Image: atiger / Shutterstock.com

SINGAPORE, June 30, 2023 – China’s emergence from the COVID-19 pandemic at the end of 2022 has triggered a strong economic rebound. Its sound economic fundamentals and proactive policy measures will enable the country to consolidate the near-term recovery and transition to high-quality long-term growth. This entails addressing challenges related to population aging, high leverage, geopolitical tensions, and global trade fragmentation. This is according to the preliminary assessment by the ASEAN+3 Macroeconomic Research Office (AMRO) after its Annual Consultation Visit (ACV) to China from June 5 to 21, 2023.

The AMRO team was led by Lead Economist Jae Young Lee, while AMRO Director Kouqing Li and Chief Economist Hoe Ee Khor participated in the policy meetings. The discussions covered a wide range of issues, including the risks and vulnerabilities affecting the short-term economic outlook; the effects of geopolitical tensions on supply chains, trade, and investments; risks in the real estate and financial sector; local government finance; and long-term structural challenges.

Economic developments and outlook

“China’s growth is expected to rebound strongly by 5.5 percent in 2023 with the reopening of the economy following the termination of its dynamic zero-Covid policy at the end of last year,” said Dr. Lee. “Despite high commodity prices, inflation has remained low at 2.0 percent in 2022, reflecting subdued demand and bumper crop harvests. Inflation is expected to decline further to 1.2 percent in 2023.”

China’s GDP growth rebounded strongly from 3.0 percent in 2022 to 4.5 percent in the first quarter of 2023. Despite signs of weakness in manufacturing, exports, and the real estate sector in the second quarter, the economy should pick up steadily through the rest of 2023, led by consumption and supported by well calibrated monetary policy and targeted fiscal policy measures. Consumption should be supported by further improvements in labor market conditions and consumer confidence, while investment should strengthen with further improvements in the business environment and the gradual recovery of the real estate sector.

Risks and vulnerabilities

Confronted with both multiple challenges domestically and major uncertainties externally, the balance of risks is tilted to the downside.

On the domestic front, the real estate sector has stabilized but remains weak. Its recovery is likely to be gradual. The heightened financial strains on some local governments could hinder the economic recovery of affected regions. High leverage remains a key vulnerability in some sectors of the economy, and significant deleveraging is needed to avoid the risk of financial distress which could be a drag on the economy.

Externally, there are several challenges, including the possibility of a sharper-than-expected global economic slowdown and the further escalation of geopolitical tensions.

Policy recommendations

In the near term, monetary policy should continue to ensure that monetary conditions remain supportive of the recovery while fiscal policy should provide targeted support for those sectors which are lagging in the recovery and for job creation. Policies for the real estate sector should continue to foster its sound development over the long term while supporting its nascent recovery in the near term. Ensuring financial sector soundness is crucial, especially with the recovery of the economy and property sector still at an early stage. The weaker banks should work on increasing their capital buffers and restructure to become more viable and competitive.

For the long term, China should pursue a multi-faceted strategy to achieve high-quality economic growth.

To mitigate the impact of population aging, China needs policies to boost its population growth, expand its labor force, and enhance its labor mobility, as well as improve the coverage and adequacy of its social security system.

Given the upward trend in healthcare and social services spendings due to population aging, China must find more sources of revenue, enhance the efficiency of fiscal spending, and adjust its budget allocation to reflect shifts in policy priorities.

To boost the economy’s growth potential, more investments in R&D and human capital, strengthening of market functions and entrepreneurship, and continued collaboration with other countries to strengthen the multilateral trading system are important.

The country’s pursuit of carbon neutrality is commendable. The economy’s strong advantage in renewable energy – powered by a massive investment push, rapid technological advances, and efficient supply chains – has placed it in an excellent position to become carbon neutral before 2060 and contribute to the global climate change agenda.

AMRO would like to thank the Chinese authorities and other participating organizations for their strong support, close cooperation, and candid exchange of views.

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute towards securing macroeconomic and financial stability of the ASEAN+3 region, comprising 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support regional financial arrangements, and provide technical assistance to the members. In addition, AMRO also serves as a regional knowledge hub and provides support to ASEAN+3 financial cooperation.

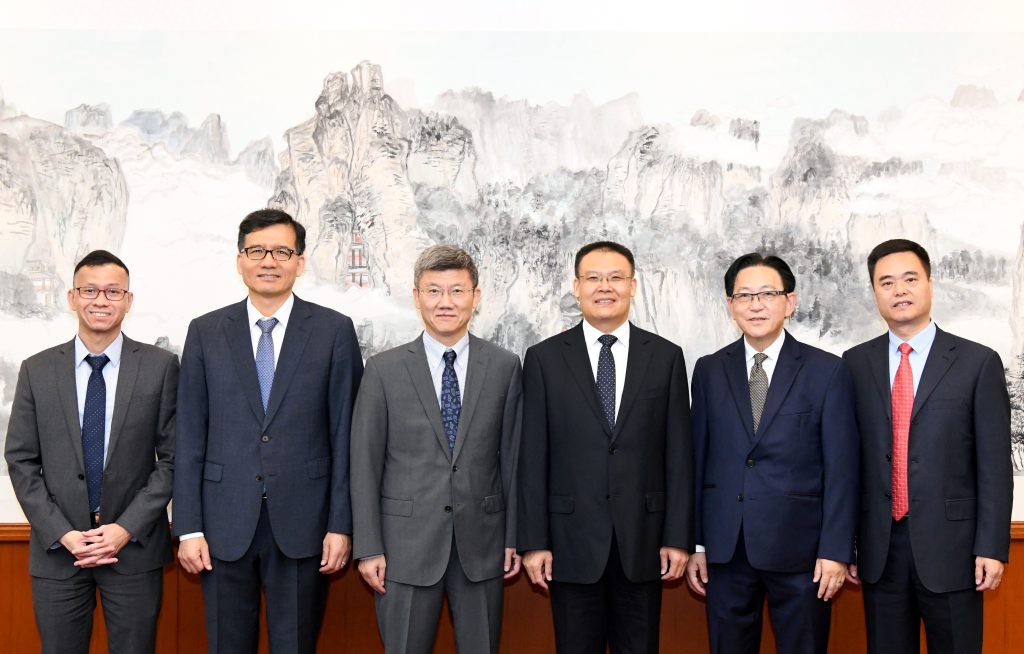

AMRO Director Kouqing Li, Chief Economist Hoe Ee Khor, and the AMRO team met Vice Finance Minister Wang Dongwei and other senior officials from the China Ministry of Finance.

AMRO Director Kouqing Li, Chief Economist Hoe Ee Khor, and the AMRO team met Deputy Director General Chen Jing and other senior officials from the People’s Bank of China.