The ASEAN+3 region is forecast to grow by 4.3 percent this year, down from July’s projection of 4.6 percent, due mainly to the weaker-than-expected growth in China. Despite the anticipated weakness in the global economy next year, the region’s growth is forecast to remain robust at 4.5 percent, in view of the expected turnaround in trade and improving growth momentum in China.

Here are five key takeaways for the region’s outlook, as seen in AMRO’s latest ASEAN+3 Regional Economic Outlook.

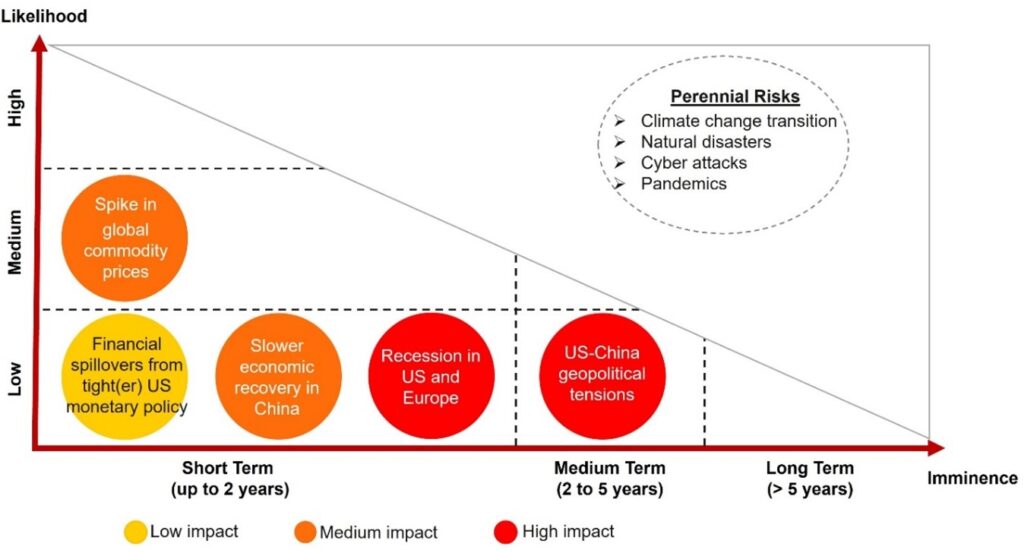

1. Domestic demand remains the main growth engine for the region. Recovery in the labor market and improving household incomes continued to support private consumption. Sectors such as retail trade and food and beverage have benefited from a resurgence in travel and tourism. China’s economic recovery has not been as strong as initially expected, primarily due to ongoing weakness in the property sector, which has dampened both investment and consumer sentiment.

Nonetheless, there are signs of recovery in investment and manufacturing outside the real estate sector, which should be further boosted by recent policy support measures.

Figure 1. Selected ASEAN+3: Contribution to Real GDP Growth

(Percent points, year-on-year; percentage points)

Note: Statistical discrepancies are not shown. Excludes Cambodia, China, Lao PDR, Myanmar, and Vietnam due to data unavailability.

