Ample and low-cost liquidity provided by global central banks in the aftermath of the global financial crisis had driven a rise in ASEAN+3 debt. The low-for-long interest rate conditions enabled many businesses, households, and governments to take on large amounts of debt at low costs. The unprecedented monetary and fiscal stimulus measures rolled out during the COVID-19 pandemic to support the economies fueled further increases in debt-to-GDP ratios.

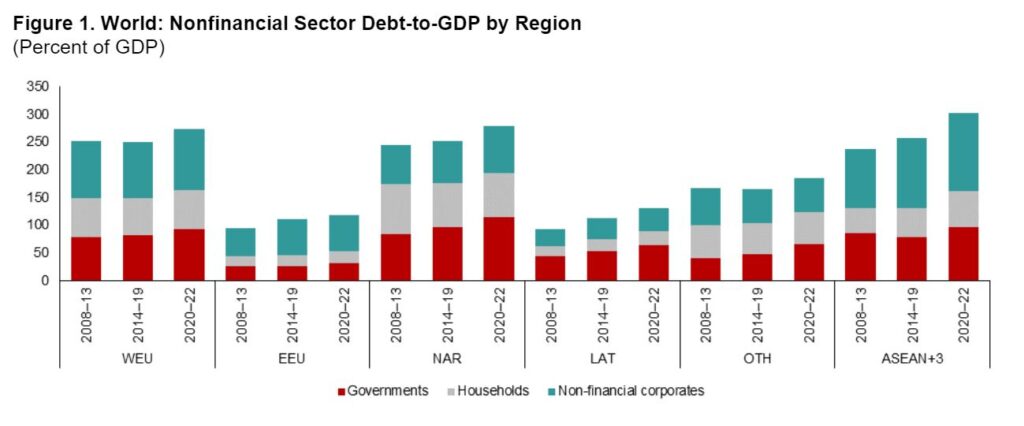

The total debt-to-GDP ratio in ASEAN+3—including corporate, household, and public debt—has steadily increased since the Global Financial Crisis, peaking at 325 percent of the region’s GDP during the pandemic before declining to 299 percent of GDP at the end of 2022 (Figure 1).

The corporate debt-to-GDP ratio is notably higher in ASEAN+3 than in other regions, whereas the ratios for household and government debt are close to the global average. The corporate debt-to-GDP ratio was about 140 percent, while the ratio for households was 63 percent in 2022, an increase of 40 and 18 percentage points respectively from 2008. The rapid expansion of private sector debt drove the increase in overall debt in Plus-3 economies and international financial centers (China; Hong Kong, China; Japan; Korea and Singapore).

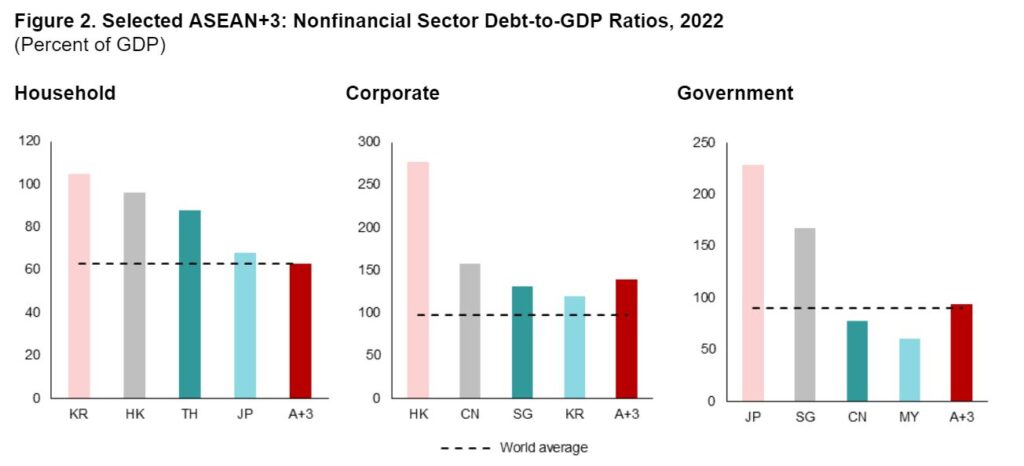

The composition of debt and associated risks vary greatly across ASEAN+3 economies. Relative to world averages, Korea, Hong Kong, Thailand and Japan have higher household debt, while China, Hong Kong, Singapore, and Korea have higher corporate debt. Japan maintains an exceptionally high public debt (Figure 2).

