Supportive policies needed to safeguard inclusive and sustainable recovery

Digitalization of global value chains crucial to future regional growth

(from L to R): Glenn van Zutphen, AMRO Group Head and Lead Specialist Li Lian Ong, AMRO Economist and AREO Lead Author Marthe Hinojales, AMRO Economist and AREO Lead Author Anne Oeking, and AMRO Director Toshinori Doi

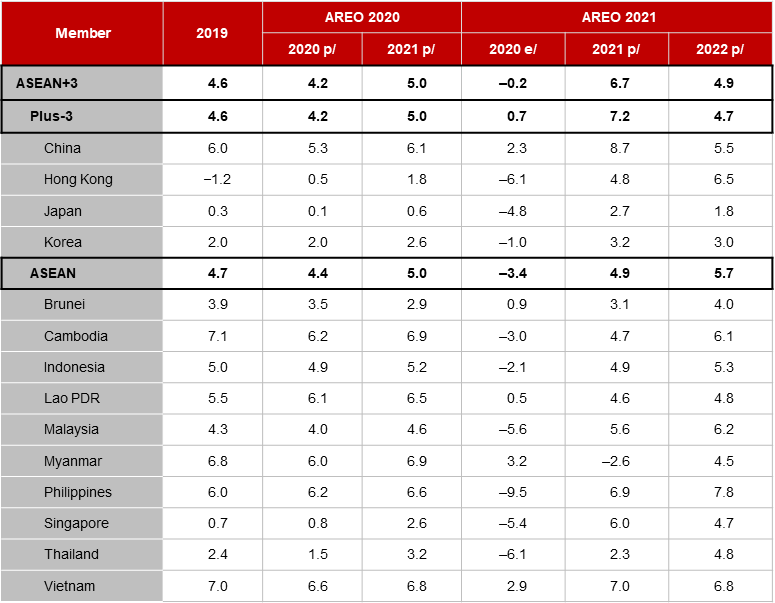

SINGAPORE, March 31, 2021 — The ASEAN+3 Macroeconomic Research Office (AMRO) today published its annual flagship report, the ASEAN+3 Regional Economic Outlook (AREO 2021). AMRO staff forecast that the ASEAN+3 region will expand by 6.7 percent this year and 4.9 percent in 2022, after contracting marginally by 0.2 percent in 2020.

ASEAN+3 economies have proven to be resilient in the face of the COVID-19 pandemic, but are not out of the woods yet. The region, which is home to 30 percent of the world’s population, collectively accounts for only 3 percent of the total number of confirmed COVID-19 cases globally. However, until herd immunity is achieved through widespread vaccinations, localized containment of the virus may continue to be necessary. “As governments become more experienced at handling infections, targeted measures that are decisive, effective, and proactive will allow economies to minimize further loss of lives while enabling economic activity to continue,” said AMRO Chief Economist Hoe Ee Khor.

The road to recovery is fraught with challenges, but also presents opportunities. The pandemic has impacted the region unevenly, and recovery across sectors and economies remains fragile. Some segments will rebound quickly, with the turnaround in manufacturing and exports and the adoption of new technologies; others will remain under pressure and must adapt to new realities, move on, or reinvent themselves to survive. Employment prospects will also differ, with workers in certain in-person service industries and those employed by smaller businesses and in the informal sector being most vulnerable.

Meanwhile, the financial sector appears to be on a dual track. Financial markets have soared since the first quarter of 2020, on the back of unprecedented policy stimuli and the successful development of vaccines. At the same time, the pandemic has substantially weakened public and private sector balance sheets. Unprecedented policy support has come at the cost of higher public debt, while shocks to household and business incomes have affected their debt servicing capacity and increased the credit risks to banks, currently contained by regulatory forbearance measures that were introduced.

