Nearly two years into the COVID-19 pandemic, the mix of efficacious vaccines and emerging virus variants are providing more clarity on what the “new normal” could look like. The rapid spread of the Delta variant this year, even among the vaccinated, has undermined the effectiveness of the “zero COVID” strategy adopted by some countries.

In the ASEAN+3 region, comprising the 10 ASEAN economies, China; Hong Kong – China, Japan, and Korea, continuing policy support and more targeted containment measures have kept economic activity going. However, as the region’s policy space narrows, swift rollouts of vaccination programs and the shift toward an “endemic new normal” could become a game changer for growth.

Let’s take a look at five key trends that are shaping the region’s economic recovery as highlighted in AMRO’s latest ASEAN+3 Regional Economic Outlook.

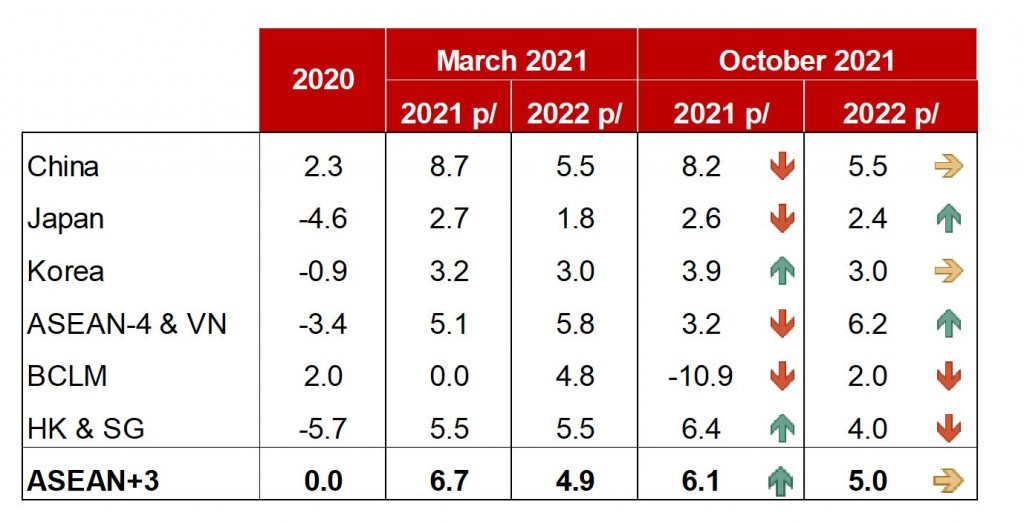

1. Slower growth. Strong rebound in the ASEAN+3 region in the first half of this year has been partially dampened by the recurring new waves of infections across ASEAN, especially in the third quarter. Consequently, the ASEAN+3 region is expected to grow by 6.1 percent in 2021, somewhat lower than AMRO’s projection in March this year. With most regional economies on track to achieve their vaccination targets by end of the year or early next year, almost all the ASEAN countries are projected to register stronger growth in 2022 (Figure 1). On the other hand, the recovery in demand, in addition to base effects and global supply chain bottlenecks, would contribute to higher inflation this year.

Figure 1. AMRO’s Growth Projections, 2021‒2022

(Percent year-over-year)

Sources: National authorities; and AMRO staff. Projections for October were made at end-September.

Note: ASEAN-4 includes Malaysia, Indonesia, Thailand, and the Philippines. VN = Vietnam; BCLM = Brunei Darussalam, Cambodia, Lao PDR, and Myanmar; HK = Hong Kong; SG= Singapore. Arrows refer to the change between the March 2021 and October 2021 projections.

