China’s low inflation shows a disinflationary process, propelled by a robust supply side recovery, coupled with sluggish consumer demand linked to the property market downturn, relatively lower wage growth and weak manufacturing exports.

China stands out as an outlier amid the recent global surge in inflation. While major advanced economies (AEs) and many emerging market economies (EMEs) were grappling with elevated prices, China was experiencing exceptionally low inflation.

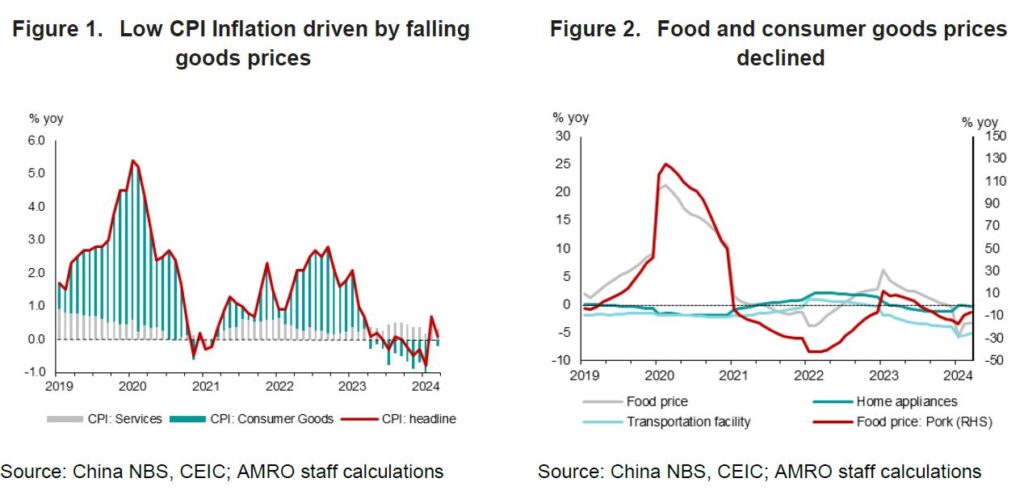

China’s headline CPI inflation stayed low, averaging 1.5 percent between 2020 and 2022. It further declined after the economy reopened in 2023, dipping into negative territory in Q4 2023 and early 2024, prompting concerns over persistent deflation risks.

Recent inflation dynamics reveal that China does not show symptoms of a typical deflationary spiral. The threat of deflation is also mitigated by the country’s robust growth potential and ample policy space.

Deciphering China’s inflation dynamics

Inflation in China has predominantly been influenced by supply-side factors, as opposed to demand-side forces.

During the COVID-19 pandemic, China effectively maintained a low inflation as the recovery of production outpaced domestic demand. Unlike many countries, China avoided upward price pressure from supply shocks and instead was able to maintain operation of its domestic supply chain and production. However, consumer spending fell behind production due to the strict pandemic containment measures and limited financial support being provided to households.

Following China’s reopening in 2023, this demand-supply dynamics persisted, resulting in a decline in prices. A robust recovery in production led to excess supply of consumer goods, which is the primary factor behind the recent negative CPI readings. In contrast, service price inflation has been positive, driven by the recovery in services activities following the reopening of the economy (Figure 1).

