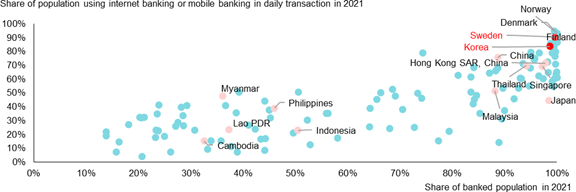

Korea and Sweden have a very high degree of financial inclusion – more than 95 percent of both populations have access to banking. Digital finance has grown very fast in tandem with smartphone penetration and e-commerce. Advanced digital infrastructure and financial technology provide various seamless payment services to serve the growing sophistication of economic activities.

Banking and Digital Banking Penetration

Source: World Bank

However, new trends and developments in the global financial landscapes have prompted the Bank of Korea and the Riksbank, alongside other central banks, to explore their own digital currencies. Those developments include a move toward a cashless society, the prominent role of big-tech firms in the retail payment market, and growing public interest in cryptocurrencies and digital assets.

Among advanced economies, these two countries have focused primarily on the retail Central Bank Digital Currency (CBDC) and have conducted pilot experiments.

BOK’s and Riksbank’s Pilot Projects: What Do They Have in Common?

Both central banks conducted CBDC research from early 2020 until mid-2022. Some local banks and tech firms were selected to participate in the experiments too. Both pilot projects focused on developing a retail CBDC based on distributed ledger technology (DLT).

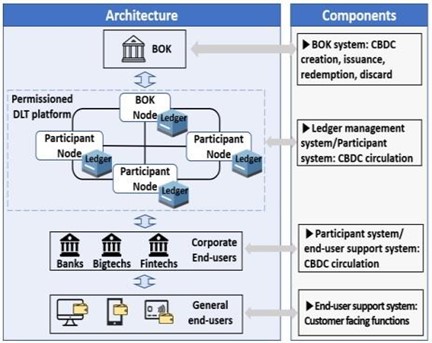

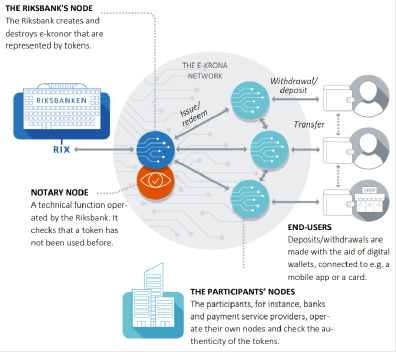

The pilot studies have focused on a two-tier retail CBDC. The central bank keeps the wholesale ledgers, independently operates the distributed ledger network, and manufactures and distributes a digital currency to participating intermediaries. Meanwhile, financial institutions and payment service providers deal with the end-users, including creating digital wallets and conducting Know-Your-Customer checks.

In addition to the basic functions of CBDC, both central banks also tested other functions, such as offline transactions, cross-border remittances, interest bearing function, aliases, integration with POS terminals, and compliance with AML/CFT regulations.

Despite intensive and ongoing pilot studies, the central banks have not yet decided to issue a digital currency, nor adopted a specific technology or changed any laws and regulations.

Distribution Models

[Bank of Korea]

[Riksbank]

Source: Bank of Korea; Riksbank

Key Takeaways from Both Pilot Projects

Both pilot projects found that most basic functions and offline transactions could operate successfully, but some extended functions had limitations.

First, the technical solutions based on DLT are limited in their scalability to perform retail payments. Both studies found that DLT technology worked well when the transactions were simple and involved small amounts. But when transactions became more complex, the systems would take a significantly longer time to complete the transactions.

In addition, using CBDC in retail commerce requires more preparation than initially expected, such as enhancing public awareness of the usage and merits of CBDC, and connecting CBDC with existing payment infrastructures, all of which have different technological and IT standards. The complexity would increase with cross-border payments.

Finally, it remains challenging to strike the right balance between protecting users’ financial confidentiality and complying with laws and regulations.