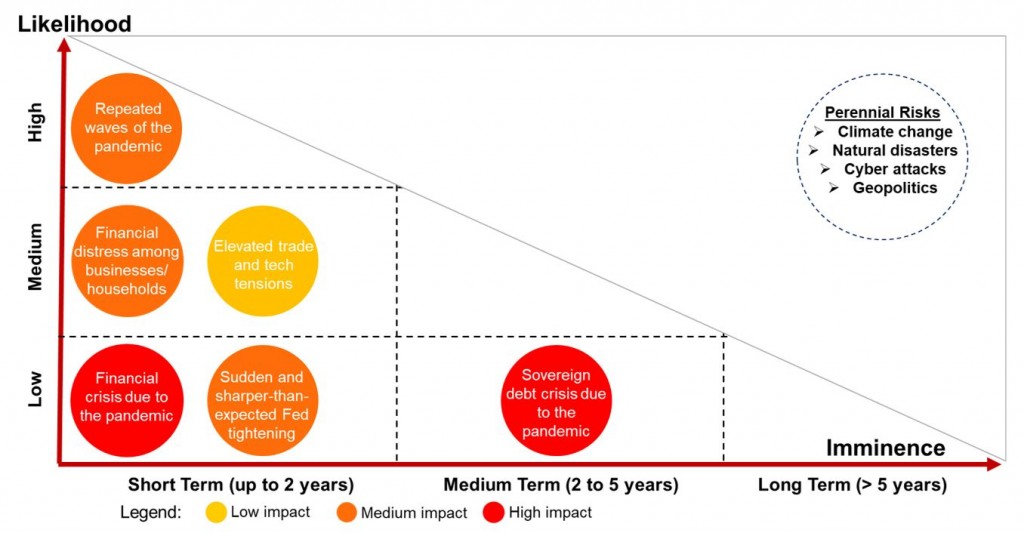

2. Cautious optimism. Prompted by rising vaccination rates in the region, authorities have begun to ease domestic mobility restrictions, with some economies even restarting international leisure travel, boding well for hard-hit sectors like tourism. Proactive support for banks, firms, and households have also helped temper the risks to financial stability wrought by the pandemic. Still, downside risks abound, especially if the virus mutates into potentially more vaccine-resistant strains (Figure 2). Public sector debt ratios are rising and the expiration of several pandemic support measures starting this year could adversely affect the ability of firms and households to repay their loans and banks’ asset quality. Increasing price pressures, along with any unexpected tightening of monetary policy by the US Federal Reserve, could also weigh on growth prospects.

Figure 2. Global Risk Map, September 2021

Source: AMRO staff.

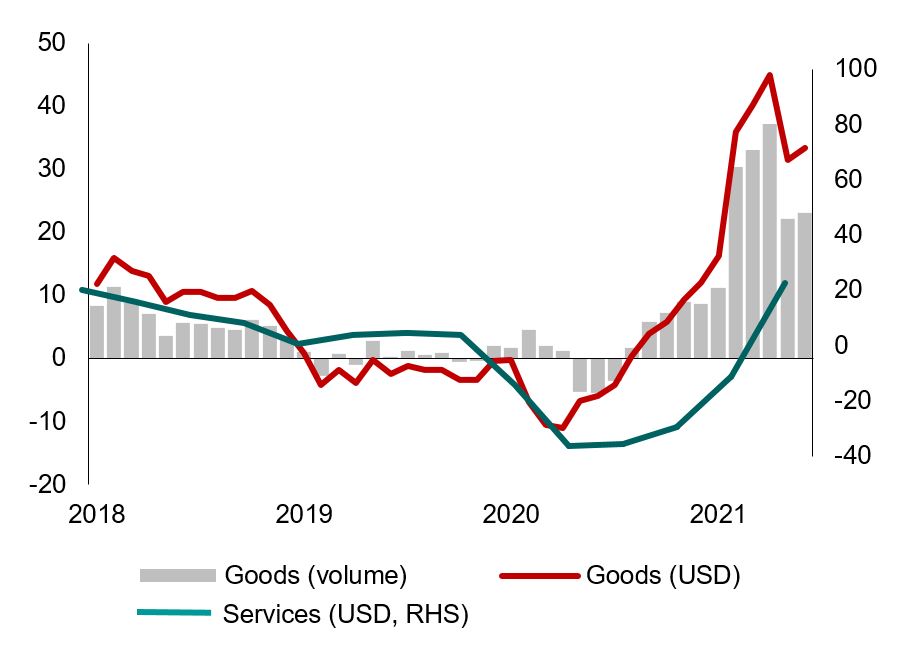

3. Uneven growth. Recovery across the world and within the region is progressing unevenly. Trade patterns in recent months show the strong rebound in goods exports, from strong demand for chips, electronics, autos and consumer products and base effects, continuing to outpace that of services, especially travel and tourism (Figure 3). Service exports have continued their lethargic trend, with the turnaround most likely pushed back by recurring outbreaks in the region. However, the export outlook for services has improved with more countries reopening their borders to international travelers, although the pace of reopening is dependent on each economy’s vaccination speed and risk tolerance toward COVID-19 infections.

Figure 3. ASEAN+3: Goods and Services Exports

(Percent year-over-year; 3-month moving average)

Sources: National authorities via Haver Analytics; and AMRO staff calculations.

