The post-pandemic recovery year of 2022 was beset by challenges: the Russia-Ukraine conflict led to a surge in global commodity prices, while record high inflation and the release of pent-up consumer demand resulted in sharper monetary tightening in the United States. Tighter financial market conditions also slowed the growth momentum in advanced economies.

Economic prospects for ASEAN+3 continue to be fraught with uncertainties. Here are the region’s prospects summarized in five key charts, as seen in AMRO’s latest ASEAN+3 Regional Economic Outlook.

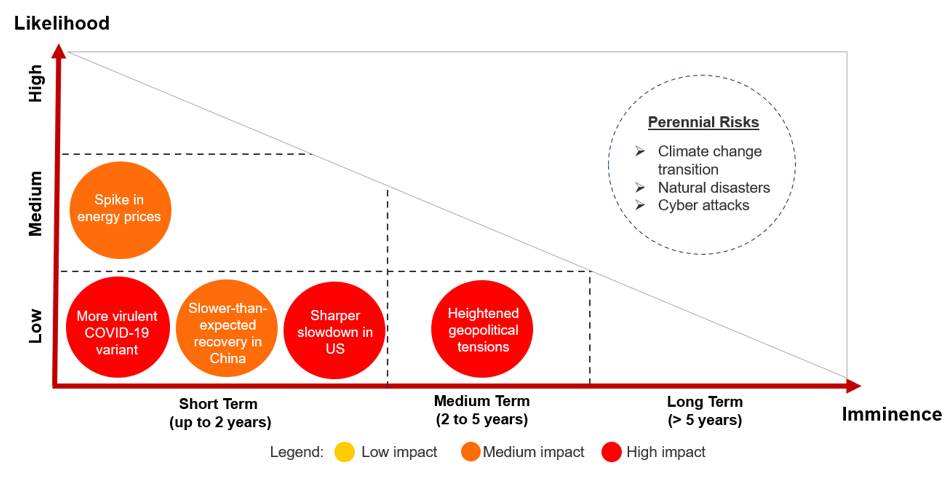

1. Growth will be anchored by domestic demand. The ASEAN+3 region grew at 3.2 percent in 2022, with private consumption being the key driver of growth. High vaccination rates in the region allowed authorities to loosen mobility restrictions and reopen borders, which released pent-up demand and led to a surge in consumer spending and investment. Looking ahead, growth in ASEAN+3 is expected to be anchored by domestic demand as economic recovery gains traction.

Figure 1. Selected ASEAN+3: Aggregate Real GDP Growth, by Expenditure Category

(Percent points, year-on-year)

Note: Selected ASEAN+3 includes Brunei, Hong Kong, Indonesia, Japan, Korea, Malaysia, the Philippines, Singapore, and Thailand. Data are unavailable for Cambodia, China, Lao PDR, Myanmar, and Vietnam. q-o-q, sa = quarter-on-quarter, seasonally adjusted; y-o-y = year-on-year. Q4 2022 data for Brunei are estimated by AMRO staff.

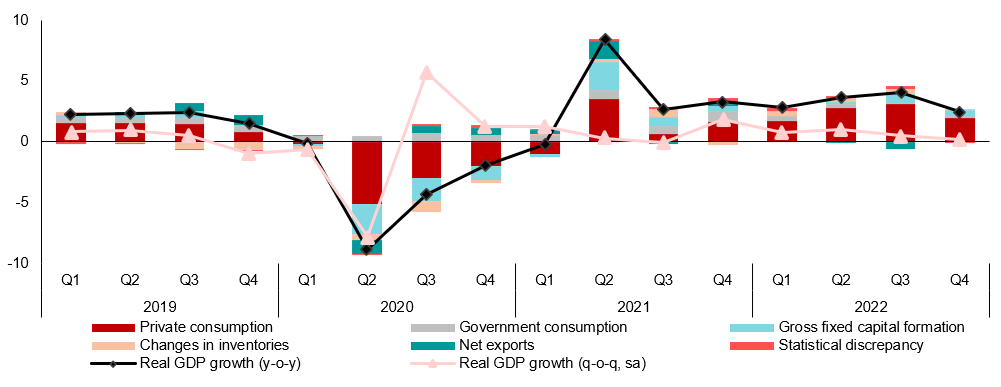

2. Export growth continues to weaken, but travel will be a bright spot. Goods exports started to contract in November 2022 as economic activity slowed in major trading partners. Export growth is projected to weaken in 2023 as global demand slows further. However, this will be offset to some extent by the strengthening of services exports, notably tourism, as border restrictions are lifted throughout the region. The region’s travel sector is poised to rebound strongly, with many economies benefitting from increased outbound tourists from China.