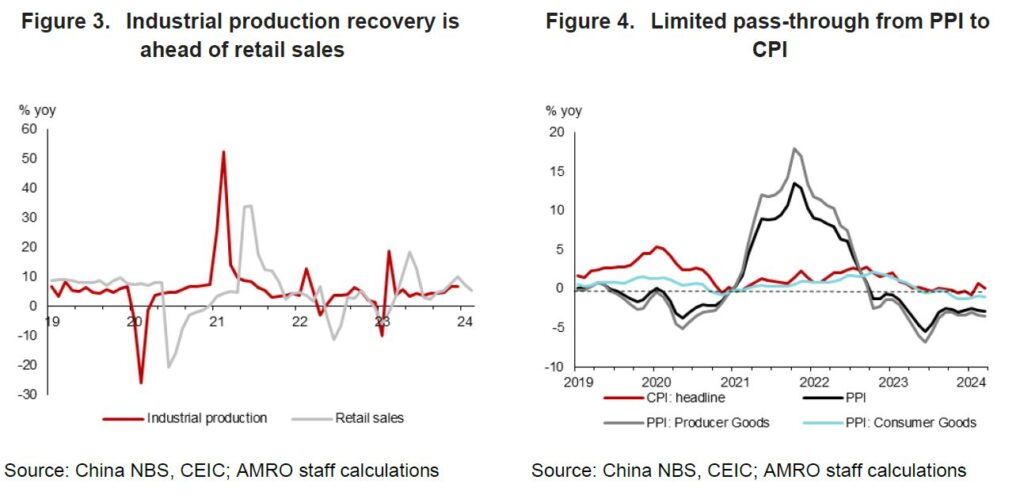

Food price inflation did not pose a significant issue, largely due to the country’s bumper food production and substantial food reserves. The post-reopening expansion in pork supply, driven by the hog cycle, has added further downward pressure on food prices (Figure 2).

Production bounced back strongly in 2021 and stayed resilient, leading to the disinflationary forces (Figure 3). China’s domestic supply demonstrated resilience during the pandemic due to the strict pandemic management measures, which prevented production interruptions. During periods of global supply disruptions and surges in global commodity prices, PPI inflation was more pronounced in upstream industries than in downstream industries, resulting in limited pass-through to consumer prices (Figure 4). This divergence may reflect the highly competitive industry structure in downstream sectors, compared to upstream sectors within China’s supply chain.

The pressure on producer prices eased further with the moderation of global commodity prices and weak exports of manufacturing products. Moreover, many consumer goods, including electric vehicles, continued to see price cuts due to intense competition.

On the other hand, the recovery in consumer demand remains notably weaker. Despite an increase in household savings, “revenge spending” did not take place after China reopened its economy as these higher savings were due to precautionary motives, deriving from withdrawal from wealth management products, and deferred property purchases.

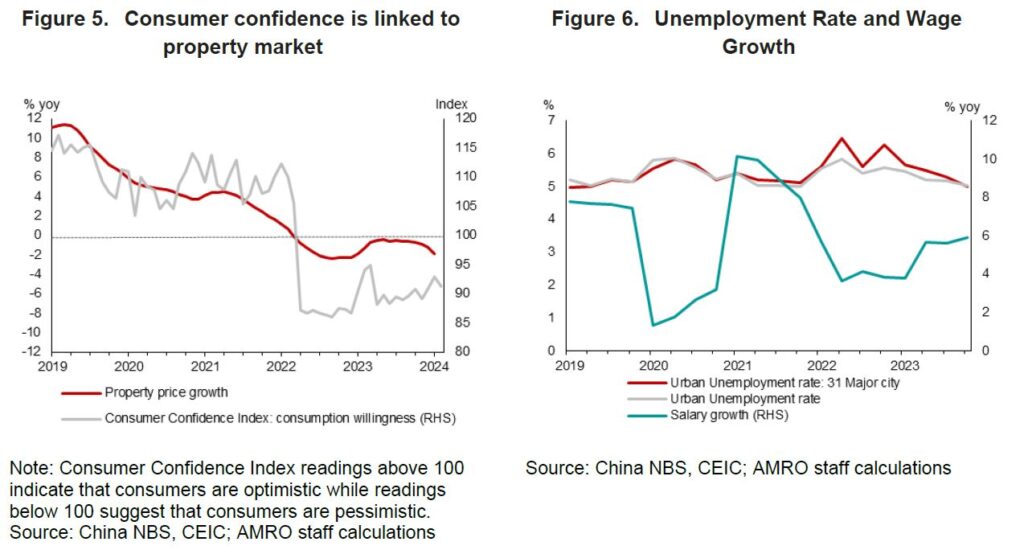

Furthermore, consumer confidence continues to weaken reflecting the ongoing property market distress, which was exacerbated by extensive delays in home delivery, and the negative wealth effect from declining property prices (Figure 5). Weak home sales may have also resulted in lower demand for home appliances and related durable goods.