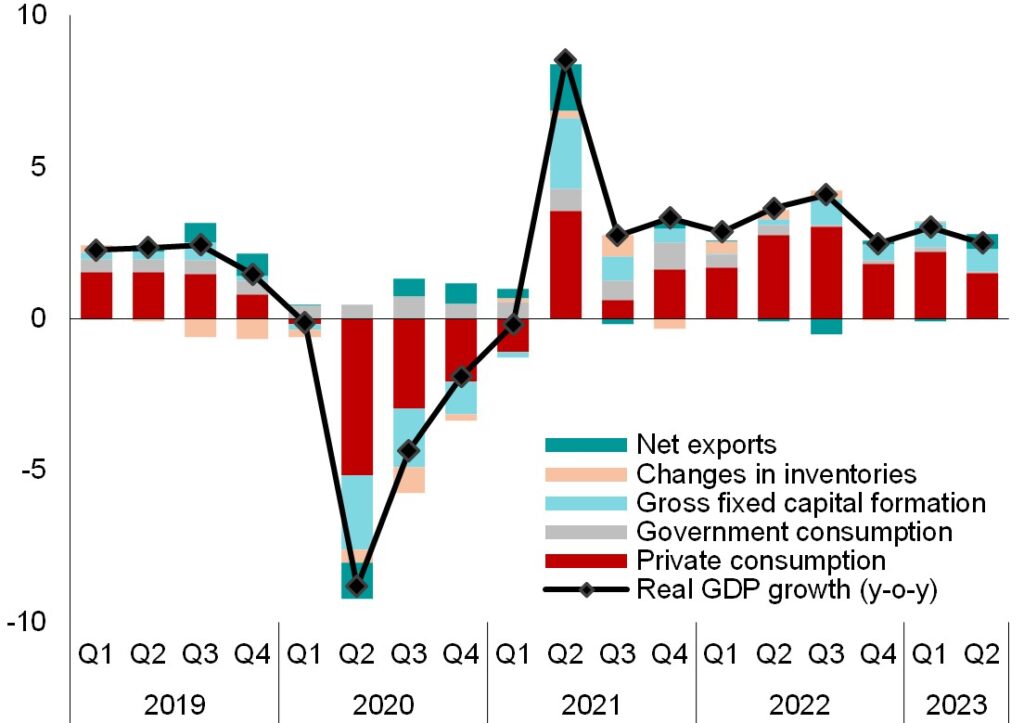

2. The worst may soon be over for ASEAN+3 goods exports. Goods exports remained weak due to muted demand from major trading partners and the global electronics downcycle, but signs of contraction appear to be easing across the region. Non-tech exports are contracting less, with a notable 50 percent year-on-year growth in ASEAN+3 auto exports, partly reflecting the increased demand for durable goods in the United States.

Moreover, brisk tourism activity is boosting service exports, with most economies at about 80 percent of their 2019 values. ASEAN+3 tourist volume is expected to fully recover to pre-pandemic levels next year, as outbound Chinese tourism regains momentum.

Figure 2. Selected ASEAN+3: Export Growth

(Percent, year-on-year; Index, 2019=100)

Note: Goods exports data are up to July 2023 and are 3-month moving averages; services exports data (quarterly) are up to Q1 2023.

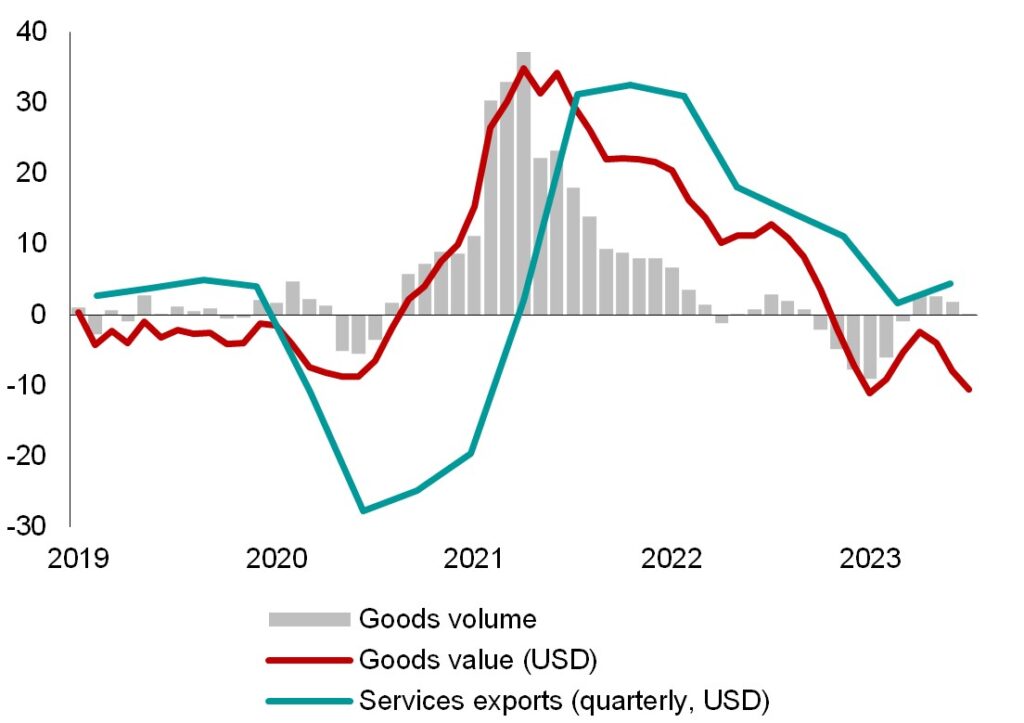

3. Headline inflation rose recently following an increase in global commodity prices. Crude oil prices reached their highest levels in 2023 after Saudi Arabia and Russia extended their oil production cuts. Unexpected dry weather conditions due to El Niño, compounded by export restrictions by key producers and disrupted agricultural supply, led to a spike in food prices.

Monetary policy remained tight in most economies. While Hong Kong and Thailand raised policy rates, China reduced its one-year prime lending rate to stimulate domestic demand. Other economies maintained their tight monetary policy stance to counter ongoing inflationary pressures.

Figure 3. ASEAN+3: Headline Consumer Inflation

(Percent, year-on-year)

Note: ASEAN-5 = Indonesia, Malaysia, Philippines, Singapore, and Thailand; BCV = Brunei, Cambodia, and Vietnam; LA = Lao PDR.

