This article first appeared in The Edge Malaysia on May 20, 2025.

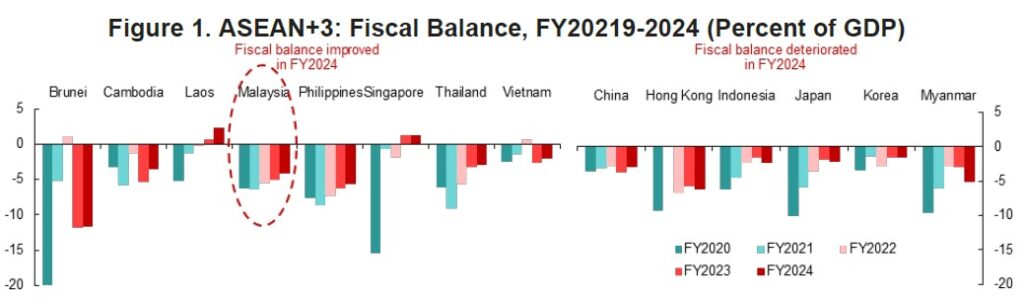

Malaysia’s 2024 fiscal performance reflects commendable progress. The federal government successfully narrowed its fiscal deficit from a pandemic high of 6.4 percent of GDP in 2021 to 4.1 percent in 2024—marking three consecutive years of improvement on the back of supported by steady economic growth (Figure 1). Public debt stood at 64.6 percent of GDP, roughly unchanged from 2023. While still above pre-pandemic levels, public debt appears to be stabilizing, positioning Malaysia as one of the few ASEAN+3 economies to have meaningfully returned to a path of fiscal normalcy.

However, the global outlook for 2025 is increasingly uncertain. The proposed 24 percent reciprocal tariffs on Malaysia’s exports to the US on April 2 underscore the need for fiscal policy support that is not only disciplined but also agile and responsive. In a more volatile external environment, rebuilding buffers is essential but so does ensuring that fiscal resources can be deployed swiftly to support vulnerable sectors and sustain domestic demand when needed.

Striking the right balance between short-term flexibility and medium-term consolidation and reform will be key to safeguarding Malaysia’s economic resilience and stability.

1. Maintaining fiscal flexibility in a changing environment

Like many open economies, Malaysia is expected to be adversely affected by US tariff measures and a likely slowdown in global demand. Although there has been a 90-day pause in the implementation of reciprocal tariffs, lingering uncertainty continues to weigh on investor sentiment and global trade flows. Malaysia’s export-oriented sectors face growing risks, with potential knock-on effects on government revenues, employment, and overall growth.

In this context, fiscal policy should remain flexible and counter-cyclical. Malaysia’s moderate fiscal space can be effectively leveraged to support domestic demand through public investment and consumption, and targeted assistance, such as wage subsidies, tax relief or grants to the most affected sectors. Ensuring the government’s ability to adapt and respond quickly will be critical in managing near-term risks.

2. Optimizing resource allocation through subsidy reforms

In 2025, the government is expected to begin removing RON95 fuel subsidies for the top 15 percent of income-earning households. Despite the uncertain global landscape, this reform should proceed as planned, as most of the population—particularly low- and middle-income households—will not be affected. Instead of the current tiered pricing mechanism, a two-phased, staggered approach to subsidy removal, supplemented by targeted cash transfers, may prove more effective and manageable.

Regardless of the approach taken, fiscal savings from subsidy rationalization should be strategically reallocated to support sectors and workers affected by trade-related shocks. Staying on course with this reform will strengthen Malaysia’s resilience and promote a more inclusive growth.

3. Strengthening fiscal management

Among the various fiscal reform options, strengthening fiscal institutions stands out as a high impact, low-cost solution. Malaysia has already taken significant steps in this direction.

The enactment of the Public Financial and Fiscal Responsibility Act last year marks a major milestone in institutionalizing sound fiscal governance. Additionally, the recent amendment to the Audit Act–which expands the Auditor-General’s oversight to over 1,800 government-linked entities–will help enhance transparency and accountability in the public sector, provided sufficient resources are allocated.

