intensive industries, which may be passed on to consumers in the form of higher prices.

Programs such as the Climate Friendly Households Program in 2020, which subsidizes eligible households’ purchase of energy-efficient products, could be expanded. Fiscal support will also be the key in providing upskilling and reskilling support for workers to tap on job opportunities in a green economy. Green budgeting, which is the incorporation of climate and environmental goals into the planning of public finance, needs to be the mainstay of public finance planning to crowd in private sector investment.

The impact of climate change mitigation on inflation is complex and can vary depending on specific circumstances, policy choices, and the duration of the transition. Distinguishing between the structural costs associated with creating a greener economy and cyclical fluctuations is crucial to ensure that monetary policy would strike the right balance between supporting the green transition and maintaining overall price stability.

Singapore launched its Green Plan 2030 in 2021 to galvanize a whole-of-nation movement and advance its national agenda on sustainable development. With ambitious and concrete targets, Singapore’s green transition journey has set sail.