Sluggish wage inflation also has a significant impact on China’s low inflation. Unlike some countries that implemented extensive policy supports to households, such as cash handouts to bolster consumption, China’s consumption recovery depends more on post-pandemic employment and wage growth.

However, the labor market improvement was moderate and youth unemployment rose and was notably higher at 15.3 percent in February 2024. Wage growth was generally slower than pre-pandemic, with some sectors even experiencing wage cuts (Figure 6). These developments indicate restrained wage growth in China.

Disinflation rather than deflation trend

Despite experiencing low inflation, China has not exhibited widespread deflationary symptoms.

First, recent data indicates that the economic recovery is gaining momentum. A strengthened consumption recovery is expected to contribute to upward price movement. Retail sales of consumer goods continued their expansion in January and February of this year, rising by 5.5 percent year-on-year.

On the supply side, profits of industrial firms surged by 10.2 percent (yoy), and industrial production grew by 7 percent (yoy) in the first two months of the year. These positive figures, together with the March PMI shifting toward expansion, suggest that recovery of economic activities is gaining traction. Under the baseline scenario, we anticipate the CPI inflation to rebound to 1 percent in 2024, with a gradual increase to 1.6 percent in 2025 as the economy continues its recovery trajectory.

Second, there are no signs of a deflationary spiral stemming from the downturn in the property sector. If we define a typical deflationary spiral as a vicious cycle where declining demand leads to lower prices, reduced investment, decreased output and income, and ultimately weaker aggregate demand, then China does not currently fit this description as both demand and supply are recovering.

The potential deflationary forces from the deleveraging of the property developers and some local governments remain contained. Investment has picked up in manufacturing and the construction of infrastructure.

A deflationary spiral could also emerge through changes in consumer inflation expectations and consumption behavior in response to a deflationary environment. Preliminary findings by an AMRO study (forthcoming) suggest that such a deflationary spiral has not materialized in China. The decline in real estate prices has not led to widespread deflationary sentiment. Additionally, Consensus Forecasts survey indicates that CPI is expected to edge up to over 1.5 percent in the latter half of this year.

Third, unlike other countries that have historically grappled with low growth and deflation, China’s current growth potential remains robust at around 5 percent. In the medium term, despite a trend slowdown, China’s growth potential will remain significantly higher than that of other advanced economies during periods of deflation and stagnation.

According to AMRO staff’s projections, China’s growth potential is expected to average around 4.5 percent until 2030. A robust GDP growth will propel the expansion of domestic activities, leading to higher wage growth and a rise in demand that will drive prices higher.

Fourth, there is ample policy space to address potential deflation risks if they materialize, although the Chinese authorities are rightly cautious about implementing massive stimulus measures at this time. Both monetary and fiscal policy can provide more support to the economy when needed.

Preventing a deflationary spiral

To prevent today’s disinflationary trend from evolving into a persistent deflationary spiral, China should maintain steady economic growth and bolster consumer confidence.

Monetary and fiscal policies will need to stay supportive to sustain growth momentum and revive domestic demand. Monetary policy should remain prudent, adopting a “precise and forceful” approach to support recovery. Going forward, there is still room to adjust policy rates, such as the 1-year LPR, and a further reduction in the reserve requirement ratio (RRR) is also possible. If major central banks pivot to cut rates later in the year, there will be more space for the PBoC to ease monetary policy further. More importantly, fiscal policy can also provide more support if the economy were to weaken, and growth is at risk of falling below the 5 percent target this year.

Stabilizing the property market will play a crucial role in restoring consumer confidence. One key area that warrants additional action is ensuring the completion of existing projects and expediting the delivery of housing units to their buyers, as these factors closely influence household sentiment. Moreover, the authorities should carefully manage risks in the property market to prevent their materialization into broader financial stability risks. This underscores the importance of employing comprehensive measures to address risks in the property market.

In the medium term, China should address the challenges posed by an aging population and enhance growth potential through structural reforms. The pension system in China requires enhancement in terms of adequacy and benefits. As replacement ratio improves for the aging population, households will be more inclined to increase consumption. Additionally, improved medical and education benefits will further reduce precautionary saving and stimulate consumption.