Macro-financial policymaking will have to gradually shift from protecting lives and livelihoods to safeguarding an inclusive and sustainable recovery. The combination of monetary, fiscal, and financial measures was swift, sizeable, and sweeping in 2020. With the economic turnaround, policymakers have begun to plan for a transition from these extraordinary crisis actions, reinforced—in some places—by the rollout of vaccinations. In doing so, adept and expansive policymaking that is both gradual, coordinated, and well-communicated will be crucial in avoiding cliff effects. “Recovery is under way but is by no means assured. So, it is more important than ever to make sure that the momentum does not falter,” said Li Lian Ong, Group Head of Financial and Regional Surveillance.

Given the depth and reach of the pandemic, some permanent output losses from economic scarring will be inevitable, but the manufacturing sector and its exports will remain the key engine for growth in the region. The pandemic exposed the vulnerability of global value chains (GVCs), which posed significant problems when lockdowns first occurred, but then facilitated a rapid regional turnaround when economic activity resumed. “We don’t think GVCs are going to be reconfigured away from Asia anytime soon,” Dr Khor stated, in response to the intensifying debate about major reconfigurations of GVCs, adding, “Asia is still one of the fastest-growing regions in the world, and we know that proximity to high-quality infrastructure, skilled labor, and customers with purchasing power all matter for GVCs.”

A silver lining in the pandemic cloud is that it has inadvertently become a springboard for digitalization in the ASEAN+3 region. As users become ever more comfortable with new technologies, the “flight to digital” will be a key factor in strengthening supply chains and facilitating global trade. Consequently, the region has a tremendous opportunity to upgrade and fortify its role in GVCs, and champion not only greater openness but also strengthen its competitiveness in the Fourth Industrial Revolution. Full deployment of new technologies will require both hard and soft infrastructures to be in place, which calls for strong bilateral and multilateral cooperation.

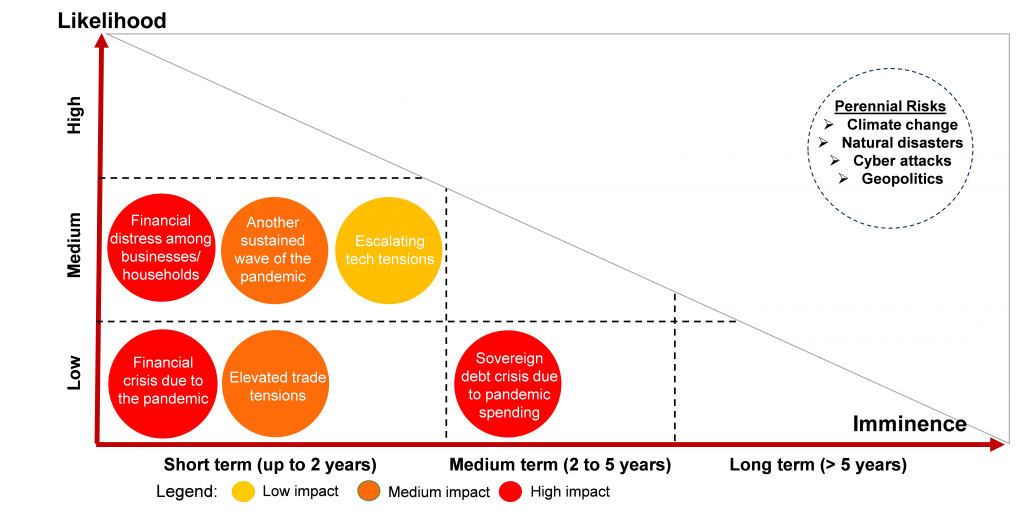

Figure. Global Risk Map, February 2021

Source: AMRO staff estimates.

Table. ASEAN+3: AMRO Staff Growth Estimates and Projections, 2020–22

(Percent)

Sources: National authorities via CEIC and Haver Analytics; and AMRO staff projections.

Note: e/ refers to AMRO staff estimates and p/ refers to AMRO staff projections. Myanmar’s growth numbers are based on its fiscal year, from October 1 to September 30. AREO 2020 = ASEAN+3 Regional Economic Outlook 2020.

–

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute towards securing macroeconomic and financial stability of the ASEAN+3 region, which includes 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support the implementation of the regional financial arrangement, the Chiang Mai Initiative Multilateralisation (CMIM), and provide technical assistance to the members.