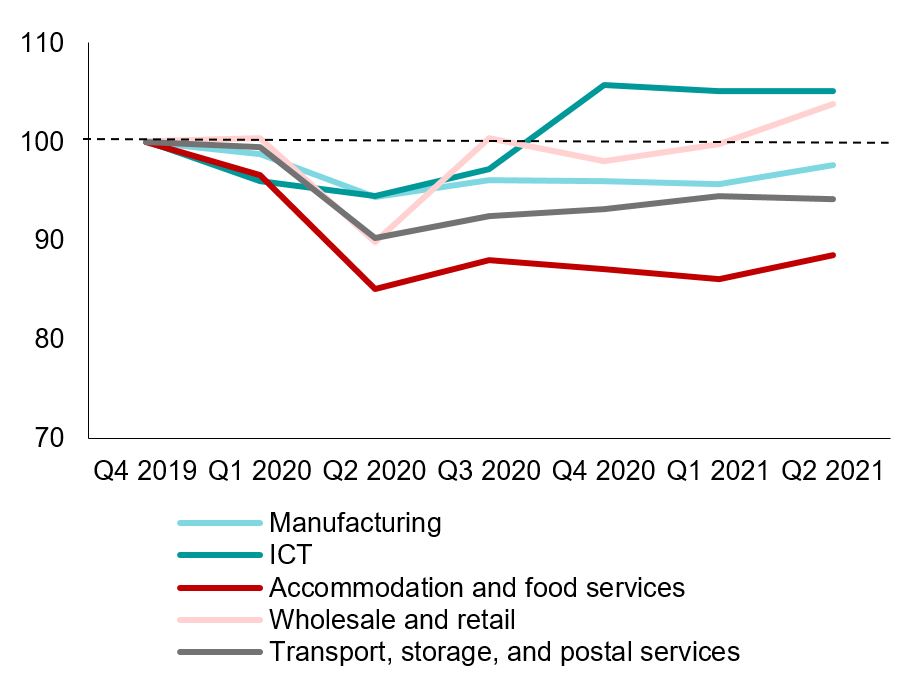

4. Improving labor market. Encouragingly, employment conditions in the region have improved since last year, thanks to unprecedented government policy support and a shift to more targeted and less restrictive containment measures. While headline unemployment rates appear to have peaked, they are still higher than pre-pandemic levels. The turnaround in employment across sectors also remains uneven, reflecting the divergence in recovery. Employment has been very sluggish in close-contact services, while it has yet to fully recover in manufacturing. In contrast, employment in information and communications technology (ICT) activities has been robust, and the wholesale and retail segment is gradually improving (Figure 4).

Figure 4. Employment by Industry

(Index, Q4 2019 = 100)

Sources: National authorities via Haver Analytics; and AMRO staff calculations.

Note: The data for employment by industry include that of Hong Kong, Japan, Korea, Malaysia, the Philippines and Singapore. Employment levels are normalized at Q4 2019 to represent pre-pandemic period.

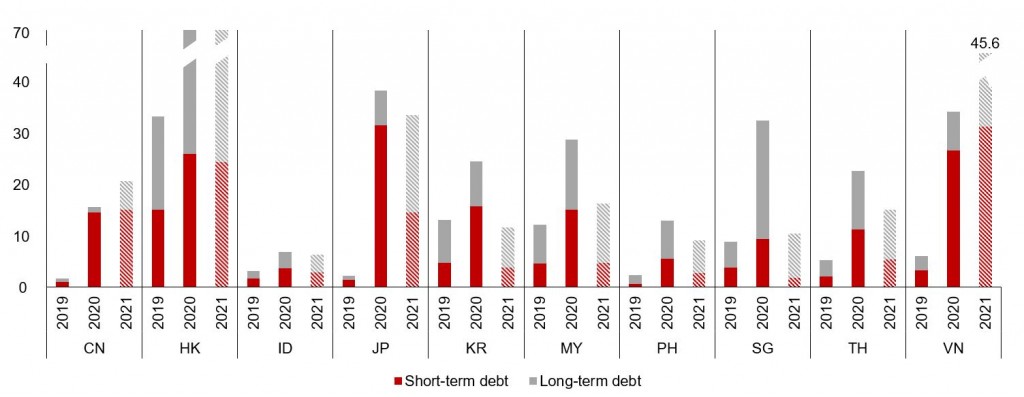

5. Lower corporate default risks. Containment measures, while critical to saving lives, have led to a significant decline in corporate earnings. Firms’ debt-at-risk as a percentage of GDP rose sharply across the region in 2020 (Figure 5). However, swift monetary easing and regulatory forbearance measures supported liquidity in credit markets and allowed banks to restructure or roll over existing debt. The turnaround in economic growth and easy monetary policy are contributing to a marked decline in corporate debt-at-risk in 2021, in turn moderating bankruptcy risks across the region.

Figure 5. Selected ASEAN+3: Debt‒at‒Risk of Listed Firms, as of End 2019–21

(Percentage of GDP)

Sources: Bloomberg L.P.; national authorities via Haver Analytics; and Ho and Ong (forthcoming).

Notes: CN = China; HK = Hong Kong; ID = Indonesia; JP = Japan; KR = Korea; MY = Malaysia; PH = The Philippines; SG = Singapore; TH = Thailand; VN = Vietnam. The ratios for 2021 (patterned bars) are projected using actual data on the first half of 2021.

Overall, the ASEAN+3 region is on track to recover more strongly going forward now that the pandemic is receding and vaccination is making rapid progress. Still, the outlook remains uncertain, particularly from the likely recurrence of new waves of infection with the virus becoming endemic. As economies shift toward living with COVID-19, more targeted containment measures are likely to be the norm. Several economies in the region are already preparing to or have begun withdrawing pandemic support policies. Most importantly, ASEAN+3 policymakers must be flexible and quick to adapt, especially in extending additional monetary and fiscal support should the need arise.