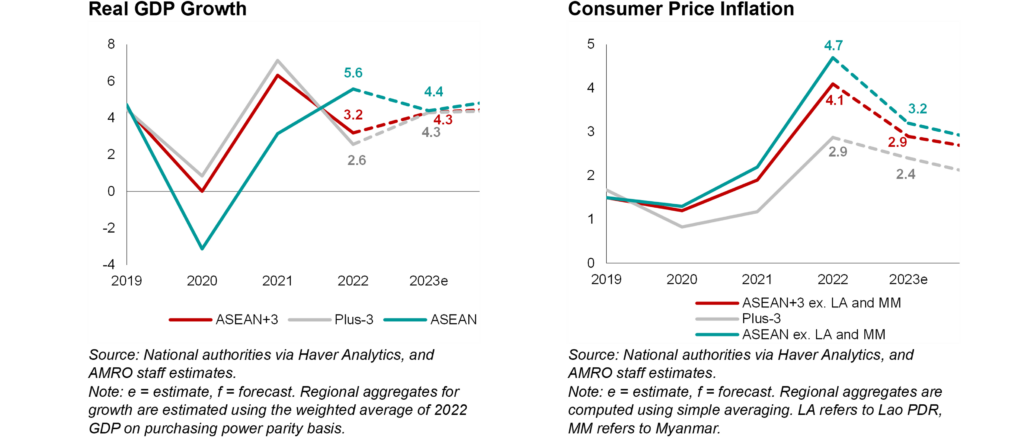

4. ASEAN+3 growth is revised down for 2023 but is expected to strengthen in 2024. The region is forecast to grow by 4.3 percent this year, down from July’s projection of 4.6 percent, mainly reflecting weaker-than-expected growth of China in the second quarter. The growth forecast for 2024 is maintained at 4.5 percent—despite the less sanguine outlook for the global economy—in view of the expected turnaround in trade and improving growth momentum in China.

Headline inflation is expected to moderate in 2024, but at a slower pace than previously forecast given that commodity prices remain elevated and core inflation remains high.

Figure 4. ASEAN+3: Growth and Inflation Forecasts

(Percent, year-on-year)

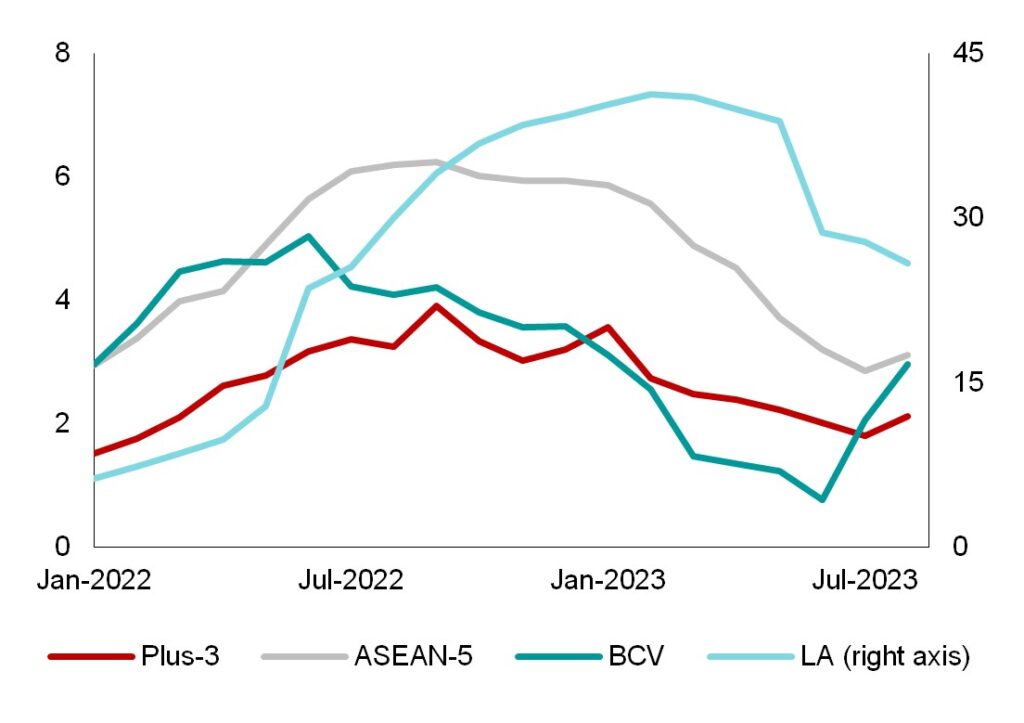

5. Overall balance of risk has shifted, with the risk of higher inflation becoming more salient. Worse-than-expected El Niño conditions and additional export restrictions on food staples could further push up prices. AMRO’s baseline forecasts could also be weighed down by weaker economic recovery in China or a recession in the United States and Europe.

The risk of financial spillovers from tighter US monetary policy has receded, but it still cannot be ruled out. In the longer term, US-China geopolitical tensions remain most pertinent to ASEAN+3 growth prospects.

Figure 5. Regional Risk Map, October 2023