Confronted with the COVID-19 pandemic, ASEAN+3 economies have swiftly deployed substantial fiscal stimulus to save lives, and protect livelihoods and businesses.

A wide range of relief measures for households has been rolled out, including cash transfers, debt reliefs, and tax deferrals. To support the corporate sector, job retention programs, provision of low-cost loans, as well as moratoriums on debt repayments have been adopted.

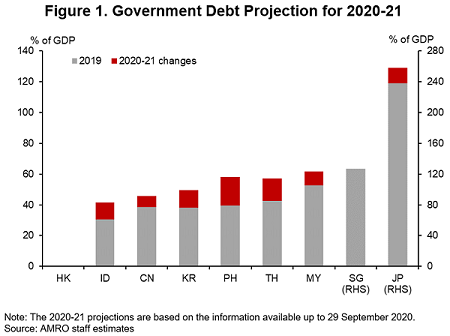

As a result, the regional economies are expected to see a sudden jump in fiscal deficits this year and the next, leading to a significant expansion in government debt (Figure 1) and possibly an increase in fiscal sustainability risk.

As long as vaccines are still unavailable, the pace and trajectory of economic recovery will remain tentative and uncertain, and policymakers will need to carefully monitor and manage their fiscal policy room, or so-called ‘fiscal policy space’.[1]

Against this backdrop, a recent AMRO working paper, “A Framework for Assessing Policy Space in ASEAN+3 Economies and the Combat against COVID-19 Pandemic” provides a useful framework for policymakers to assess the availability of their ‘fiscal policy space’.

Three pillars to determine fiscal space

Under this framework, a country’s fiscal policy space is determined based on three pillars – i) quantitative debt sustainability indicators; ii) risks to financing capacity and debt profile; and iii) country-specific factors.

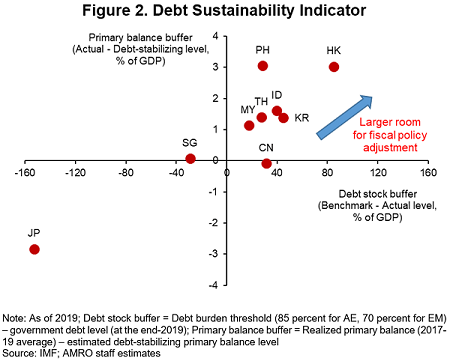

In the first pillar, widely used key indicators relating to debt sustainability, such as government debt-to-GDP ratio and primary balance are considered. These indicators show how much a government is indebted at any point in time as well as whether the debt level tends to decrease or increase (surplus/ deficit). A country’s debt-to-GDP ratio and fiscal balance allow us to gauge its fiscal conditions and compare them with other countries (Figure 2).

The extent that a government can expand its fiscal policy may rely on more diverse factors, including qualitative and hard-to-compare elements.

The second pillar takes into account ‘risk factors’ relating to a government’s financing capacity and debt composition. For instance, some emerging market economies with relatively low government debt may face high funding costs due to an unfavorable assessment of their sovereign risk by the financial markets.

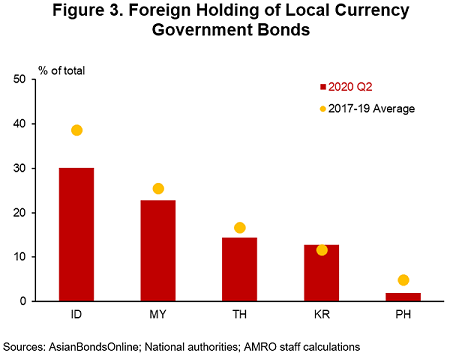

Moreover, a government’s excessive reliance on external funding heightens liquidity risks in the event of risk aversion among foreign investors, leading to capital outflows. A rapid expansion in external and private sector debt may increase the government’s contingent liabilities for potential bail-outs.

While the first two pillars try to capture some measurable aspects of fiscal policy space, these indicators need to be interpreted carefully in the country-specific context. That brings us to the third pillar, which considers the country-specific idiosyncratic aspects, such as fiscal institutions and the level of financial market development, to make a final judgment on a country’s fiscal space assessment.

For instance, the size of a government’s financial and non-financial assets needs to be considered in assessing its debt liabilities. The presence of prudent fiscal rules and a broad domestic investor base are balancing factors that can offset the risks to financing capacity.

Fiscal space of ASEAN+3 economies

Prior to the pandemic, government debt was generally contained at a low to moderate level, and most economies in the ASEAN+3 region had built up a moderate amount of policy room to allow them to maintain primary balance deficits. This was partly due to the fact that regional policymakers had strengthened fiscal prudence after the Asian Financial Crisis.

Market perception of sovereign risks had generally improved in the region. While the size of external debt stock varied widely, contingent liabilities risk from rising domestic credit to the private sector, was relatively well contained. Balance sheet indicators, however, revealed some weaknesses in the debt structure, even in less indebted countries.

After additional consideration of country-specific factors, our analysis suggests that most regional economies had moderate room to roll out expansionary fiscal policy to combat the pandemic.

In addition, the regional economies’ growing reliance on domestic funding (Figure 3) and accumulation of foreign reserves, and the low global interest rate environment are factors that contributed to favorable debt financing conditions.

A prolonged pandemic may compel regional authorities to continue fiscal stimulus measures to support their economies while raising concerns about the sustainability of the policies.

The uncertainty around the recovery process and the extent of economic fallout could severely undermine fiscal sustainability. Therefore, fiscal policy support needs to focus more on improving efficacy, together with a credible medium-term plan to manage fiscal policy space and a strong commitment to fiscal discipline.

Lastly, deepening domestic financial markets will enhance debt management and facilitate fiscal policy buffer rebuilding. The continuing build-up of domestic savings and investment institutions will boost a country’s debt management capacity by improving its debt profile and deepening liquidity in the debt market.

[1] There is no universally accepted definition of ‘fiscal policy space’ but it is generally understood as the extent to which a government can undertake discretionary fiscal policy measures to mitigate short-term economic downturns without undermining fiscal sustainability.