Figure 2. Selected ASEAN+3: Goods and Travel Services Export Growth

(Percent, year-on-year, three-month moving average)

Note: Goods exports data are not available for Brunei, Cambodia, Lao PDR, and Myanmar. Travel services exports data for Brunei, Cambodia, Myanmar, and Vietnam are not available. Exports of travel services cover goods and services (excluding transport services) that are acquired from an economy by nonresidents during visits to that economy.

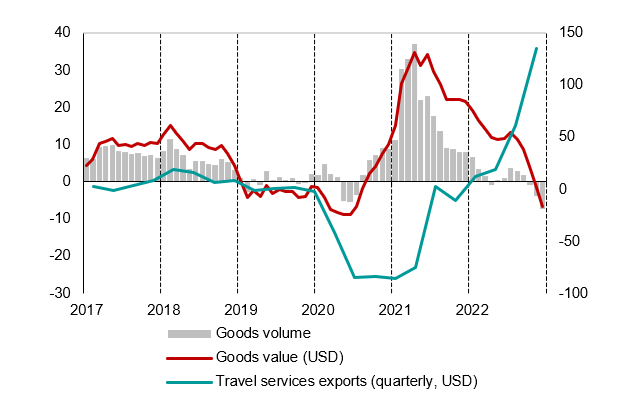

3. Inflation will moderate but remain elevated. Headline inflation reached a nine-year high in 2022 due to sharp increases in the price of food, utilities, and transport goods and services. The rise in domestic prices was worsened by the depreciation of most currencies in the region following aggressive monetary policy tightening in advanced economies. Headline inflation is expected to moderate from 6.5 percent in 2022 to 4.7 percent in 2023, mainly due to lower global commodity prices.

Figure 3. ASEAN+3, United States and European Union: Headline Consumer Price Inflation

(Index, year-on-year)

Note: Data are up to Jan 2023 except for Brunei, Cambodia, Japan, Malaysia, Singapore, and the European Union (Dec 2022), and Myanmar (Jul 2022).

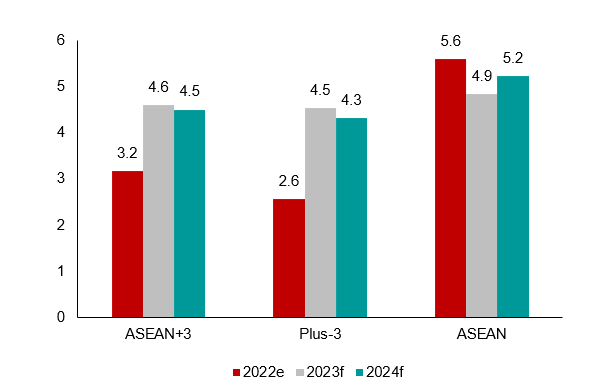

4. ASEAN+3 will see higher growth in 2023. The region is expected to grow at a faster pace of 4.6 percent in 2023 despite the challenging global environment. The improvement will be mainly driven by the economic recovery in the Plus-3 economies, especially China. Growth in the ASEAN region is likely to remain firm at 4.9 percent in 2023 as resilient domestic demand will be partially offset by weaker global demand. In 2024, growth for ASEAN+3 is forecast to be sustained at 4.5 percent.

Figure 4. ASEAN+3: AMRO Growth Estimates and Forecasts, 2023-2024

(Percent year-on-year)

Note: e = estimates; f = forecast. Regional aggregates for growth are estimated using the weighted average of 2021 GDP on purchasing power parity basis.

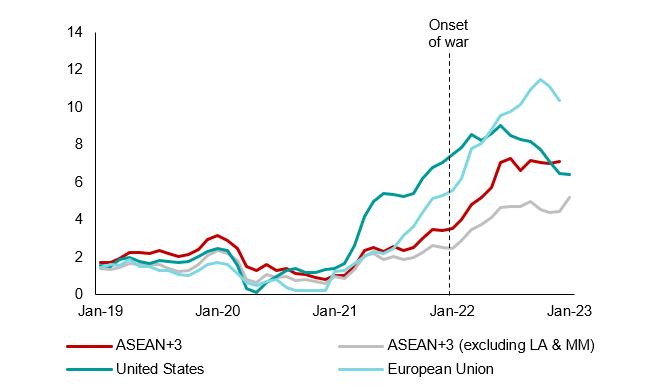

5. Yet, downside risks abound. The most immediate risk is the possibility of another shock to global energy prices should the Ukraine crisis escalate. Tight financial conditions could also trigger a sharper US slowdown, resulting in significant spillovers to the rest of the world. In China, prolonged weakness in the real estate sector could weigh on consumer and investor confidence and hinder the economy’s recovery, dragging down regional growth. Heightened geopolitical tensions and the emergence of a more virulent COVID-19 variant continue to be risks for the region’s outlook.

Figure 5. Regional Risk Map, April 2023