The next critical step is the tabling of the long-awaited Public Procurement Act. Malaysia currently lacks a unified legal framework for public procurement, relying instead on Treasury Instructions and Ministry of Finance circulars, which are administratively binding but not legally enforceable. Provisions are also fragmented across outdated laws, such as the Financial Procedure Act 1957 and the Government Contracts Act 1949.

A comprehensive Public Procurement Act aligned with international standards (such as OECD and UNCITRAL guidelines) would help institutionalize transparency, competitive bidding, and strengthen contract management. Such governance reforms require little financial costs, yet are vital to improving spending efficiency, reducing conflicts of interest, building public trust and investor confidence.

4. Expanding the revenue base for fiscal resilience

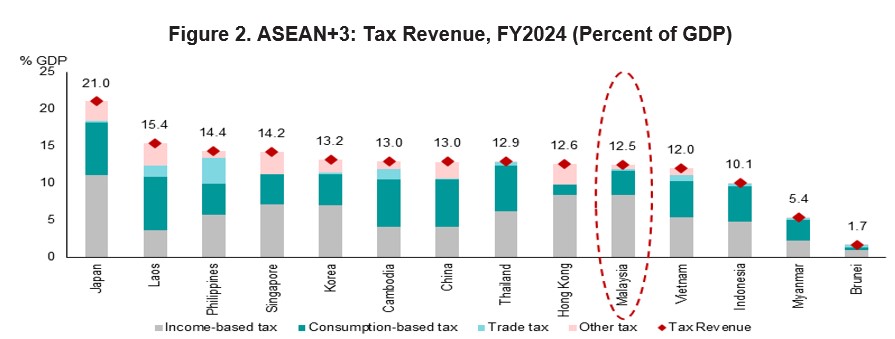

Amid rising global risks, Malaysia must also stay focused on its medium-term goal of strengthening the revenue base. At just 12.5 percent of GDP in 2024, Malaysia’s tax revenue is among the lowest in the region and below the 15 percent threshold widely regarded as the minimum for supporting sustainable development (Figure 2).

Recent measures, including an increased service tax and the introduction of a capital gains tax on unlisted shares and dividend tax, mark incremental progress. However, these are expected to yield only 0.4 percent of GDP in additional revenue. In contrast, a well-designed Goods and Services Tax (GST) is estimated to generate an additional 1.3 percent of GDP annually, with greater efficiency.

Malaysia’s longstanding reliance on petroleum-based revenue has delayed broader tax reforms. Without meaningful tax reform, the country risks being fiscally constrained not only during economic downturns, but also in meeting long-term fiscal needs such as rising healthcare costs associated with an aging population.

5. What should the government do next?

A range of targeted measures can be swiftly deployed to cushion the impact of the tariff. Recent initiative to increase government guarantee to SMEs exporters are welcome. To sustain domestic demand, the government could expedite fiscal spending—rather than the usual backloading in fourth quarter—and channel resources toward public investment and household support. Depending on the severity, temporary and targeted tax relief, deferrals, and direct grants could be extended to the most affected industries. In addition, strengthening the Employment Insurance System will be critical to preserving labor market stability. Streamlining the application procedures and accelerating benefit disbursement would enhance its counter-cyclical role.

Meanwhile, subsidy rationalization should proceed as planned, with savings earmarked for relief measures targeting affected sector. These efforts should be complemented by prioritizing the tabling of the Public Procurement Act. As uncertainty begins to ease, advancing tax reforms will be key to reinforce fiscal resilience.

Conclusion

Malaysia has made meaningful strides in restoring fiscal discipline post-pandemic, but the growing uncertainty underscores the need for continued prudence. The path forward lies in preserving fiscal flexibility to respond swiftly to external disruptions, while staying the course on subsidy rationalization, enhancing institutional governance, and broader revenue reforms to safeguard fiscal sustainability.