Source: BIS; IMF; AMRO staff calculations

Note: WEU = Western Europe; EEU = Eastern Europe; NAR = North America; LAT = Latin America; OTH = Others. ASEAN+3 includes China, Hong Kong, Indonesia, Japan, Korea, Malaysia, Singapore and Thailand.

Source: BIS; IMF; AMRO staff calculations

Note: For household and corporate debt-to-GDP ratios, Hong Kong, Indonesia, Japan, Korea, Malaysia, Singapore and Thailand are included in ASEAN+3. For public debt ratios, all ASEAN+3 economies are included. A+3 = ASEAN+3; CN = China; HK = Hong Kong; JP = Japan; KR = Korea; MY = Malaysia; SG = Singapore; TH=Thailand.

Rising debt threatens financial stability

Rapid debt accumulation by private or public sectors makes financial systems more vulnerable to sudden shocks. Long periods of credit expansion and risk-taking could lead to over-indebtedness that could become unsustainable with the sharp rise in interest rates, resulting in widespread bankruptcies, panic and crisis.

With increased debt to GDP ratios, rising debt service burdens in a high interest rate environment could threaten financial stability, especially when regulatory forbearance and other pandemic support measures have been, or are still being, phased out.

For households, the property sector and rising debt burdens are major pressure points. Housing prices have fallen since the pandemic, but may remain overvalued relative to fundamentals, contributing to the risk of large corrections. Interest rate increases raise the cost of servicing debt, with a faster transmission in economies with a high proportion of floating mortgage loans.

Corporates with relatively weak balance sheets owing to low profitability and cash buffers, and/or high leverage could find it more difficult to refinance and cover interest expenses. This risk tends to be higher in the property and construction sectors, especially in a housing market downturn, and for unlisted micro, small and medium-sized enterprises.

Governments with elevated debt-to-GDP ratios face increased refinancing costs and rollover risk on maturing debt. The risk of refinancing problems in ASEAN+3 depends on factors such as the maturity and currency structure of its debt, investor composition, and market liquidity. Excessive debt levels raise concerns about debt sustainability and a fiscal crisis, which can erode investor confidence, cause a reduction in sovereign credit rating, and reduce access to finance.

Furthermore, the soundness of some banks and nonbank financial intermediaries (NBFIs) may be tested. And this has the potential to adversely impact the functioning of financial markets.

Addressing the risks posed by the higher debt levels amid tighter monetary and financial conditions necessitates a balanced policy mix across monetary, fiscal, and macroprudential policies and close cooperation among authorities.

Policymakers can deploy a wide range of macroprudential tools to mitigate systemic risks to the financial system from high nonfinancial private debt. These can target different sources of risk arising from high household and corporate debt and help curb excessive leverage by property developers.

To rein in financial stability risks from higher public debt, a medium-term fiscal consolidation plan may be warranted and a fiscal rule can also be considered in some cases. Efficient public debt management should help too.

Safeguarding the soundness of financial intermediaries is paramount to ensure stable and efficient provision of credit to the macroeconomy. For banks, this involves keeping leverage ratios of borrowers in check through effective micro and macroprudential policies to reduce vulnerabilities. Weaker banks should increase provisioning and improve capital reserves.

The scope of the deposit insurance coverage could be widened to help maintain depositor confidence in times of stress. NBFIs’ growing systemic importance makes strengthening their supervisory and regulatory framework a priority. Their central role in the functioning of financial markets in the region, especially in dollar funding and hedging markets, requires close cooperation among regulatory and macroprudential authorities and central banks in ASEAN+3.

ASEAN+3 is facing hidden and/or less-visible financial vulnerabilities within an evolving financial landscape. The combination of higher debt and interest rates could pose challenges for borrowers to repay debt. Fortunately, corporate borrowers are showing resilience with high interest coverage ratios, and housing prices have been closer to levels consistent with macroeconomic fundamentals for most economies in ASEAN+3. Public debt is relatively sound in structure, limiting interest rate and exchange rate risks, and foreign participation is generally low. While banks display robust fundamentals with adequate to ample capital buffers and strong asset quality, the expanding role of NBFIs could introduce potential hidden and intricate risks to the region. In response, policymakers are urged to enhance surveillance capabilities, remain vigilant, and be prepared to respond swiftly and decisively to emerging shocks when necessary.