The ASEAN+3 region is expected to grow by 4.6 percent this year, unchanged from our assessment in April, with downside risks receding slightly. Inflation for the region—excluding Lao PDR and Myanmar—has been revised downwards to 3.0 percent, slightly lower than our previous forecast. Here are five key takeaways from AMRO’s July update of the ASEAN+3 Regional Economic Outlook.

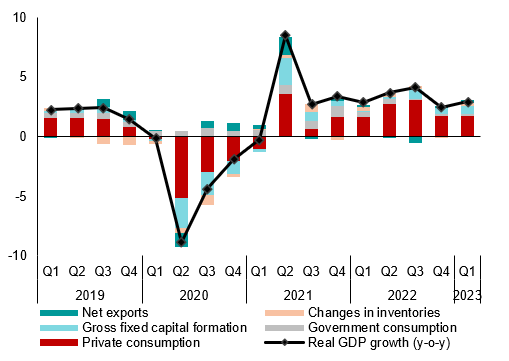

1. Growth anchored by resilient domestic demand. Private consumption growth stayed firm in most economies, supported by recovering labor markets as well as easing inflation. Investment activities, previously disrupted by COVID-19, are also picking up pace.

Figure 1. Selected ASEAN+3: Contribution to Real GDP Growth

(Percent points, year-on-year; percentage points)

Note: Statistical discrepancies are not shown. Excludes Cambodia, China, Lao PDR, Myanmar, and Vietnam due to data unavailability.

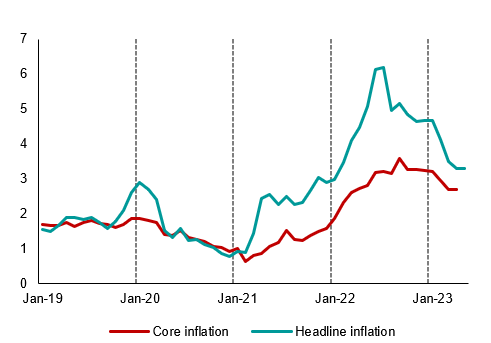

2. Headline inflation is moderating across the region. Lower global commodity prices and the normalization of supply chains are helping to keep cost pressures at bay. However, core inflation, which excludes the prices of food and energy, remains relatively sticky, especially for economies where demand conditions are strong.

Figure 2. ASEAN+3: Average Headline and Core Inflation

(Percent, year-on-year)

Note: Average headline and core inflation refer to the respective trim means, which exclude outliers. Core inflation excludes food and energy. For Singapore, core inflation refers to the MAS core inflation. Data are up to June 2023, except Malaysia, Singapore, China, Japan, and Hong Kong (up to May 2023), Brunei and Cambodia (up to April 2023), and Myanmar (up to July 2022).

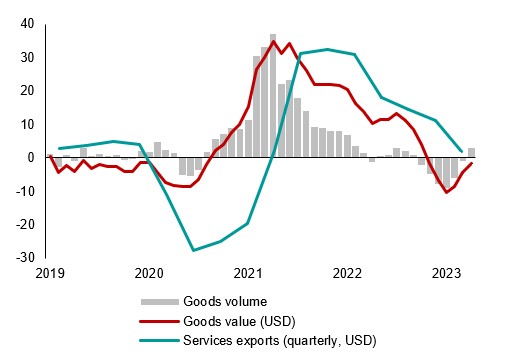

3. Services exports, especially tourism, are helping to offset weak goods trade. The latter remained weak in the first half of 2023—affecting highly-open ASEAN+3 economies, in particular—but there are tentative signs of a turnaround. Meanwhile, the region’s tourist arrivals have already surpassed 50 percent of pre-pandemic levels by the first quarter of 2023. The return of more Chinese visitors is expected to provide additional boost in the next few months.

Figure 3. Selected ASEAN+3: Export Growth

(Percent, year-on-year; Index, 2019=100)

Note: Goods exports data are up to April 2023; services exports data (quarterly) are up to Q4 2022, and exclude Brunei and Myanmar.

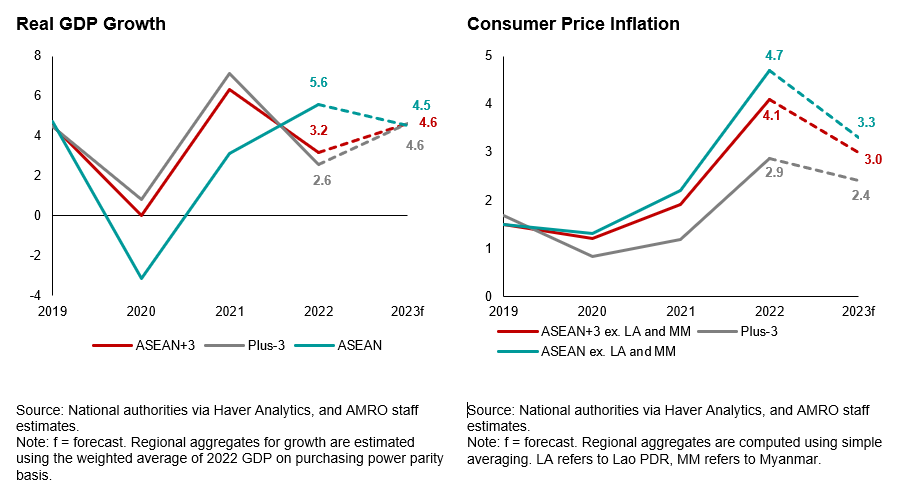

4. The region’s growth momentum remains intact. While the ongoing weakness in global trade has prompted a slight reduction in the ASEAN growth forecast for 2023 to 4.5 percent from April’s projection of 4.9 percent, this will be offset by improving prospects in the Plus-3 economies. Meanwhile, inflation in 9 out of 14 members is now lower than initially expected, which will help bolster consumption.

Figure 4. ASEAN+3: Growth and Inflation Forecasts

(Percent, year-on-year)

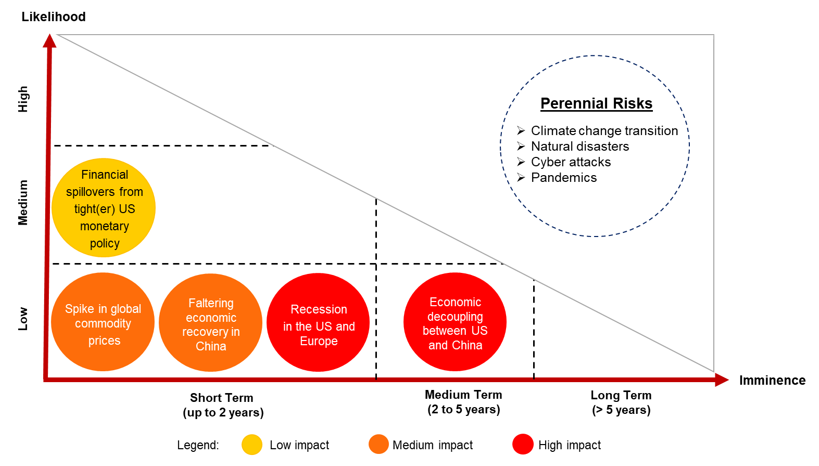

5. Downside risks to growth have receded slightly since April, but there is no room for complacency. Our baseline forecasts would be weighed down by faltering economic growth in China or a recession in advanced economies, should these risks materialize. Tight(er) US monetary policy would have negative spillovers to the region’s financial markets, while another spike in global commodity prices cannot be ruled out.

Figure 5. Regional Risk Map, July 2023

Source: AMRO staff estimates.